Region:Africa

Author(s):Shubham

Product Code:KRAA1131

Pages:86

Published On:August 2025

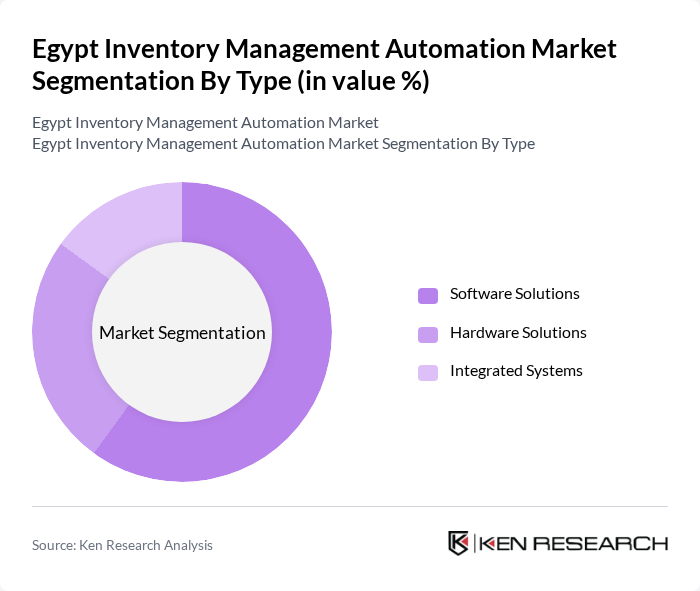

By Type:The market is segmented into Software Solutions, Hardware Solutions, and Integrated Systems. Software Solutions dominate the market due to their flexibility, scalability, and ability to integrate with other business systems, allowing businesses to customize and automate their inventory management processes. Hardware Solutions, including barcode scanners and RFID devices, are essential for accurate tracking and are often integrated with software to enhance functionality. Integrated Systems are gaining traction as companies seek comprehensive solutions that combine both software and hardware for seamless, end-to-end operations .

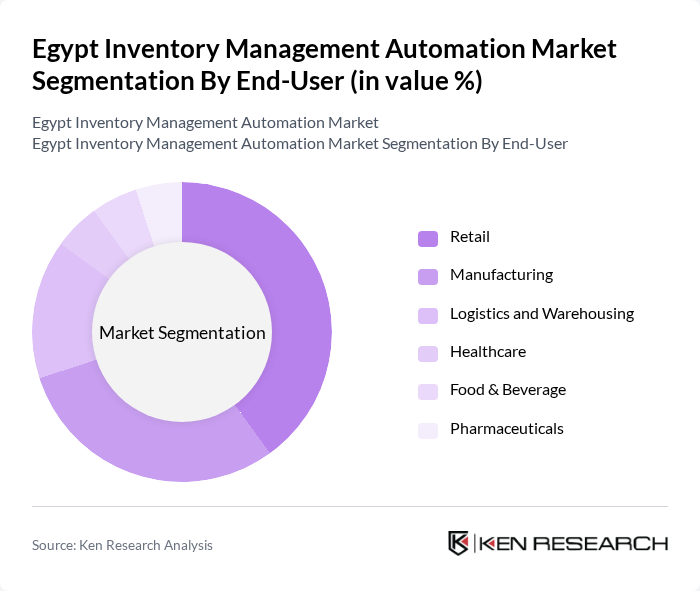

By End-User:The end-user segmentation includes Retail, Manufacturing, Logistics and Warehousing, Healthcare, Food & Beverage, and Pharmaceuticals. The Retail sector leads the market, driven by the need for efficient inventory management to meet consumer demands, minimize stockouts, and reduce costs. Manufacturing follows closely, as companies seek to optimize production processes and manage raw material inventories effectively. Logistics and Warehousing are also significant, with increasing demand for automation to support e-commerce growth and improve supply chain visibility. Healthcare, Food & Beverage, and Pharmaceuticals sectors are adopting automation to ensure compliance, traceability, and inventory accuracy .

The Egypt Inventory Management Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Microsoft Egypt (Microsoft Dynamics), Infor, Odoo, Zoho Corporation (Zoho Inventory), NetSuite (Oracle NetSuite), Epicor Software Corporation, Sumerge, ITWorx, Link Development, Sphinx IT, Brightpearl, Unleashed Software, and Inventory Planner contribute to innovation, geographic expansion, and service delivery in this space.

The future of the inventory management automation market in Egypt appears promising, driven by technological advancements and increasing digital transformation initiatives. As businesses continue to embrace automation, the integration of artificial intelligence and machine learning will enhance inventory accuracy and forecasting capabilities. Additionally, the growing emphasis on sustainability will encourage companies to adopt eco-friendly practices in inventory management, aligning with global trends and consumer preferences for responsible business operations.

| Segment | Sub-Segments |

|---|---|

| By Type | Software Solutions Hardware Solutions Integrated Systems |

| By End-User | Retail Manufacturing Logistics and Warehousing Healthcare Food & Beverage Pharmaceuticals |

| By Component | Inventory Tracking Software Barcode Scanners RFID Systems IoT Sensors Mobile Applications |

| By Sales Channel | Direct Sales Online Sales Distributors System Integrators |

| By Deployment Mode | On-Premise Cloud-Based Hybrid |

| By Price Range | Budget Solutions Mid-Range Solutions Premium Solutions |

| By Others | Custom Solutions Niche Market Offerings |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 100 | Inventory Managers, Supply Chain Analysts |

| Manufacturing Automation Solutions | 80 | Operations Managers, Production Supervisors |

| E-commerce Fulfillment Strategies | 60 | Logistics Coordinators, IT Managers |

| Warehouse Management Systems | 50 | Warehouse Managers, Technology Officers |

| Supply Chain Optimization Practices | 40 | Consultants, Business Development Managers |

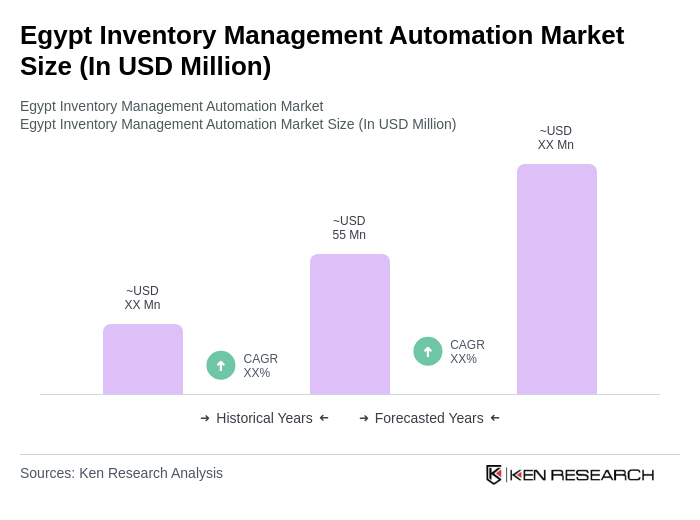

The Egypt Inventory Management Automation Market is valued at approximately USD 55 million, reflecting a historical analysis of the supply chain management and inventory management software sectors, driven by the adoption of automated solutions and real-time inventory tracking.