Region:Central and South America

Author(s):Shubham

Product Code:KRAA1163

Pages:91

Published On:August 2025

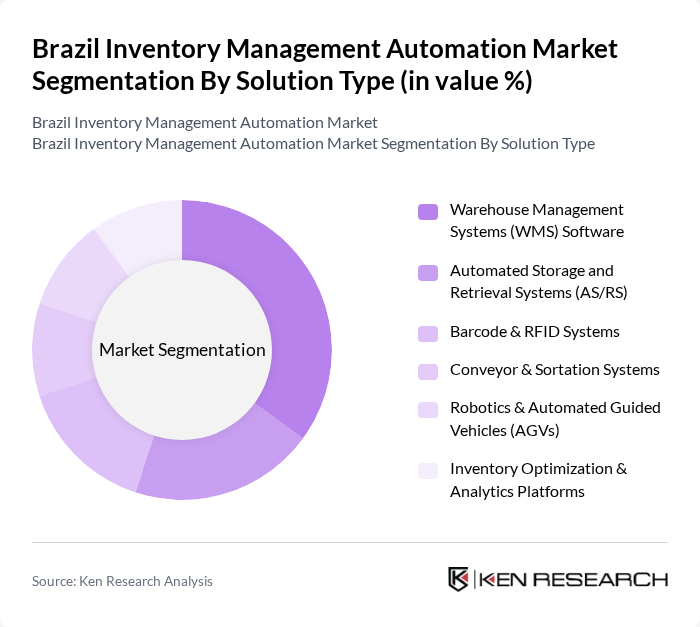

By Solution Type:The solution type segmentation includes technologies that facilitate inventory management automation. The subsegments are Warehouse Management Systems (WMS) Software, Automated Storage and Retrieval Systems (AS/RS), Barcode & RFID Systems, Conveyor & Sortation Systems, Robotics & Automated Guided Vehicles (AGVs), and Inventory Optimization & Analytics Platforms. Among these, Warehouse Management Systems (WMS) Software is the leading subsegment, driven by the increasing need for efficient warehouse operations and real-time inventory visibility. Hardware solutions, including AS/RS and robotics, also see substantial adoption as companies seek to automate physical processes and reduce labor dependency .

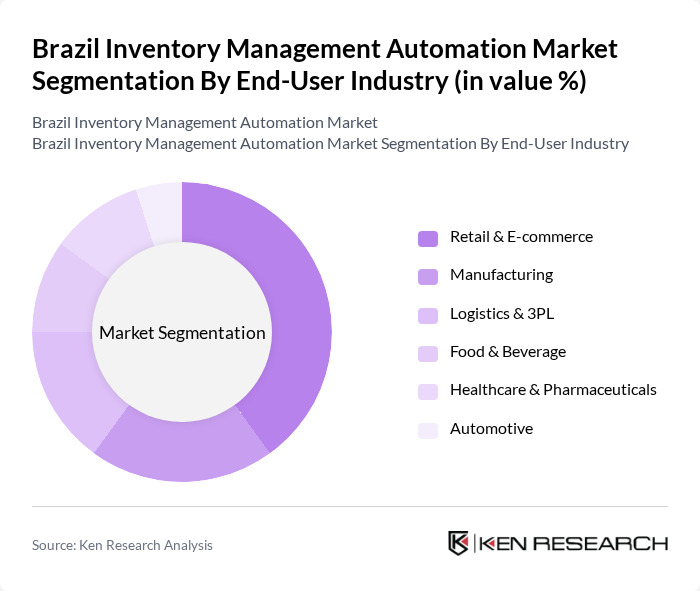

By End-User Industry:The end-user industry segmentation encompasses sectors utilizing inventory management automation solutions. The subsegments include Retail & E-commerce, Manufacturing, Logistics & 3PL, Food & Beverage, Healthcare & Pharmaceuticals, Automotive, and Others. The Retail & E-commerce sector is the dominant segment, driven by the rapid growth of online shopping and the need for efficient inventory management to meet consumer demands. Manufacturing and logistics sectors are also significant adopters, leveraging automation to improve throughput and accuracy .

The Brazil Inventory Management Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as TOTVS S.A., Senior Sistemas, WMS Brasil, SAP SE, Oracle Corporation, Manhattan Associates, Infor, Blue Yonder (JDA Software), Dematic (KION Group), Swisslog (KUKA Group), Körber Supply Chain (Körber AG), Zebra Technologies, Honeywell Intelligrated, Consinco (now part of TOTVS), Linx (a StoneCo company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Brazil inventory management automation market appears promising, driven by technological advancements and increasing digital transformation initiatives. As businesses continue to embrace automation, the integration of IoT and AI technologies will enhance inventory accuracy and efficiency. Furthermore, government initiatives aimed at promoting digitalization will likely provide additional support, fostering a conducive environment for innovation and growth in the sector, ultimately leading to improved supply chain management practices across various industries.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Warehouse Management Systems (WMS) Software Automated Storage and Retrieval Systems (AS/RS) Barcode & RFID Systems Conveyor & Sortation Systems Robotics & Automated Guided Vehicles (AGVs) Inventory Optimization & Analytics Platforms |

| By End-User Industry | Retail & E-commerce Manufacturing Logistics & 3PL Food & Beverage Healthcare & Pharmaceuticals Automotive Others |

| By Component | Hardware Software Services |

| By Deployment Mode | Cloud-Based On-Premises |

| By Organization Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By Region | Southeast South Northeast North Central-West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 100 | Inventory Managers, Supply Chain Analysts |

| Manufacturing Automation Solutions | 80 | Operations Managers, Production Supervisors |

| E-commerce Fulfillment Strategies | 90 | Logistics Coordinators, eCommerce Directors |

| Warehouse Management Systems | 70 | Warehouse Managers, IT Directors |

| Technology Adoption in Supply Chains | 50 | Chief Technology Officers, Business Development Managers |

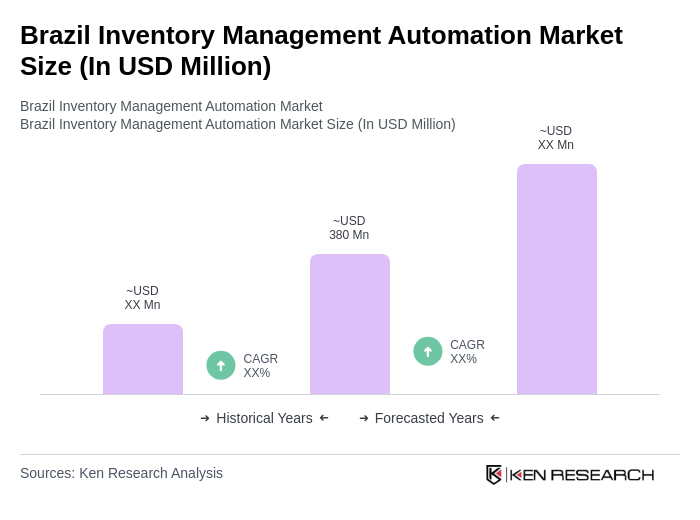

The Brazil Inventory Management Automation Market is valued at approximately USD 380 million, driven by the increasing demand for operational efficiency, the rapid growth of e-commerce, and the need for real-time inventory tracking solutions.