Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA2015

Pages:82

Published On:August 2025

By Type:The logistics solutions market in Chile can be segmented into various types, including Freight Forwarding, Warehousing & Storage, Courier, Express, and Parcel (CEP) Services, Transportation Services, Supply Chain Management, Cold Chain Logistics, Last-Mile Delivery, Value-Added Services, and Others. Among these, Freight Forwarding and Transportation Services are particularly dominant due to the increasing volume of goods being transported both domestically and internationally. The rise of e-commerce has significantly boosted the demand for Last-Mile Delivery services, as consumers expect faster and more reliable delivery options. Warehousing and storage, especially temperature-controlled facilities, are also seeing notable growth due to increased demand from food and pharmaceutical sectors.

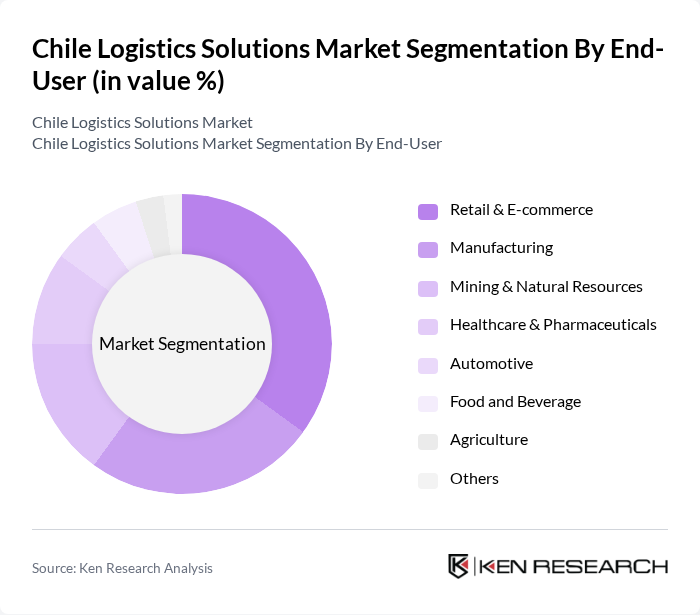

By End-User:The end-user segmentation of the logistics solutions market in Chile includes Retail & E-commerce, Manufacturing, Mining & Natural Resources, Healthcare & Pharmaceuticals, Automotive, Food and Beverage, Agriculture, and Others. The Retail & E-commerce sector is the leading end-user, driven by the rapid growth of online shopping and consumer demand for quick delivery services. The Manufacturing and Mining sectors also contribute significantly to logistics demand due to their need for efficient supply chain management and transportation of goods. Healthcare and pharmaceuticals are increasingly reliant on cold chain logistics and specialized delivery solutions.

The Chile Logistics Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain Chile, Kuehne + Nagel Chile, DB Schenker Chile, DSV Chile, Agunsa S.A., Andes Logistics de Chile S.A., Grupo Ransa (Loginsa), Ultramar Agencia Marítima Ltda., Maersk Chile, CEVA Logistics Chile, Geodis Chile, Chilexpress S.A., FedEx Express Chile, UPS Chile, LATAM Cargo Chile contribute to innovation, geographic expansion, and service delivery in this space.

The Chile logistics solutions market is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As e-commerce continues to expand, logistics providers will increasingly focus on enhancing last-mile delivery capabilities and integrating smart technologies into their operations. Additionally, sustainability will play a crucial role, with companies adopting green logistics practices to meet regulatory requirements and consumer demand for environmentally friendly solutions. This dynamic environment presents both challenges and opportunities for growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Forwarding Warehousing & Storage Courier, Express, and Parcel (CEP) Services Transportation Services Supply Chain Management Cold Chain Logistics Last-Mile Delivery Value-Added Services (e.g., packaging, labeling) Others |

| By End-User | Retail & E-commerce Manufacturing Mining & Natural Resources Healthcare & Pharmaceuticals Automotive Food and Beverage Agriculture Others |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea Transport Intermodal Transport Others |

| By Service Type | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Freight Brokerage Dedicated Contract Carriage Customs Brokerage Reverse Logistics Others |

| By Technology | Warehouse Management Systems (WMS) Transportation Management Systems (TMS) Inventory Management Solutions Fleet Management Software Real-Time Tracking & Visibility Solutions Automation & Robotics Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Performance-Based Pricing Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Non-Profit Organizations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Operations | 100 | Logistics Managers, Supply Chain Analysts |

| Manufacturing Supply Chain | 80 | Operations Directors, Procurement Managers |

| E-commerce Fulfillment Strategies | 90 | E-commerce Operations Managers, Logistics Coordinators |

| Transportation and Freight Forwarding | 70 | Freight Managers, Business Development Executives |

| Warehouse Management Practices | 50 | Warehouse Supervisors, Inventory Control Managers |

The Chile Logistics Solutions Market is valued at approximately USD 21 billion, reflecting significant growth driven by the demand for efficient supply chain management, e-commerce expansion, and infrastructure investments.