Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA4547

Pages:89

Published On:September 2025

By Type:The market is segmented into various types of wearables, including fitness trackers, smartwatches, medical wearables, smart clothing & smart textiles, sleep monitors, wearable ECG & biosignal monitors, connected hearing aids, and others. Among these, fitness trackers and smartwatches are the most popular due to their user-friendly interfaces and comprehensive health tracking features. The increasing focus on fitness and wellness, coupled with the rise of chronic diseases and the popularity of remote health monitoring, has led to a surge in demand for these devices. Recent launches by leading brands highlight enhanced health metrics, longer battery life, and advanced connectivity, further driving adoption .

By End-User:The end-user segmentation includes individual consumers, healthcare providers & hospitals, corporate wellness programs, insurance companies, research & academic institutions, elderly care facilities, and others. Individual consumers represent the largest segment, driven by the growing trend of personal health management and fitness tracking. Healthcare providers are also increasingly adopting wearables for remote patient monitoring and chronic disease management, further expanding the market. Corporate wellness programs and insurance companies are leveraging wearable data for employee health initiatives and risk assessment, while elderly care facilities utilize these technologies for continuous health monitoring and safety .

The Brazil HealthTech Wearables & IoT Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fitbit Inc. (now part of Google LLC), Apple Inc., Samsung Electronics Co., Ltd., Garmin Ltd., Xiaomi Corporation, Philips Healthcare, Huawei Technologies Co., Ltd., Withings S.A., Medtronic plc, Omron Corporation, AliveCor, Inc., BioTelemetry, Inc. (now part of Philips), Abbott Laboratories, Johnson & Johnson, Boston Scientific Corporation, Positivo Tecnologia S.A., Biolinker (Brazil), Hi Technologies (Brazil), Phelcom Technologies (Brazil), TOTVS S.A. (Healthcare IoT) contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's HealthTech wearables and IoT market appears promising, driven by ongoing technological innovations and increasing health awareness among consumers. As telehealth services expand, the integration of AI and machine learning into wearables will enhance personalized healthcare solutions. Furthermore, partnerships between technology firms and healthcare providers are expected to foster the development of more effective health monitoring systems, ultimately improving patient outcomes and driving market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Trackers Smartwatches Medical Wearables Smart Clothing & Smart Textiles Sleep Monitors Wearable ECG & Biosignal Monitors Connected Hearing Aids Others |

| By End-User | Individual Consumers Healthcare Providers & Hospitals Corporate Wellness Programs Insurance Companies Research & Academic Institutions Elderly Care Facilities Others |

| By Application | Fitness and Wellness Chronic Disease Management Remote Patient Monitoring Emergency Response Health Tracking Medication Adherence Others |

| By Distribution Channel | Online Retail Offline Retail (Pharmacies, Electronics Stores) Direct Sales B2B Sales Healthcare Provider Distribution Others |

| By Price Range | Low-End Wearables ( |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers First-Time Buyers Others |

| By User Demographics | Age Groups Gender Income Levels Geographic Distribution (Urban/Rural/Region) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 100 | Doctors, Nurses, Health Administrators |

| Wearable Technology Users | 120 | Patients, Fitness Enthusiasts, Elderly Users |

| IoT Solution Developers | 60 | Product Managers, Software Engineers, R&D Specialists |

| Regulatory Bodies | 40 | Policy Makers, Health Regulators, Compliance Officers |

| Market Analysts | 50 | Industry Analysts, Market Researchers, Consultants |

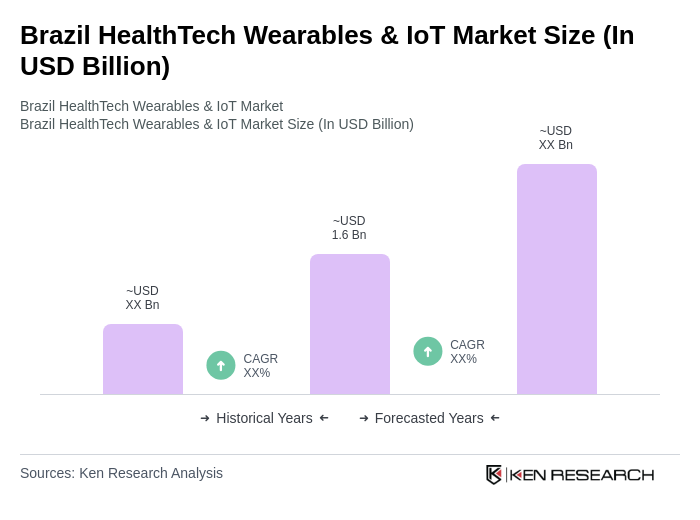

The Brazil HealthTech Wearables & IoT Market is valued at approximately USD 1.6 billion, driven by the increasing adoption of health monitoring devices and advancements in IoT technology that enhance healthcare connectivity and data analytics capabilities.