Region:Central and South America

Author(s):Shubham

Product Code:KRAA0793

Pages:81

Published On:August 2025

By Type:The market is segmented into Software Solutions, Consulting Services, Hardware Solutions, Managed Services, and Value-Added Warehousing & Fulfillment Services. Software Solutions lead the segment, driven by the increasing adoption of cloud-based, AI-enabled inventory management systems that provide real-time tracking, analytics, and integration with other business platforms. Consulting Services are gaining traction as organizations seek expert guidance to optimize inventory processes and comply with regulatory requirements. Managed Services are in demand as companies increasingly outsource inventory management to focus on their core operations and benefit from specialized expertise .

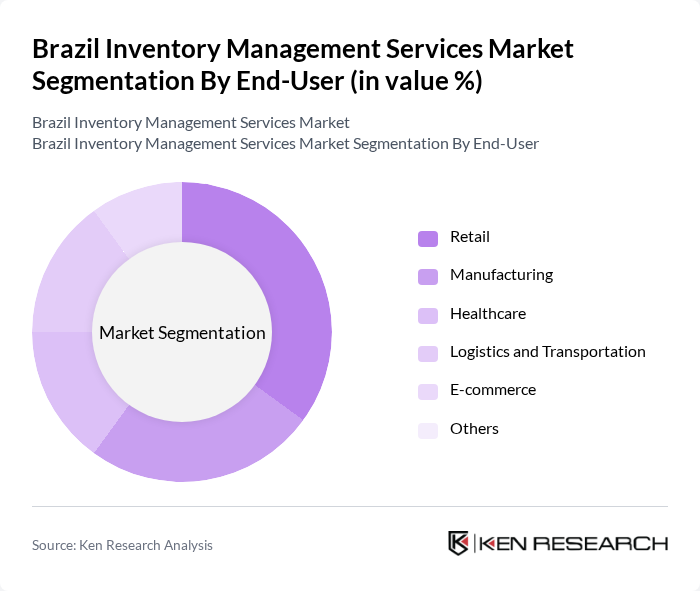

By End-User:The end-user segmentation includes Retail, Manufacturing, Healthcare, Logistics and Transportation, E-commerce, and Others. The Retail sector is the largest consumer of inventory management services, driven by the need for efficient stock management and customer satisfaction in a highly competitive environment. E-commerce is rapidly growing, requiring advanced inventory solutions to handle high transaction volumes, real-time stock visibility, and efficient returns processing. The Manufacturing sector also demands robust inventory systems to streamline production, minimize downtime, and reduce operational costs .

The Brazil Inventory Management Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as TOTVS S.A., Senior Sistemas, Linx S.A. (a StoneCo company), SAP SE, Oracle Corporation, Manhattan Associates, Infor, Blue Yonder (JDA Software), Benner Sistemas, Sankhya Gestão de Negócios, Mercado Libre (Mercado Envios), DHL Supply Chain Brazil, Grupo Solística, Loggi Tecnologia, and VTEX contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Brazilian inventory management services market appears promising, driven by technological advancements and evolving consumer expectations. As businesses increasingly adopt automation and data analytics, the demand for innovative inventory solutions is expected to rise. Furthermore, the integration of artificial intelligence and the Internet of Things (IoT) will enhance inventory accuracy and efficiency. Companies that embrace these trends will likely gain a competitive edge, positioning themselves favorably in a rapidly changing market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Software Solutions Consulting Services Hardware Solutions Managed Services Value-Added Warehousing & Fulfillment Services |

| By End-User | Retail Manufacturing Healthcare Logistics and Transportation E-commerce Others |

| By Sales Channel | Direct Sales Online Sales Distributors Resellers System Integrators Others |

| By Distribution Mode | Physical Distribution Digital Distribution Hybrid Distribution Others |

| By Industry Vertical | Consumer Goods Electronics Automotive Food and Beverage Pharmaceuticals Others |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time Purchase Others |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 60 | Inventory Managers, Supply Chain Coordinators |

| Manufacturing Inventory Control | 50 | Operations Managers, Production Supervisors |

| E-commerce Fulfillment Strategies | 45 | Logistics Directors, eCommerce Operations Heads |

| Warehouse Management Systems | 40 | Warehouse Managers, IT Systems Analysts |

| Supply Chain Optimization Practices | 45 | Supply Chain Analysts, Business Development Managers |

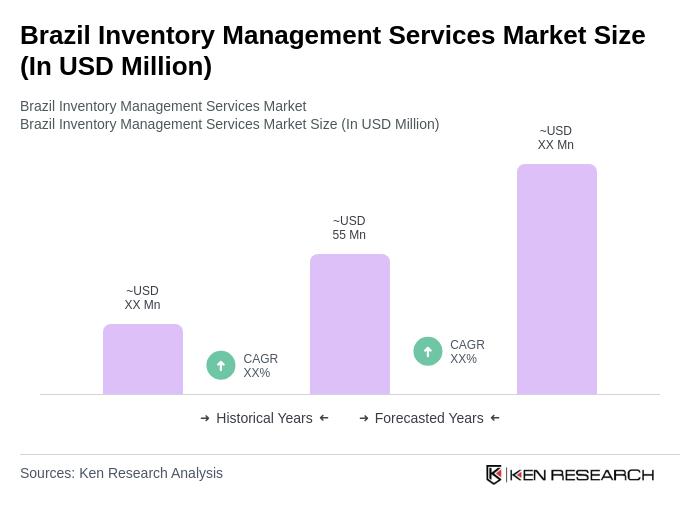

The Brazil Inventory Management Services Market is valued at approximately USD 55 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for efficient supply chain solutions and the rapid adoption of advanced inventory management technologies.