Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA2000

Pages:91

Published On:August 2025

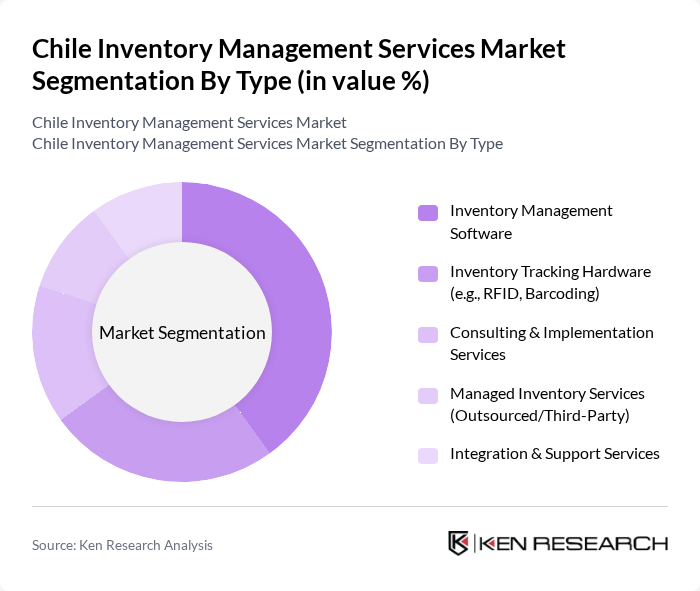

By Type:The inventory management services market can be segmented into various types, includingInventory Management Software, Inventory Tracking Hardware (e.g., RFID, Barcoding), Consulting & Implementation Services, Managed Inventory Services (Outsourced/Third-Party), and Integration & Support Services. Among these,Inventory Management Softwareis the leading sub-segment, driven by the increasing need for automation, real-time data analytics, and seamless integration with other business systems. Businesses are increasingly adopting software solutions to enhance operational efficiency, reduce costs, and improve supply chain visibility .

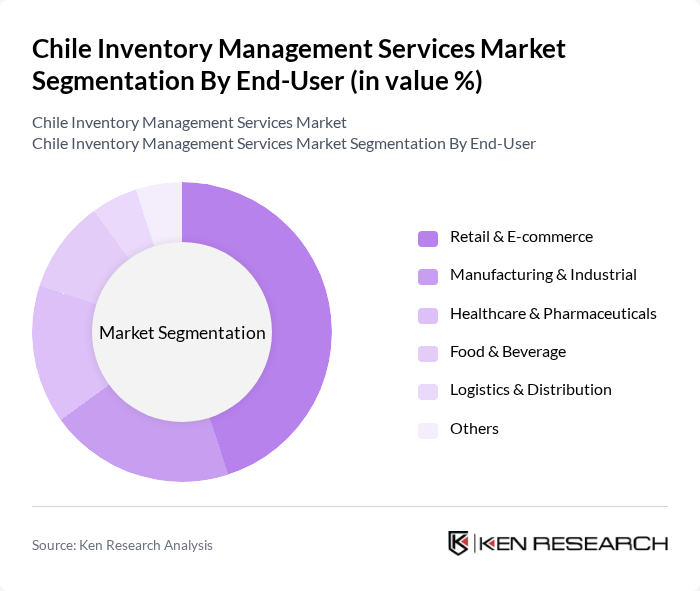

By End-User:The end-user segmentation includesRetail & E-commerce, Manufacturing & Industrial, Healthcare & Pharmaceuticals, Food & Beverage, Logistics & Distribution, and Others. TheRetail & E-commercesector is the dominant segment, as the rapid growth of online shopping has led to an increased focus on inventory management solutions to ensure product availability and timely delivery. This trend is further supported by consumer expectations for fast shipping, accurate inventory information, and the need for omnichannel fulfillment capabilities .

The Chile Inventory Management Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Manhattan Associates, Inc., Blue Yonder (formerly JDA Software Group, Inc.), Infor, Inc., Fishbowl Inventory, NetSuite Inc. (Oracle NetSuite), Epicor Software Corporation, Zoho Corporation (Zoho Inventory), Cin7 Limited, SkuVault Inc., Brightpearl (a Sage Group company), Unleashed Software, TradeGecko (now QuickBooks Commerce by Intuit), DEAR Systems (now Cin7 Core), Softland Chile S.A., Defontana, TOTVS Chile, Kame ERP, Inversiones Logísticas S.A. (ILOG Chile) contribute to innovation, geographic expansion, and service delivery in this space.

The Chilean inventory management services market is poised for significant transformation, driven by technological advancements and evolving consumer behaviors. As businesses increasingly adopt artificial intelligence and data analytics, operational efficiencies are expected to improve markedly. Additionally, the rise of omnichannel retailing will necessitate more integrated inventory solutions, allowing companies to meet customer demands effectively. This dynamic environment presents opportunities for innovation and growth, particularly for firms that can adapt quickly to changing market conditions and consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Inventory Management Software Inventory Tracking Hardware (e.g., RFID, Barcoding) Consulting & Implementation Services Managed Inventory Services (Outsourced/Third-Party) Integration & Support Services |

| By End-User | Retail & E-commerce Manufacturing & Industrial Healthcare & Pharmaceuticals Food & Beverage Logistics & Distribution Others |

| By Industry Vertical | Consumer Goods Automotive Pharmaceuticals Electronics & Electricals Agriculture & Fresh Produce Others |

| By Service Model | On-Premise Cloud-Based Hybrid |

| By Deployment Type | Public Cloud Private Cloud Hybrid Cloud |

| By Geographic Coverage | National Regional (e.g., Santiago Metropolitan, Valparaíso, Antofagasta) Local |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee Freemium/Trial |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 100 | Inventory Managers, Supply Chain Coordinators |

| Manufacturing Supply Chain Optimization | 60 | Operations Managers, Production Supervisors |

| E-commerce Fulfillment Strategies | 50 | Logistics Directors, E-commerce Operations Managers |

| Warehouse Management Systems | 40 | Warehouse Managers, IT Systems Analysts |

| Cold Chain Inventory Solutions | 45 | Logistics Managers, Quality Assurance Officers |

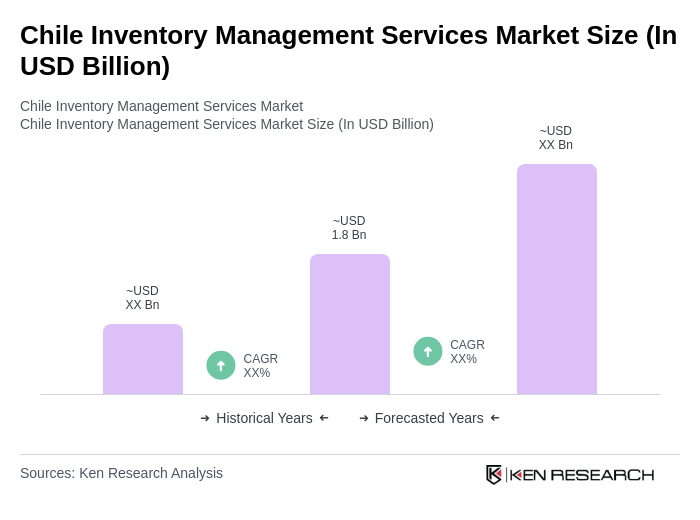

The Chile Inventory Management Services Market is valued at approximately USD 1.8 billion, reflecting a significant growth driven by the demand for efficient supply chain management and the rise of e-commerce, among other factors.