Region:Asia

Author(s):Geetanshi

Product Code:KRAA0200

Pages:92

Published On:August 2025

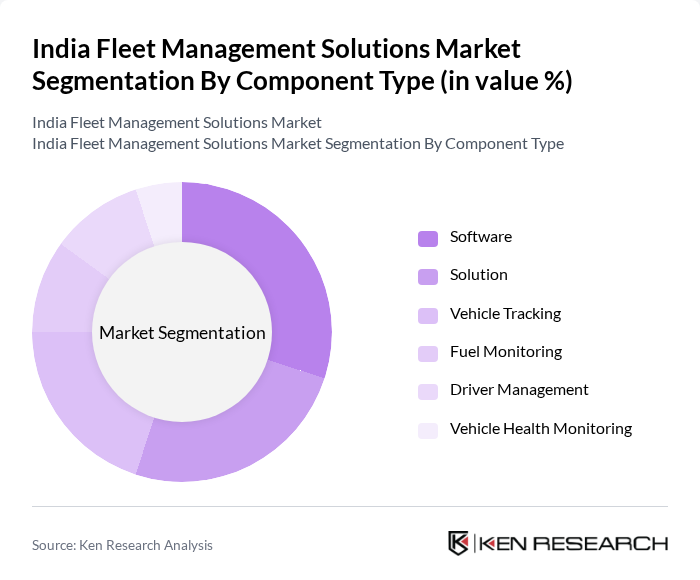

By Component Type:The component type segmentation includes various subsegments such as Software, Solution, Vehicle Tracking, Fuel Monitoring, Driver Management, and Vehicle Health Monitoring. Each of these components plays a crucial role in enhancing the efficiency and effectiveness of fleet operations. The software segment is particularly significant as it encompasses various applications that facilitate real-time tracking, data analytics, and reporting functionalities. The adoption of cloud-based fleet management platforms and integration with telematics and IoT devices are key trends shaping the component landscape .

The Software segment is leading the market due to the increasing reliance on digital solutions for fleet management. Companies are investing in advanced software that offers features like real-time tracking, route optimization, and predictive maintenance. This trend is driven by the need for enhanced operational efficiency and cost savings, making software solutions indispensable for fleet operators. The growing adoption of cloud-based platforms and integration with artificial intelligence and telematics further supports the dominance of this segment .

By Fleet Type:The fleet type segmentation includes Commercial Fleets and Passenger Fleets. Commercial fleets are primarily used for logistics and transportation services, while passenger fleets cater to personal and public transport needs. The commercial fleet segment is experiencing significant growth due to the booming e-commerce sector and the increasing demand for goods transportation. The adoption of fleet management solutions in commercial fleets is further propelled by regulatory compliance requirements and the need for real-time vehicle monitoring .

The Commercial Fleets segment dominates the market, driven by the rapid growth of logistics and supply chain operations in India. The rise of e-commerce has led to an increased need for efficient transportation solutions, prompting businesses to adopt fleet management systems that enhance delivery speed and reduce operational costs. This segment's growth is further supported by government initiatives aimed at improving infrastructure, digitalization, and logistics capabilities .

The India Fleet Management Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tata Motors Fleet Edge, Mahindra Telematics, WheelsEye, LocoNav, Fleetx, Trimble Inc., Bosch Limited (Mobility Solutions), MapmyIndia (C.E. Info Systems Ltd.), AVL India, Letstrack, BlackBuck, Transight Systems, Arya Omnitalk, Intangles Lab Pvt. Ltd., EFKON India Pvt. Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India Fleet Management Solutions market appears promising, driven by technological advancements and increasing regulatory support. The integration of AI and machine learning is expected to enhance predictive maintenance and operational efficiency. Additionally, as the government continues to promote electric vehicles, fleet operators will likely invest in sustainable solutions, aligning with global trends towards greener logistics. This shift will create a dynamic environment for innovation and growth in the fleet management sector.

| Segment | Sub-Segments |

|---|---|

| By Component Type | Software Solution Vehicle Tracking Fuel Monitoring Driver Management Vehicle Health Monitoring |

| By Fleet Type | Commercial Fleets Passenger Fleets |

| By Deployment Type | Cloud-Based On-Premises Hybrid |

| By End-User | Logistics Manufacturing Public Sector Construction Retail Others (Corporate, Education, etc.) |

| By Region | North India South India East India West and Central India |

| By Technology | GNSS (Global Navigation Satellite System) Telematics Solutions Mobile Applications Cloud-Based Platforms Data Analytics Tools Others |

| By Application | Fleet Tracking Driver Management Compliance Management Maintenance Scheduling Route Optimization Fuel Management Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Fleet Management | 120 | Fleet Managers, Operations Directors |

| Construction Vehicle Fleet | 60 | Project Managers, Equipment Supervisors |

| Public Transport Fleet Solutions | 50 | Transport Planners, Fleet Coordinators |

| Corporate Fleet Management | 40 | Procurement Managers, Fleet Administrators |

| Technology Providers in Fleet Management | 45 | Product Managers, Business Development Executives |

The India Fleet Management Solutions Market is valued at approximately USD 1.5 billion, driven by the increasing demand for operational efficiency, cost reduction, and enhanced safety measures in fleet operations, particularly in logistics and e-commerce sectors.