Region:Europe

Author(s):Dev

Product Code:KRAA0486

Pages:80

Published On:August 2025

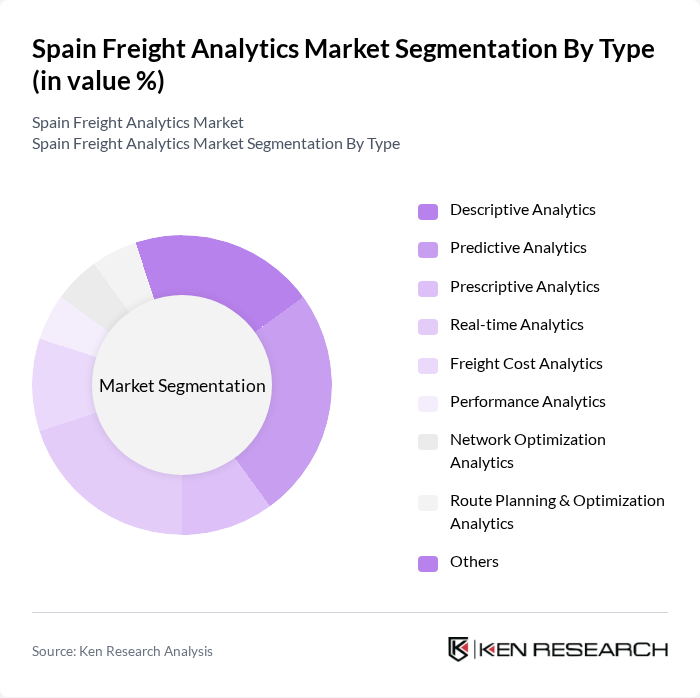

By Type:The freight analytics market is segmented into descriptive analytics, predictive analytics, prescriptive analytics, real-time analytics, freight cost analytics, performance analytics, network optimization analytics, route planning & optimization analytics, and others. Predictive analytics is gaining traction as it enables companies to forecast demand, optimize inventory levels, and improve route planning, thereby enhancing operational efficiency and reducing costs .

By End-User:The end-user segmentation includes retail & e-commerce, manufacturing, transportation and logistics providers, healthcare & pharmaceuticals, food and beverage, automotive, agriculture, construction, and others. The retail & e-commerce sector is the leading end-user, driven by the surge in online shopping and the need for efficient logistics solutions to meet consumer demands. The manufacturing sector also represents a significant share, leveraging analytics to streamline production and distribution processes .

The Spain Freight Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain Spain, DB Schenker Spain, XPO Logistics Spain, Kuehne + Nagel Spain, Grupo Sesé, Logista, Rhenus Logistics Spain, FedEx Express Spain, Girteka Spain, CTT Express, Carreras Grupo Logístico, Azkar Dachser Group, STEF Iberia, Noatum Logistics, and Transfesa Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Spain freight analytics market appears promising, driven by technological advancements and increasing demand for efficiency. As companies prioritize data-driven strategies, the integration of AI and IoT will enhance operational capabilities. Furthermore, the emphasis on sustainability will push firms to adopt analytics solutions that optimize resource use and reduce emissions. In future, the market is expected to witness a significant shift towards cloud-based platforms, enabling real-time data access and collaboration across the supply chain, fostering innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Real-time Analytics Freight Cost Analytics Performance Analytics Network Optimization Analytics Route Planning & Optimization Analytics Others |

| By End-User | Retail & E-commerce Manufacturing Transportation and Logistics Providers Healthcare & Pharmaceuticals Food and Beverage Automotive Agriculture Construction Others |

| By Mode of Transport | Road Freight Rail Freight Air Freight Sea Freight Intermodal Freight Courier, Express & Parcel (CEP) Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Analytics Type | Operational Analytics Financial Analytics Customer Analytics Supply Chain Analytics Risk Analytics Sustainability Analytics Others |

| By Industry Vertical | E-commerce Telecommunications Energy Government Others |

| By Geographic Coverage | National Regional Local Cross-Border Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Operations | 120 | Logistics Managers, Fleet Operations Directors |

| Rail Freight Services | 60 | Railway Operations Managers, Supply Chain Analysts |

| Air Cargo Logistics | 40 | Air Freight Managers, Customs Compliance Officers |

| Maritime Freight Solutions | 50 | Port Operations Managers, Shipping Line Executives |

| Freight Analytics Technology | 45 | IT Managers, Data Analysts in Logistics |

The Spain Freight Analytics Market is valued at approximately USD 1.3 billion, reflecting a significant growth driven by the demand for efficient logistics solutions and advancements in technology such as AI and IoT.