Region:Middle East

Author(s):Shubham

Product Code:KRAA0800

Pages:88

Published On:August 2025

By Type:The market is segmented into various types of fleet management solutions, including Vehicle Tracking Systems, Fleet Telematics Solutions, Driver Management Systems, Maintenance Management Solutions, Fuel Management Systems, Route Optimization Software, Asset Management Solutions, and Compliance Management Solutions. Among these, Vehicle Tracking Systems and Fleet Telematics Solutions are particularly prominent due to their ability to enhance operational efficiency, enable predictive maintenance, and provide real-time data analytics. The increasing need for safety, regulatory compliance, and sustainability in fleet operations further drives the demand for these solutions .

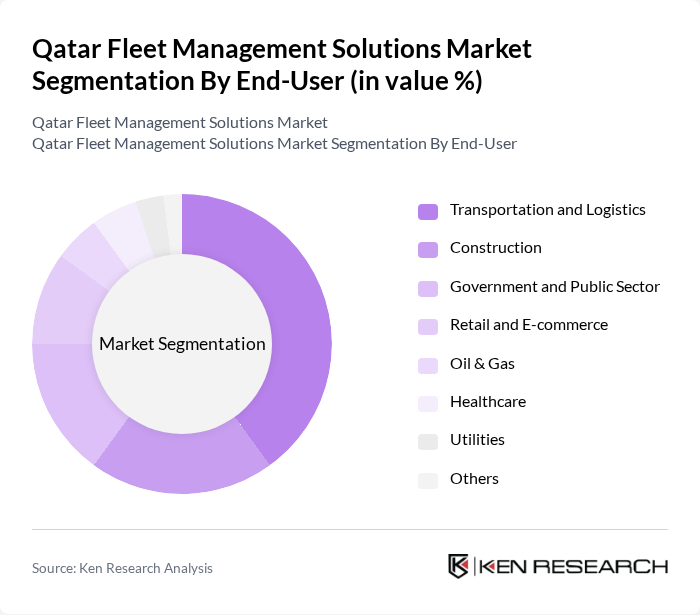

By End-User:The end-user segmentation includes Transportation and Logistics, Construction, Government and Public Sector, Retail and E-commerce, Oil & Gas, Healthcare, Utilities, and Others. The Transportation and Logistics sector is the largest end-user of fleet management solutions, driven by the need for efficient supply chain management, real-time tracking of goods, and compliance with safety regulations. The growing e-commerce sector, along with increased activity in construction and public sector fleet modernization, also contributes significantly to the demand for fleet management solutions .

The Qatar Fleet Management Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Masar Fleet Management (Qatar Mobility Innovations Center - QMIC), Vodafone Qatar, Gulf Exchange Fleet Management, MiX Telematics, Geotab, Gurtam, TomTom Telematics (now Webfleet Solutions), Trakker Middle East, Fleet Complete, Omnicomm, Verizon Connect, Teletrac Navman, Fleetio, Ctrack, Inseego contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar fleet management solutions market appears promising, driven by technological advancements and increasing demand for efficiency. As businesses continue to embrace digital transformation, the integration of artificial intelligence and machine learning into fleet management systems is expected to enhance decision-making processes. Additionally, the growth of electric vehicles and smart city initiatives will further shape the market landscape, providing opportunities for innovative solutions that align with sustainability goals and government regulations.

| Segment | Sub-Segments |

|---|---|

| By Type | Vehicle Tracking Systems Fleet Telematics Solutions Driver Management Systems Maintenance Management Solutions Fuel Management Systems Route Optimization Software Asset Management Solutions Compliance Management Solutions |

| By End-User | Transportation and Logistics Construction Government and Public Sector Retail and E-commerce Oil & Gas Healthcare Utilities Others |

| By Fleet Size | Small Fleets (1-10 vehicles) Medium Fleets (11-50 vehicles) Large Fleets (51+ vehicles) |

| By Deployment Mode | On-Premise Solutions Cloud-Based Solutions Hybrid Solutions |

| By Region | Doha Al Rayyan Umm Salal Al Wakrah Al Khor Others |

| By Service Type | Software as a Service (SaaS) Managed Services Consulting Services |

| By Pricing Model | Subscription-Based Pricing Pay-Per-Use Pricing One-Time License Fee Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Fleet Management | 100 | Fleet Managers, Operations Directors |

| Construction Vehicle Fleet | 60 | Project Managers, Equipment Supervisors |

| Public Transport Fleet Operations | 50 | Transport Planners, Fleet Coordinators |

| Corporate Fleet Management | 70 | Procurement Managers, Financial Analysts |

| Technology Adoption in Fleet Management | 40 | IT Managers, Innovation Officers |

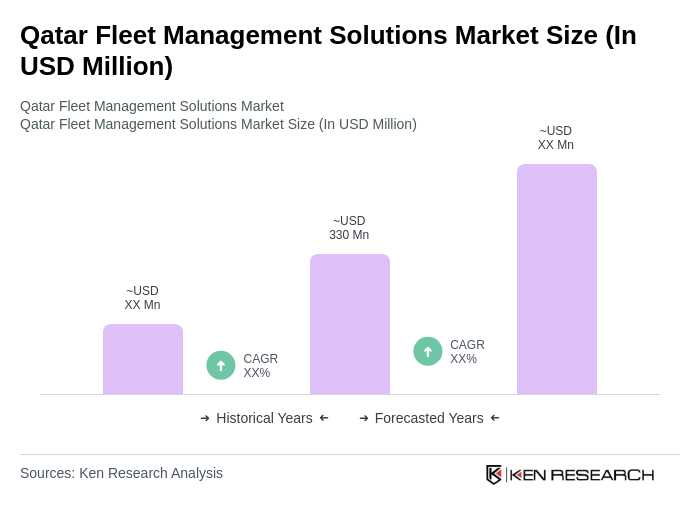

The Qatar Fleet Management Solutions Market is valued at approximately USD 330 million, reflecting a five-year historical analysis. This growth is driven by the demand for efficient fleet operations, safety measures, and advanced technologies like IoT and telematics.