Region:Europe

Author(s):Shubham

Product Code:KRAA0961

Pages:89

Published On:August 2025

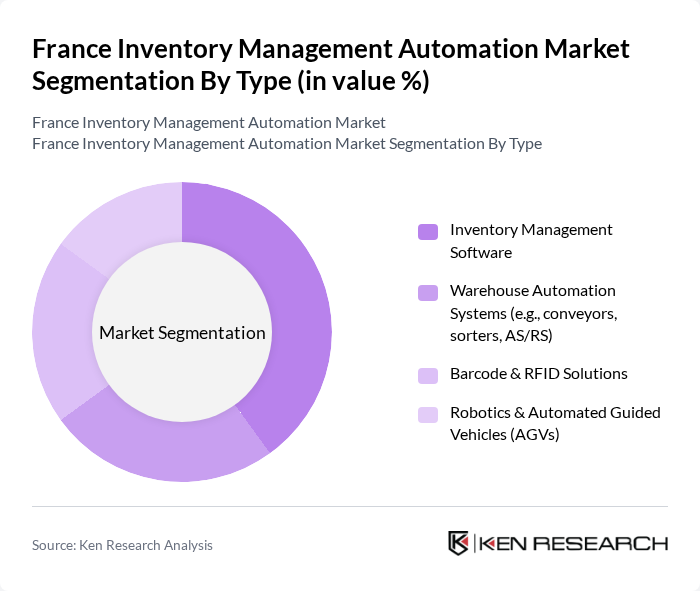

By Type:The market is segmented into Inventory Management Software, Warehouse Automation Systems (e.g., conveyors, sorters, AS/RS), Barcode & RFID Solutions, and Robotics & Automated Guided Vehicles (AGVs). Inventory Management Software remains the leading sub-segment, driven by its critical role in optimizing inventory levels, enabling real-time analytics, and integrating with broader enterprise resource planning (ERP) systems. The growing complexity of supply chains and the need for compliance with traceability regulations are increasing demand for sophisticated software solutions .

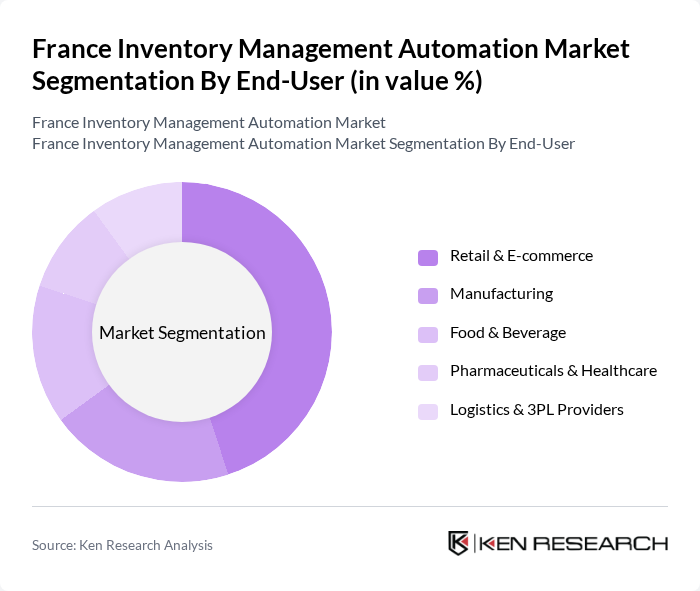

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Food & Beverage, Pharmaceuticals & Healthcare, and Logistics & 3PL Providers. Retail & E-commerce is the dominant segment, propelled by rapid online sales growth, omnichannel fulfillment, and the need for agile inventory management to meet evolving consumer expectations. Manufacturing and logistics sectors are also accelerating adoption, leveraging automation to address labor shortages and increase operational efficiency .

The France Inventory Management Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Infor, Manhattan Associates, Blue Yonder (formerly JDA Software), Generix Group, Hardis Group, Savoye, Körber Supply Chain (formerly Consoveyo), Zebra Technologies, Mecalux, SSI Schäfer, Dematic (a KION Group company), Swisslog (a KUKA company), Reflex Logistics Solutions (by Hardis Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of inventory management automation in France appears promising, driven by technological advancements and evolving consumer expectations. As businesses increasingly prioritize efficiency and accuracy, the integration of advanced analytics and AI will become standard practice. Moreover, the ongoing digital transformation across sectors will likely accelerate the adoption of automated solutions, enabling companies to respond swiftly to market changes. This trend will foster a more agile supply chain, enhancing competitiveness in the global marketplace.

| Segment | Sub-Segments |

|---|---|

| By Type | Inventory Management Software Warehouse Automation Systems (e.g., conveyors, sorters, AS/RS) Barcode & RFID Solutions Robotics & Automated Guided Vehicles (AGVs) |

| By End-User | Retail & E-commerce Manufacturing Food & Beverage Pharmaceuticals & Healthcare Logistics & 3PL Providers |

| By Application | Order Fulfillment & Picking Stock Replenishment & Tracking Demand Forecasting & Planning Returns Management |

| By Sales Channel | Direct Sales Channel Partners & Distributors Online Platforms |

| By Enterprise Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By Deployment Mode | Cloud-Based Solutions On-Premise Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Automation | 100 | Inventory Managers, Supply Chain Analysts |

| Manufacturing Process Optimization | 80 | Operations Managers, Production Supervisors |

| E-commerce Fulfillment Strategies | 90 | Logistics Coordinators, E-commerce Directors |

| Warehouse Management Systems | 70 | Warehouse Managers, IT Directors |

| Technology Adoption in Inventory Management | 60 | Chief Technology Officers, Automation Specialists |

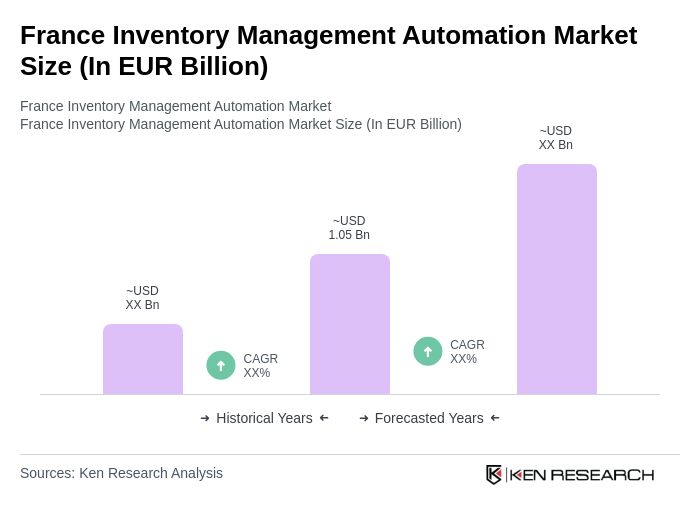

The France Inventory Management Automation Market is valued at approximately EUR 1.05 billion. This valuation reflects the growing demand for efficiency in supply chain operations, particularly driven by the rise of e-commerce and the need for real-time inventory tracking.