Region:Europe

Author(s):Geetanshi

Product Code:KRAA0280

Pages:84

Published On:August 2025

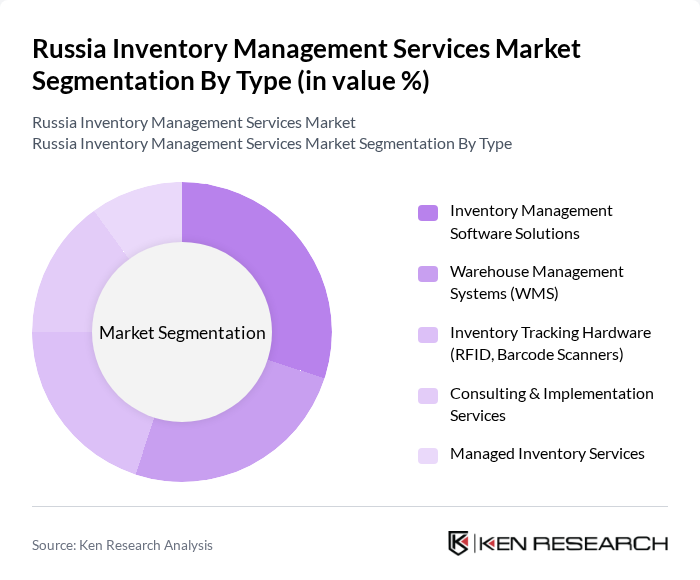

By Type:The market is segmented into Inventory Management Software Solutions, Warehouse Management Systems (WMS), Inventory Tracking Hardware (RFID, Barcode Scanners), Consulting & Implementation Services, and Managed Inventory Services. Each of these sub-segments plays a crucial role in enhancing inventory efficiency and accuracy by enabling automation, real-time tracking, and process optimization .

The leading sub-segment in the market is Inventory Management Software Solutions, which is gaining traction due to the increasing need for real-time data analytics and inventory visibility. Businesses are increasingly adopting software solutions to streamline their inventory processes, reduce errors, and enhance decision-making capabilities. The trend towards digital transformation in various industries is further propelling the demand for these solutions, making them essential for modern inventory management .

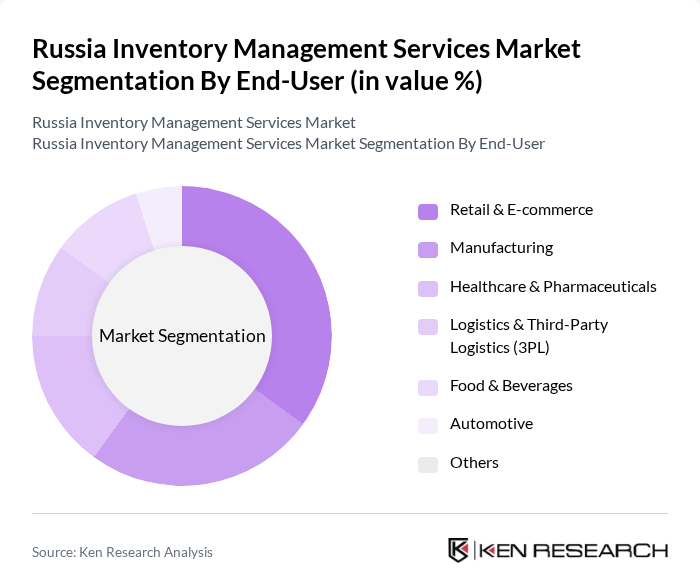

By End-User:The market is segmented by end-users, including Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Logistics & Third-Party Logistics (3PL), Food & Beverages, Automotive, and Others. Each end-user segment has unique requirements and drives demand for tailored inventory management solutions, with a focus on automation, regulatory compliance, and supply chain visibility .

The Retail & E-commerce segment is the dominant force in the market, driven by the rapid growth of online shopping and the need for efficient inventory management to meet consumer demands. Retailers are increasingly investing in advanced inventory solutions to manage stock levels, optimize supply chains, and enhance customer satisfaction. The shift towards omnichannel retailing is also contributing to the growth of this segment, as businesses seek to integrate their online and offline inventory systems .

The Russia Inventory Management Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as 1C Company, Korus Consulting, LANIT, Axoft, Cleverence, LogistiX, SoftBalance, SAP SE (Russia/CIS), Infor (Russia), Oracle (Russia) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Russian inventory management services market appears promising, driven by technological advancements and evolving consumer expectations. As businesses increasingly prioritize efficiency and accuracy, the integration of AI and machine learning into inventory systems is expected to enhance predictive analytics capabilities. Additionally, the growing emphasis on sustainability will likely lead to the adoption of eco-friendly inventory practices, aligning with global trends and consumer preferences. These developments will shape a more agile and responsive inventory management landscape in Russia.

| Segment | Sub-Segments |

|---|---|

| By Type | Inventory Management Software Solutions Warehouse Management Systems (WMS) Inventory Tracking Hardware (RFID, Barcode Scanners) Consulting & Implementation Services Managed Inventory Services |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Logistics & Third-Party Logistics (3PL) Food & Beverages Automotive Others |

| By Industry Vertical | Consumer Goods Automotive Electronics & Electricals Pharmaceuticals & Healthcare Chemicals Metals & Machinery Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Geographic Distribution | Central Russia Northwestern Russia Southern Russia Volga Region Siberia & Far East |

| By Service Type | Inventory Optimization Order & Fulfillment Management Demand Forecasting & Analytics Returns Management Others |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 100 | Inventory Managers, Supply Chain Analysts |

| Manufacturing Supply Chain Optimization | 60 | Operations Managers, Production Supervisors |

| E-commerce Fulfillment Strategies | 50 | eCommerce Directors, Logistics Coordinators |

| Warehouse Management Systems | 40 | Warehouse Managers, IT Specialists |

| Inventory Software Solutions | 45 | Product Managers, Business Development Executives |

The Russia Inventory Management Services Market is valued at approximately USD 1.3 billion, reflecting a significant growth driven by the demand for efficient supply chain management and advanced technologies in inventory management.