Region:Central and South America

Author(s):Shubham

Product Code:KRAA0847

Pages:99

Published On:August 2025

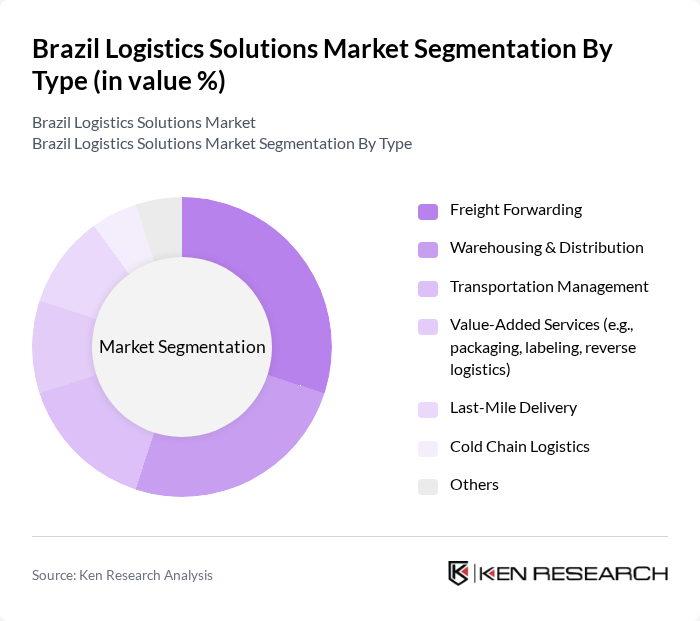

By Type:The logistics solutions market is segmented into Freight Forwarding, Warehousing & Distribution, Transportation Management, Value-Added Services, Last-Mile Delivery, Cold Chain Logistics, and Others. Freight Forwarding remains the leading sub-segment, driven by the globalization of trade and the need for efficient multimodal transportation solutions. Warehousing & Distribution is also significant, as businesses seek to optimize inventory management and reduce delivery times. The adoption of advanced technologies such as automation, AI, and real-time tracking is further transforming these segments, enabling faster and more reliable logistics operations .

By End-User:The logistics solutions market is also segmented by end-user industries, including Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Automotive, Food and Beverage, Consumer Goods, Chemicals, Construction, and Others. Retail & E-commerce is the dominant end-user, driven by the rapid growth of online shopping and the demand for efficient delivery systems. Manufacturing and Healthcare & Pharmaceuticals are also significant, requiring reliable logistics for timely and secure supply chain operations. The food and beverage sector, as well as pharmaceuticals, are further boosting demand for specialized cold chain logistics solutions .

The Brazil Logistics Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as JSL S.A., Grupo TPC, Loggi Tecnologia, DHL Supply Chain Brazil, Kuehne + Nagel Brasil, Rumo Logística, FedEx Express Brasil, Movida Logística, Translovato, Cargill Transportes (Cargill Logística), Grupo Águia Branca, GOLLOG (Gol Linhas Aéreas), VLI Logística, Azul Cargo Express, and Tegma Gestão Logística contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Brazil logistics solutions market appears promising, driven by ongoing investments in technology and infrastructure. As e-commerce continues to grow, logistics providers are expected to enhance their service offerings, focusing on efficiency and customer satisfaction. The integration of digital solutions and automation will likely streamline operations, while sustainability initiatives will shape the industry's evolution. Companies that adapt to these trends will be well-positioned to capitalize on emerging opportunities in the logistics landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Forwarding Warehousing & Distribution Transportation Management Value-Added Services (e.g., packaging, labeling, reverse logistics) Last-Mile Delivery Cold Chain Logistics Others |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Automotive Food and Beverage Consumer Goods Chemicals Construction Others |

| By Transportation Mode | Roadways Railways Airways Seaways Intermodal Transport Others |

| By Service Model | Second-Party Logistics (2PL) Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Freight Brokerage Dedicated Contract Carriage Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| By Technology Adoption | Automated Warehousing Fleet Management Systems Tracking and Visibility Solutions Cloud Logistics Platforms AI & Data Analytics Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Operations | 100 | Logistics Coordinators, Supply Chain Managers |

| Food and Beverage Distribution | 60 | Operations Managers, Warehouse Supervisors |

| Pharmaceutical Supply Chain | 50 | Compliance Officers, Logistics Managers |

| Automotive Logistics Solutions | 40 | Procurement Managers, Distribution Analysts |

| E-commerce Fulfillment Strategies | 80 | E-commerce Operations Managers, Logistics Analysts |

The Brazil Logistics Solutions Market is valued at approximately USD 120 billion, reflecting significant growth driven by the demand for efficient supply chain management, e-commerce expansion, and infrastructure development across various transportation modes.