Region:Global

Author(s):Geetanshi

Product Code:KRAA2044

Pages:93

Published On:August 2025

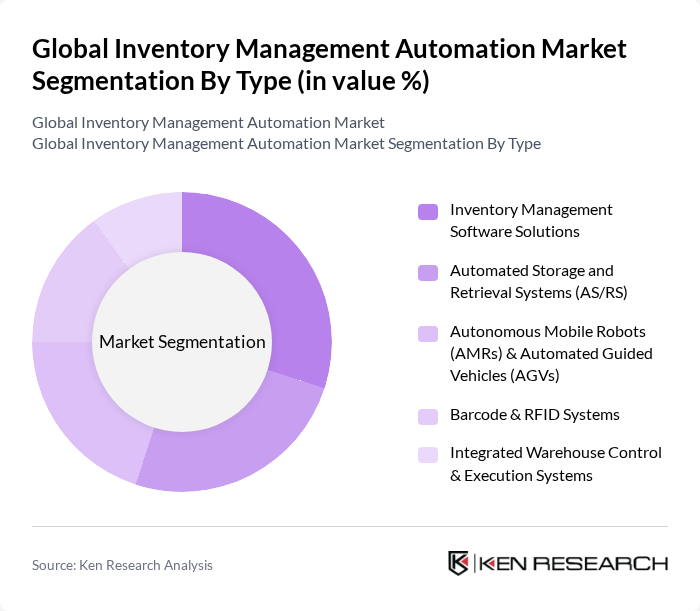

By Type:The market is segmented into various types, including Inventory Management Software Solutions, Automated Storage and Retrieval Systems (AS/RS), Autonomous Mobile Robots (AMRs) & Automated Guided Vehicles (AGVs), Barcode & RFID Systems, and Integrated Warehouse Control & Execution Systems. Each of these subsegments plays a crucial role in enhancing operational efficiency and accuracy in inventory management. Inventory Management Software Solutions lead the market, driven by the demand for real-time data, integration with ERP and sales platforms, and the need for automated reordering and demand forecasting. Automated Storage and Retrieval Systems and robotics are gaining traction as warehouses seek to optimize space and labor efficiency .

The leading subsegment in this category is Inventory Management Software Solutions, which is favored for its ability to provide comprehensive visibility and control over inventory levels. Businesses are increasingly relying on software solutions to automate their inventory processes, reduce human error, and enhance decision-making capabilities. The growing trend of digital transformation across industries, as well as the adoption of cloud-based and SaaS platforms, further supports the dominance of this subsegment .

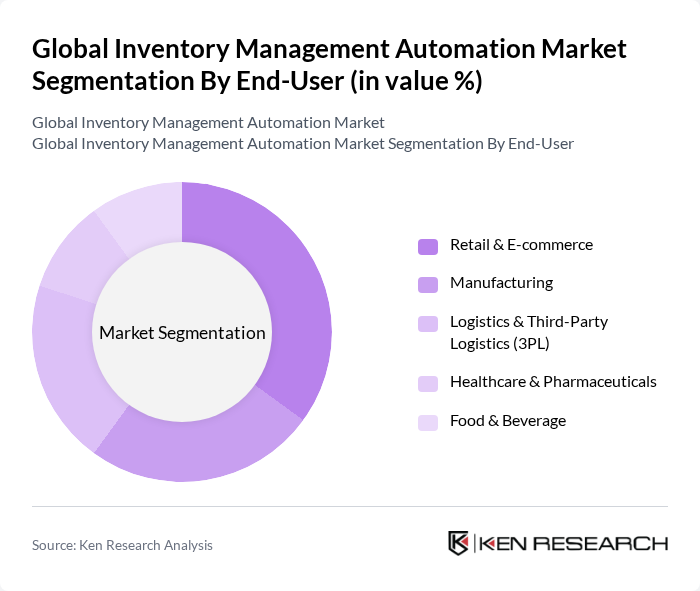

By End-User:The market is segmented by end-users, including Retail & E-commerce, Manufacturing, Logistics & Third-Party Logistics (3PL), Healthcare & Pharmaceuticals, and Food & Beverage. Each end-user segment has unique requirements and challenges that drive the adoption of inventory management automation solutions. Retail & E-commerce leads due to the rapid growth of online shopping and the need for real-time inventory visibility, while manufacturing and logistics sectors are adopting automation to improve supply chain resilience and efficiency .

Retail & E-commerce is the dominant end-user segment, driven by the rapid growth of online shopping and the need for efficient inventory management to meet customer demands. The increasing complexity of supply chains and the necessity for real-time inventory visibility are pushing retailers to adopt automated solutions to enhance their operational efficiency and customer satisfaction. Manufacturing and logistics sectors are also accelerating adoption to address supply chain disruptions and optimize operational costs .

The Global Inventory Management Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Manhattan Associates, Inc., Infor, Inc., Blue Yonder (formerly JDA Software), Fishbowl Inventory, Zoho Corporation (Zoho Inventory), NetSuite Inc. (Oracle NetSuite), Cin7 Limited, SkuVault Inc., TradeGecko (now QuickBooks Commerce), Wasp Barcode Technologies, Brightpearl (a Sage company), Zebra Technologies Corporation, DEAR Systems (now Cin7 Core) contribute to innovation, geographic expansion, and service delivery in this space.

The future of inventory management automation is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As businesses increasingly adopt AI and machine learning, they will enhance their inventory optimization capabilities, leading to improved accuracy and efficiency. Additionally, the growing emphasis on sustainability will push companies to adopt eco-friendly practices, integrating automation solutions that minimize waste and energy consumption, ultimately reshaping the landscape of inventory management in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Inventory Management Software Solutions Automated Storage and Retrieval Systems (AS/RS) Autonomous Mobile Robots (AMRs) & Automated Guided Vehicles (AGVs) Barcode & RFID Systems Integrated Warehouse Control & Execution Systems |

| By End-User | Retail & E-commerce Manufacturing Logistics & Third-Party Logistics (3PL) Healthcare & Pharmaceuticals Food & Beverage |

| By Application | Warehouse Management Order Fulfillment & Picking Demand Forecasting & Planning Inventory Tracking & Traceability |

| By Distribution Channel | Direct Sales Online Sales Distributors & System Integrators |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Industry Vertical | Consumer Goods Automotive Electronics & Electricals Apparel & Fashion Aerospace & Defense |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Automation | 100 | Inventory Managers, Supply Chain Analysts |

| Manufacturing Process Automation | 90 | Operations Managers, Production Supervisors |

| E-commerce Fulfillment Automation | 80 | Logistics Coordinators, Warehouse Managers |

| Healthcare Inventory Management | 60 | Pharmacy Managers, Supply Chain Directors |

| Food and Beverage Supply Chain Automation | 50 | Quality Control Managers, Distribution Managers |

The Global Inventory Management Automation Market is valued at approximately USD 5.9 billion, driven by the increasing demand for operational efficiency, e-commerce growth, and real-time inventory tracking solutions.