Region:Africa

Author(s):Shubham

Product Code:KRAA0849

Pages:93

Published On:August 2025

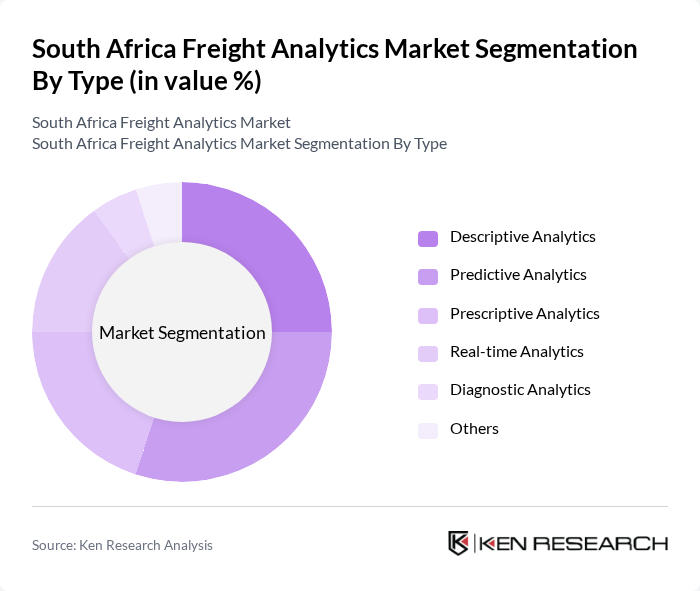

By Type:The freight analytics market can be segmented into Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, Real-time Analytics, Diagnostic Analytics, and Others. Descriptive analytics focuses on analyzing historical logistics data to identify patterns and trends. Predictive analytics uses statistical models and machine learning to forecast future logistics outcomes, such as demand or delays. Prescriptive analytics provides actionable recommendations for optimizing logistics decisions. Real-time analytics enables immediate insights into ongoing freight operations, supporting dynamic decision-making. Diagnostic analytics investigates the causes of logistics issues to improve future performance. The "Others" category includes emerging analytics types and custom solutions tailored to specific freight challenges .

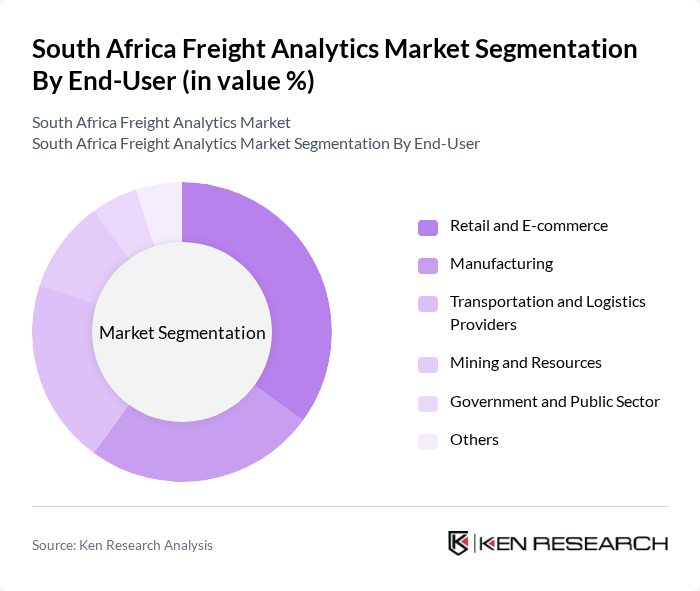

By End-User:The end-user segmentation includes Retail and E-commerce, Manufacturing, Transportation and Logistics Providers, Mining and Resources, Government and Public Sector, and Others. Retail and E-commerce companies leverage freight analytics to optimize last-mile delivery and inventory management. Manufacturing firms use analytics to streamline inbound and outbound logistics. Transportation and logistics providers deploy analytics for route optimization, fleet management, and operational efficiency. The mining and resources sector applies analytics to manage bulk commodity flows and supply chain risks. Government and public sector entities utilize analytics for infrastructure planning and regulatory compliance. The "Others" segment covers sectors such as agriculture and healthcare with specialized freight analytics needs .

The South Africa Freight Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Transnet Freight Rail, Imperial Logistics (now part of DP World Logistics South Africa), Bidvest International Logistics, DHL Supply Chain South Africa, Kuehne + Nagel South Africa, Barloworld Logistics, Grindrod Limited, Safmarine (Maersk South Africa), M24 Logistics, inDrive.Freight, Ctrack, Fleet Complete, Geotab, Infor, SAP SE contribute to innovation, geographic expansion, and service delivery in this space.

The South African freight analytics market is poised for significant transformation, driven by technological advancements and evolving consumer demands. As companies increasingly adopt predictive analytics, the focus will shift towards enhancing operational efficiency and sustainability. The integration of IoT and AI technologies will further streamline logistics processes, while government initiatives will support infrastructure development. This evolving landscape presents opportunities for innovation and collaboration, positioning the market for robust growth in the coming years, particularly in smart logistics and sustainable solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Real-time Analytics Diagnostic Analytics Others |

| By End-User | Retail and E-commerce Manufacturing Transportation and Logistics Providers Mining and Resources Government and Public Sector Others |

| By Application | Route Optimization Fleet Management Supply Chain Visibility Demand Forecasting Asset Tracking and Monitoring Risk and Compliance Management Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Region | Gauteng Western Cape KwaZulu-Natal Eastern Cape Others |

| By Business Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Operations | 100 | Fleet Managers, Operations Directors |

| Rail Freight Services | 60 | Logistics Coordinators, Rail Operations Managers |

| Air Cargo Management | 40 | Air Freight Managers, Customs Compliance Officers |

| Maritime Freight Logistics | 40 | Port Operations Managers, Shipping Line Executives |

| Cold Chain Logistics | 40 | Supply Chain Managers, Quality Assurance Officers |

The South Africa Freight Analytics Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by the demand for efficient logistics and supply chain management solutions, particularly in the context of rising e-commerce and real-time data analytics.