Region:Central and South America

Author(s):Dev

Product Code:KRAA0406

Pages:94

Published On:August 2025

By Component:The components of the market include Software Solutions and Services. Software Solutions encompass Warehouse Management Systems, Inventory Optimization Software, and Barcode/RFID Systems, while Services include Professional Services, Managed Services, Consulting, and Inventory Auditing. The Software Solutions segment is currently leading the market due to the increasing adoption of advanced technologies that enhance inventory accuracy and efficiency .

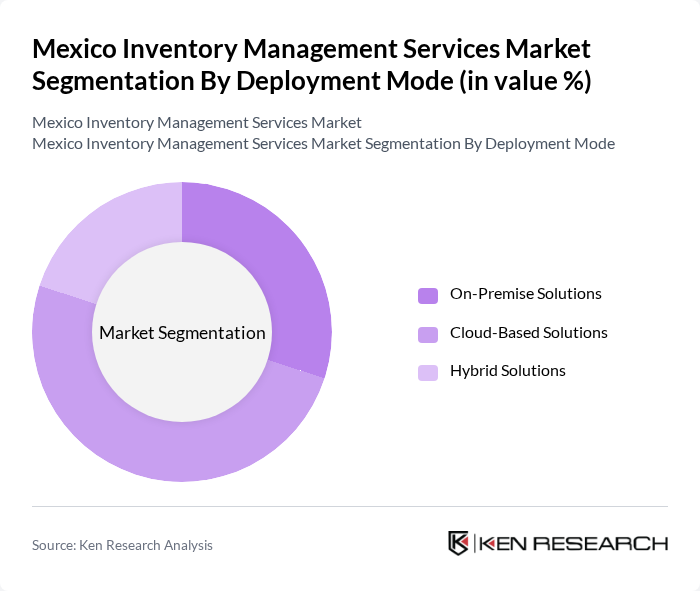

By Deployment Mode:The market is segmented into On-Premise Solutions, Cloud-Based Solutions, and Hybrid Solutions. The Cloud-Based Solutions segment is gaining traction due to its flexibility, scalability, and cost-effectiveness, making it the preferred choice for many businesses looking to optimize their inventory management processes .

The Mexico Inventory Management Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP México, Oracle México, Manhattan Associates, Infor, Blue Yonder (formerly JDA Software), Fishbowl Inventory, Zoho Inventory, Cin7, SkuVault, Brightpearl, Unleashed Software, QuickBooks Commerce, DEAR Inventory, Inventory Planner, Ryder México, DHL Supply Chain México, CEVA Logistics México, Kuehne + Nagel México, Penske Logistics México, XPO Logistics México contribute to innovation, geographic expansion, and service delivery in this space .

The future of inventory management services in Mexico appears promising, driven by technological advancements and evolving consumer expectations. As businesses increasingly prioritize efficiency and customer satisfaction, the integration of IoT and AI technologies will become essential. Additionally, the growth of e-commerce will necessitate more sophisticated inventory solutions, enabling companies to manage stock across various channels seamlessly. This dynamic landscape will foster innovation and collaboration among industry players, paving the way for enhanced service offerings and operational excellence.

| Segment | Sub-Segments |

|---|---|

| By Component | Software Solutions (Warehouse Management Systems, Inventory Optimization Software, Barcode/RFID Systems) Services (Professional Services, Managed Services, Consulting, Inventory Auditing) |

| By Deployment Mode | On-Premise Solutions Cloud-Based Solutions Hybrid Solutions |

| By Enterprise Size | Large Enterprises Small and Medium Enterprises (SMEs) |

| By End-User Industry | Retail and Consumer Goods Manufacturing Automotive Healthcare and Pharmaceuticals Food and Beverage Transportation and Logistics Electronics Others |

| By Service Model | Dedicated Contracts Shared Contracts Managed Contracts |

| By Technology | RFID Technology Barcode Technology IoT Solutions AI and Machine Learning Blockchain Technology Others |

| By Geographic Distribution | Northern Mexico Central Mexico Southern Mexico Urban Areas Rural Areas Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 80 | Inventory Managers, Supply Chain Coordinators |

| Manufacturing Inventory Control | 60 | Operations Managers, Production Supervisors |

| E-commerce Fulfillment Strategies | 50 | Logistics Managers, eCommerce Operations Managers |

| Warehouse Management Systems | 40 | Warehouse Managers, IT Systems Analysts |

| Supply Chain Optimization Practices | 45 | Supply Chain Analysts, Business Development Managers |

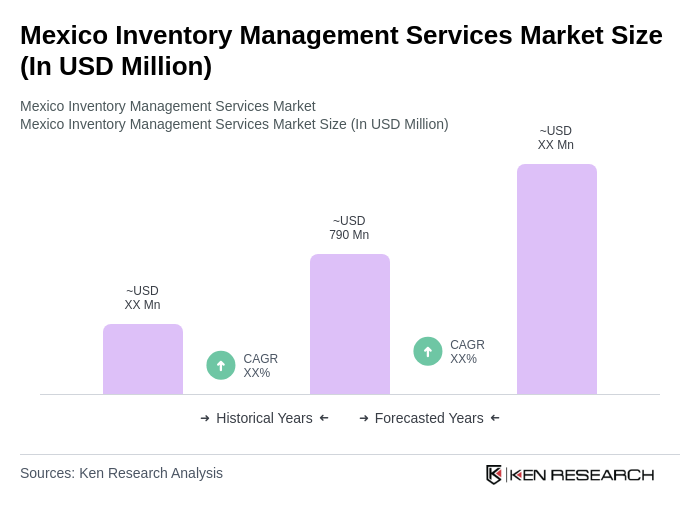

The Mexico Inventory Management Services Market is valued at approximately USD 790 million, reflecting a significant growth driven by the demand for efficient supply chain management and advancements in inventory tracking technologies.