Region:Asia

Author(s):Shubham

Product Code:KRAA1064

Pages:82

Published On:August 2025

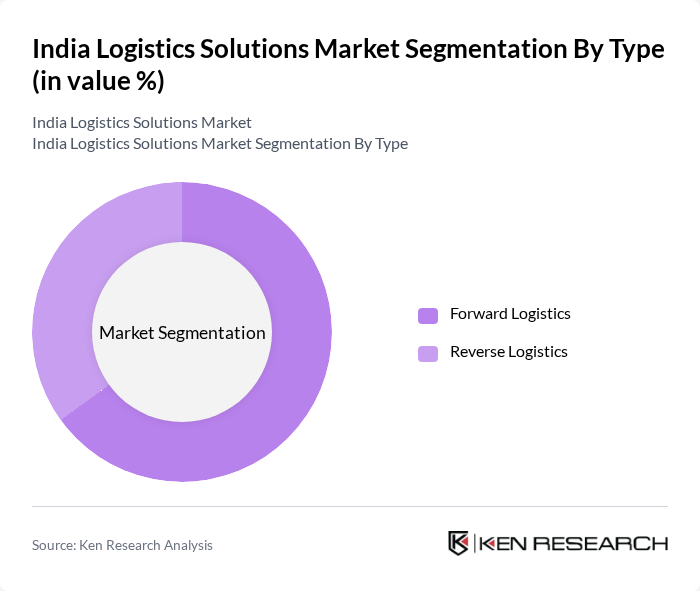

By Type:The logistics solutions market can be segmented into Forward Logistics and Reverse Logistics. Forward Logistics involves the movement of goods from the manufacturer to the end-user, while Reverse Logistics focuses on the return of products from consumers back to the manufacturers or retailers for reuse, recycling, or disposal. The increasing emphasis on sustainability, regulatory compliance, and circular economy practices is driving growth in Reverse Logistics .

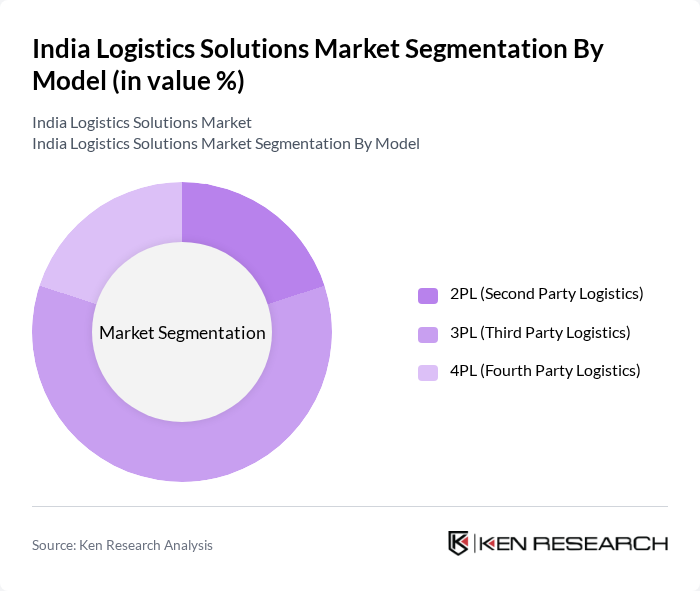

By Model:The logistics solutions market can also be categorized into 2PL (Second Party Logistics), 3PL (Third Party Logistics), and 4PL (Fourth Party Logistics). 3PL is currently the most dominant model, as it offers comprehensive logistics services, including transportation, warehousing, and distribution, enabling businesses to focus on their core competencies while outsourcing logistics functions. The adoption of 3PL is further accelerated by the need for scalable, technology-driven, and cost-efficient supply chain solutions .

The India Logistics Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain India, Blue Dart Express Ltd., Gati Ltd., TCI Express Ltd., Mahindra Logistics Ltd., Allcargo Logistics Ltd., Xpressbees Logistics, Delhivery Ltd., FedEx Express Transportation, Rivigo Services Pvt. Ltd., Transport Corporation of India Ltd., Ecom Express Pvt. Ltd., Shadowfax Technologies Pvt. Ltd., Locus.sh, Safexpress Pvt. Ltd., TVS Supply Chain Solutions Ltd., Redington Ltd., DTDC Express Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India logistics solutions market appears promising, driven by ongoing digital transformation and the integration of advanced technologies. As companies increasingly adopt automation and AI, operational efficiencies are expected to improve significantly. Furthermore, the focus on sustainable logistics practices will likely shape the industry, as businesses seek to reduce their carbon footprint while meeting consumer demands for eco-friendly solutions. This evolving landscape presents numerous opportunities for growth and innovation in the logistics sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Forward Logistics Reverse Logistics |

| By Model | PL (Second Party Logistics) PL (Third Party Logistics) PL (Fourth Party Logistics) |

| By Service | Transportation Warehousing and Inventory Management Value-added Services (Labeling, Packaging) |

| By End-User | Manufacturing Consumer Goods Retail Food & Beverage IT Hardware Healthcare Chemicals Construction Automotive Telecom Oil & Gas Others |

| By Region | North India South India East India West India Central India Others |

| By Mode of Transport | Roadways Railways Airways Seaways Intermodal Others |

| By Technology Adoption | Automated Warehousing Fleet Management Systems Tracking and Visibility Solutions Drones and Autonomous Vehicles Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Third-Party Logistics Providers | 100 | Operations Managers, Business Development Managers |

| Cold Chain Logistics | 60 | Logistics Coordinators, Supply Chain Managers |

| Last-Mile Delivery Services | 50 | Delivery Managers, Fleet Supervisors |

| Freight Forwarding Operations | 40 | Customs Brokers, Freight Managers |

| Warehouse Management Systems | 45 | IT Managers, Warehouse Operations Managers |

The India Logistics Solutions Market is valued at approximately USD 230 billion, reflecting significant growth driven by e-commerce expansion, efficient supply chain management, and government initiatives aimed at improving logistics infrastructure across the country.