Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA0168

Pages:84

Published On:August 2025

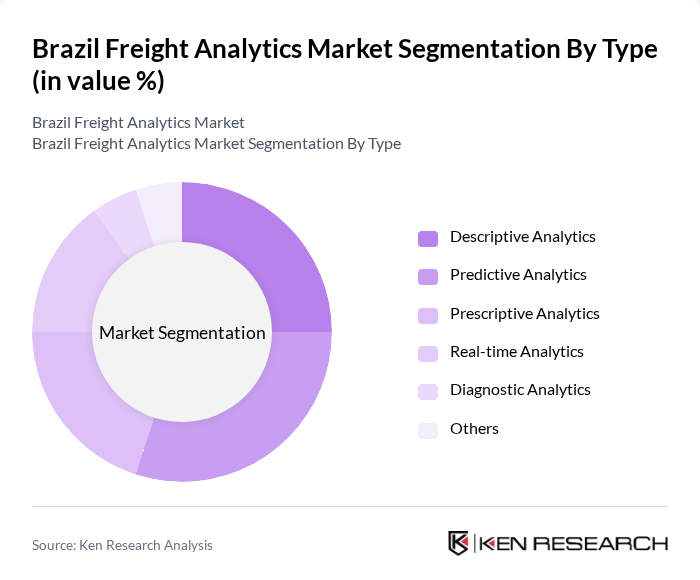

By Type:The market is segmented into various types of analytics, including Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, Real-time Analytics, Diagnostic Analytics, and Others. Each type serves a unique purpose in enhancing decision-making processes within the freight industry. Descriptive Analytics is widely used for historical data analysis, while Predictive Analytics is gaining traction for forecasting demand, route optimization, and proactive risk management. Prescriptive Analytics is increasingly adopted for recommending optimal actions based on real-time and historical data, supporting complex logistics decisions. Real-time Analytics enables immediate visibility and response to supply chain disruptions, while Diagnostic Analytics helps identify root causes of inefficiencies.

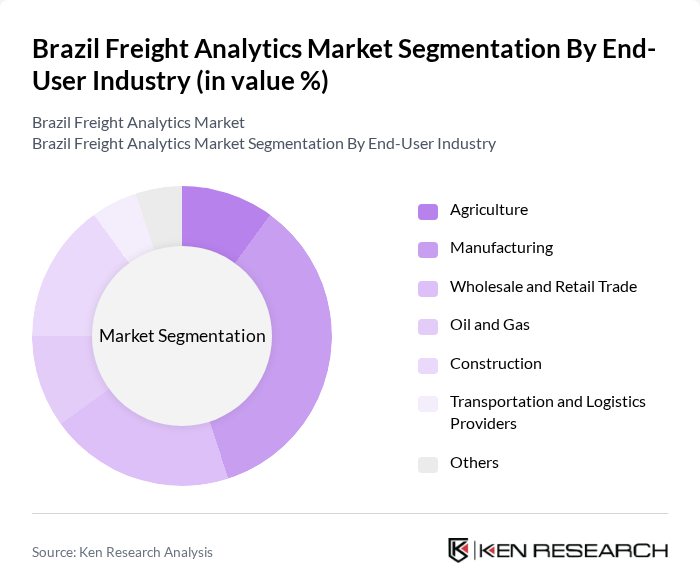

By End-User Industry:The freight analytics market is also segmented by end-user industries, including Agriculture, Manufacturing, Wholesale and Retail Trade, Oil and Gas, Construction, Transportation and Logistics Providers, and Others. Each industry utilizes freight analytics to improve operational efficiency, reduce costs, and enhance supply chain visibility. The Manufacturing sector is a significant user due to its reliance on timely deliveries, inventory management, and production scheduling. Wholesale and Retail Trade leverage analytics for demand forecasting and last-mile delivery optimization. Agriculture, Oil and Gas, and Construction sectors benefit from analytics in route planning, asset tracking, and compliance management .

The Brazil Freight Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Logistics, TOTVS, SAP SE, Oracle Corporation, Manhattan Associates, Trimble Inc., JSL S.A., DHL Supply Chain Brazil, CargoX, Intelipost, Solistica Brasil, IBM Brazil, Accenture Brazil, Loggi, and Edenred (FreteBras) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Brazil freight analytics market appears promising, driven by technological advancements and increasing demand for efficiency. As companies increasingly adopt predictive analytics, the focus on sustainability will intensify, with logistics firms aiming to reduce their carbon footprint. Additionally, the rise of autonomous freight vehicles is expected to revolutionize the industry, enhancing operational efficiency and safety. These trends will likely shape the market landscape, fostering innovation and growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Real-time Analytics Diagnostic Analytics Others |

| By End-User Industry | Agriculture Manufacturing Wholesale and Retail Trade Oil and Gas Construction Transportation and Logistics Providers Others |

| By Mode of Transport | Road Freight Rail Freight Air Freight Sea Freight Multimodal Transport Others |

| By Geographic Region | North Region Northeast Region Central-West Region Southeast Region South Region |

| By Technology Used | Cloud-based Solutions On-premise Solutions Hybrid Solutions IoT-enabled Platforms AI & Machine Learning Solutions Others |

| By Application | Supply Chain Management Fleet Management Route Optimization Inventory Management Warehouse Management Risk & Compliance Analytics Others |

| By Investment Source | Private Investments Government Funding Venture Capital Public-Private Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Analytics | 100 | Logistics Coordinators, Fleet Managers |

| Rail Freight Optimization | 60 | Operations Directors, Rail Network Planners |

| Air Cargo Management | 40 | Air Freight Managers, Cargo Operations Supervisors |

| Maritime Freight Solutions | 50 | Shipping Line Executives, Port Authority Officials |

| Freight Analytics Software Adoption | 70 | IT Managers, Data Analysts in Logistics |

The Brazil Freight Analytics Market is valued at approximately USD 105 billion, reflecting a comprehensive analysis of the freight and logistics sector over the past five years. This growth is driven by the demand for efficient logistics solutions and real-time data analytics.