Region:Europe

Author(s):Geetanshi

Product Code:KRAA2003

Pages:96

Published On:August 2025

By Type:

The logistics solutions market is segmented into various types, including Freight Transportation, Warehousing & Storage (including Cold Chain), Inventory & Order Management, Supply Chain Management Solutions, Courier, Express & Parcel (CEP), Last-Mile Delivery, and Value-Added Logistics Services (e.g., packaging, labeling). Among these,Freight Transportationis the leading sub-segment, driven by the increasing demand for efficient and timely delivery of goods. The surge in e-commerce and retail activity has significantly boosted the need for reliable freight services, making it a critical component of the logistics ecosystem. Warehousing & Storage, particularly cold chain logistics, is also experiencing robust growth due to rising demand from food, pharmaceutical, and e-commerce sectors.

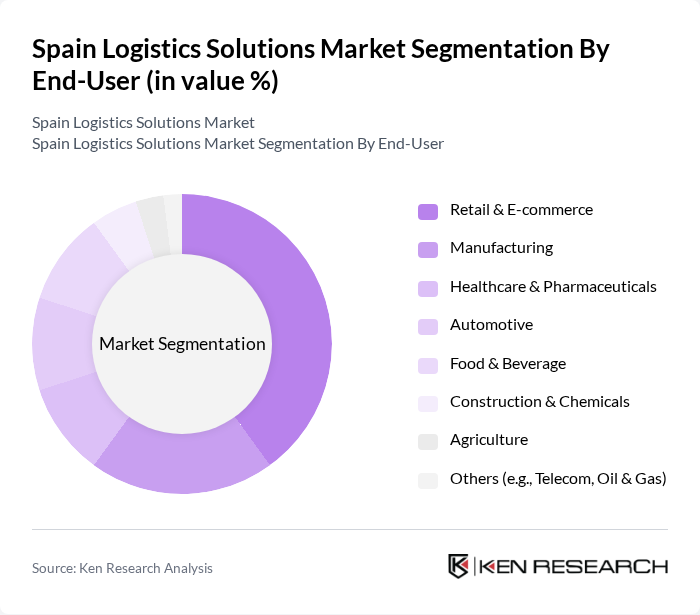

By End-User:

The end-user segmentation includes Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Automotive, Food & Beverage, Construction & Chemicals, Agriculture, and Others (e.g., Telecom, Oil & Gas). TheRetail & E-commercesector is the dominant end-user, fueled by the rapid growth of online shopping and consumer demand for fast delivery services. This trend has led to increased investments in logistics capabilities, particularly in last-mile delivery and inventory management, to meet the evolving needs of consumers. Manufacturing is the fastest-growing segment, supported by Spain’s position as a leading automotive producer and expanding industrial base.

The Spain Logistics Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as SEUR, DHL Supply Chain Iberia, XPO Logistics, Grupo Logístico TSB, Transcoma Grupo Empresarial, Kuehne + Nagel España, DB Schenker Spain, MRW, DPD España, Logista, CMR Group, Tredion Logistics, Grupo Carreras, TSB Express, Palibex contribute to innovation, geographic expansion, and service delivery in this space.

The logistics solutions market in Spain is poised for transformative growth, driven by technological advancements and evolving consumer expectations. As e-commerce continues to expand, logistics providers will increasingly focus on enhancing last-mile delivery capabilities and integrating sustainable practices. The adoption of AI and automation will streamline operations, while the emphasis on green logistics will align with global sustainability trends. Overall, the market is expected to adapt rapidly to these changes, positioning itself for long-term success in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Transportation Warehousing & Storage (including Cold Chain) Inventory & Order Management Supply Chain Management Solutions Courier, Express & Parcel (CEP) Last-Mile Delivery Value-Added Logistics Services (e.g., packaging, labeling) |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Automotive Food & Beverage Construction & Chemicals Agriculture Others (e.g., Telecom, Oil & Gas) |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea Transport Intermodal & Multimodal Transport |

| By Service Type | First-Party Logistics (1PL) Second-Party Logistics (2PL) Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Freight Forwarding & Customs Brokerage |

| By Technology | Warehouse Management Systems (WMS) Transportation Management Systems (TMS) Internet of Things (IoT) & Telematics Blockchain & Digital Platforms Automation & Robotics |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Performance-Based Pricing |

| By Customer Type | B2B B2C C2C Public Sector |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Operations | 60 | Logistics Coordinators, Supply Chain Managers |

| Pharmaceutical Distribution | 40 | Operations Directors, Compliance Managers |

| Automotive Supply Chain Management | 50 | Procurement Managers, Logistics Analysts |

| Food and Beverage Logistics | 45 | Warehouse Supervisors, Quality Control Managers |

| E-commerce Fulfillment Strategies | 55 | eCommerce Operations Managers, Distribution Center Managers |

The Spain Logistics Solutions Market is valued at approximately USD 70 billion, driven by the increasing demand for efficient supply chain management, the rise of e-commerce, and advancements in digital technologies like automation and artificial intelligence.