Region:Europe

Author(s):Shubham

Product Code:KRAA1014

Pages:97

Published On:August 2025

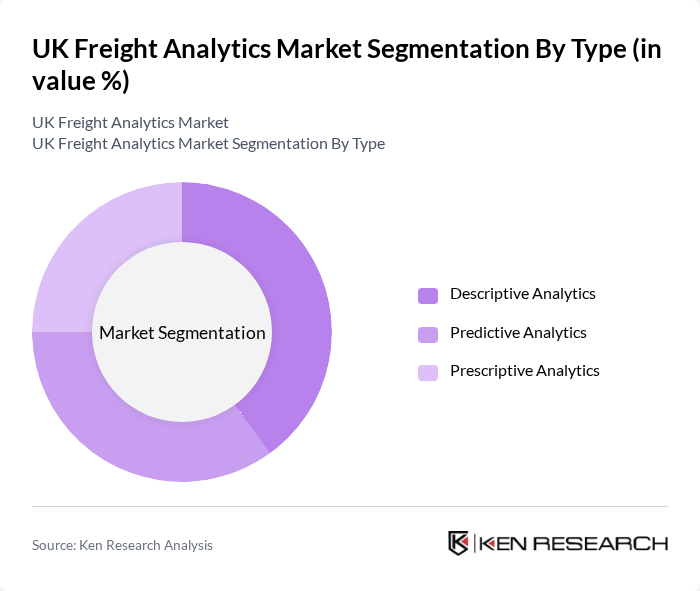

By Type:The market is segmented into three types: Descriptive Analytics, Predictive Analytics, and Prescriptive Analytics. Descriptive Analytics focuses on historical data analysis to understand trends and patterns in freight movement. Predictive Analytics employs statistical and machine learning models to forecast future logistics outcomes, such as demand surges or route bottlenecks. Prescriptive Analytics provides actionable recommendations, enabling optimal decision-making for route planning, resource allocation, and cost minimization .

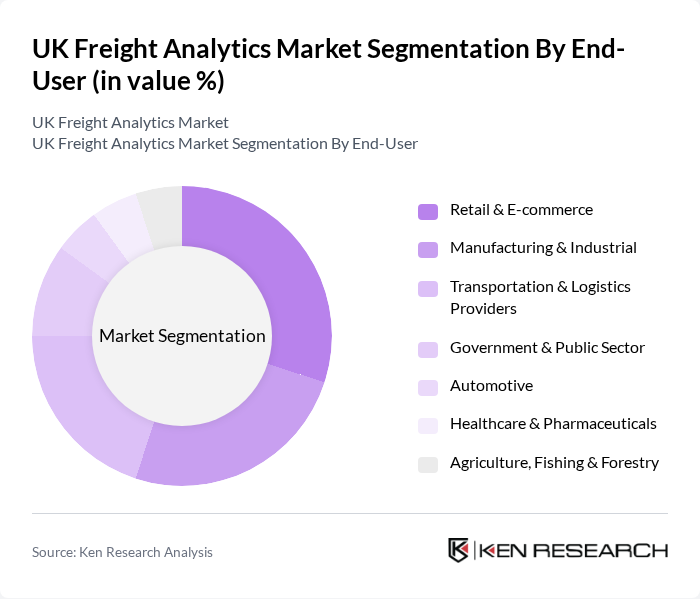

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing & Industrial, Transportation & Logistics Providers, Government & Public Sector, Automotive, Healthcare & Pharmaceuticals, and Agriculture, Fishing & Forestry. Retail & E-commerce leverages analytics for last-mile delivery optimization and inventory management. Manufacturing & Industrial sectors use analytics for supply chain visibility and production planning. Transportation & Logistics Providers focus on route optimization and fleet management. Government & Public Sector entities utilize analytics for infrastructure planning and regulatory compliance. Automotive, Healthcare & Pharmaceuticals, and Agriculture, Fishing & Forestry sectors apply analytics for specialized logistics needs, such as temperature-sensitive shipments and compliance tracking .

The UK Freight Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Descartes Systems Group, Trimble Inc., WiseTech Global, SAP SE, Oracle Corporation, BluJay Solutions (now part of E2open), Freightos Limited, FourKites, Project44, Transporeon (a Trimble company), Alpega Group, Kuehne + Nagel International AG, DHL Supply Chain (Deutsche Post DHL Group), Maersk (A.P. Moller – Maersk), and C.H. Robinson Worldwide, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The UK freight analytics market is poised for transformative growth, driven by technological advancements and evolving consumer demands. As companies increasingly adopt cloud-based solutions and IoT technologies, the ability to leverage real-time data will enhance operational efficiency. Furthermore, the focus on sustainability will push logistics firms to adopt greener practices, aligning with government regulations. By future, the integration of AI and machine learning is expected to redefine analytics capabilities, enabling predictive insights that will shape the future of freight logistics.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics |

| By End-User | Retail & E-commerce Manufacturing & Industrial Transportation & Logistics Providers Government & Public Sector Automotive Healthcare & Pharmaceuticals Agriculture, Fishing & Forestry |

| By Application | Route Optimization Fleet Management Inventory & Warehouse Management Freight Procurement & Tendering Risk & Compliance Analytics |

| By Distribution Mode | Road Freight Rail Freight Air Freight Sea Freight |

| By Business Model | B2B B2C |

| By Pricing Model | Subscription-Based Pay-Per-Use |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Analytics | 60 | Logistics Managers, Fleet Operations Directors |

| Rail Freight Optimization | 40 | Rail Operations Managers, Supply Chain Analysts |

| Air Cargo Data Solutions | 45 | Air Freight Managers, Data Scientists |

| Maritime Freight Tracking | 40 | Port Operations Managers, Shipping Analysts |

| Integrated Freight Management Systems | 50 | IT Managers, Business Development Executives |

The UK Freight Analytics Market is valued at approximately USD 1.3 billion, reflecting a significant growth trend driven by the increasing demand for data-driven decision-making in logistics and supply chain management.