Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB2805

Pages:93

Published On:October 2025

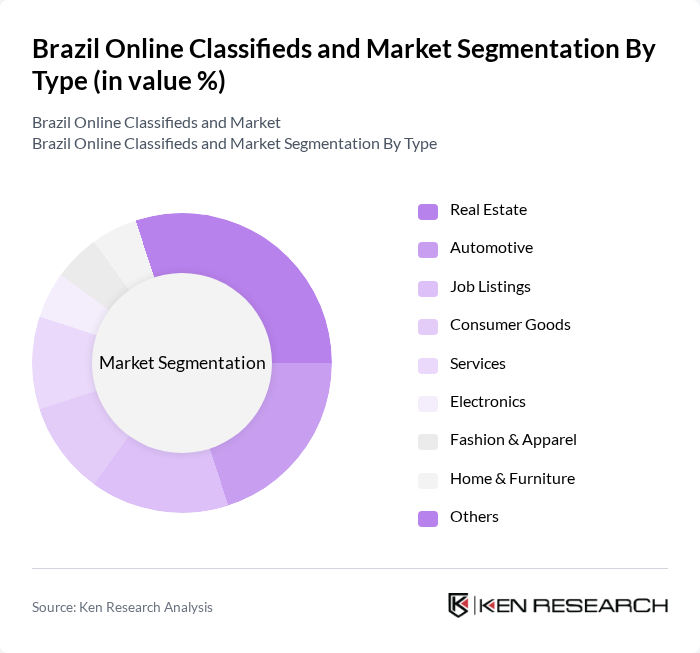

By Type:The market can be segmented into various types, including Real Estate, Automotive, Job Listings, Consumer Goods, Services, Electronics, Fashion & Apparel, Home & Furniture, and Others. Each of these segments caters to different consumer needs and preferences, contributing to the overall market dynamics.

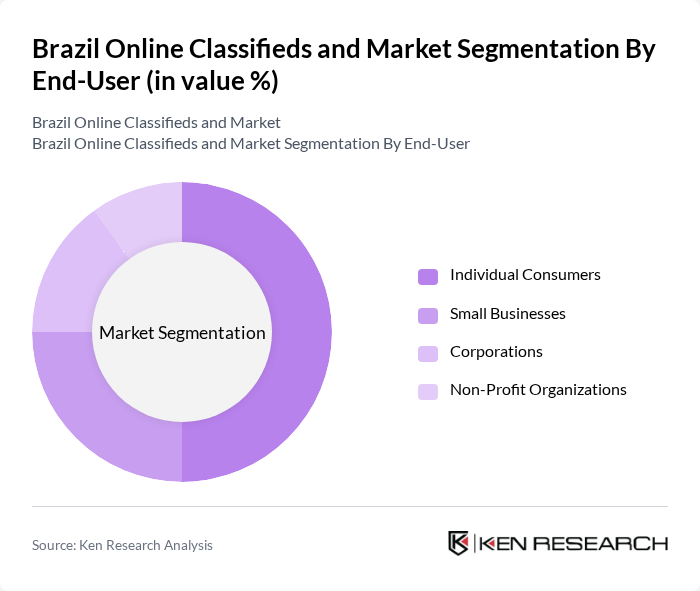

By End-User:The end-user segmentation includes Individual Consumers, Small Businesses, Corporations, and Non-Profit Organizations. Each segment has distinct requirements and usage patterns, influencing the overall market landscape.

The Brazil Online Classifieds and Market is characterized by a dynamic mix of regional and international players. Leading participants such as OLX Brasil, Webmotors, Mercado Livre, Zap Imóveis, iCarros, VivaReal, Trovit, Enjoei, OLX Autos, Facebook Marketplace, Shopee Brasil, GetNinjas, Olist, 99Freelas, QuintoAndar contribute to innovation, geographic expansion, and service delivery in this space.

The Brazilian online classifieds market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. As AI integration enhances personalization, platforms will likely see increased user engagement. Additionally, the rise of social media integration will facilitate seamless transactions, attracting younger demographics. Sustainability practices are becoming essential, with consumers favoring eco-friendly options. These trends indicate a dynamic market landscape, where adaptability and innovation will be crucial for success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Real Estate Automotive Job Listings Consumer Goods Services Electronics Fashion & Apparel Home & Furniture Others |

| By End-User | Individual Consumers Small Businesses Corporations Non-Profit Organizations |

| By Sales Channel | Online Platforms (Websites) Mobile Applications Social Media Marketplaces |

| By Price Range | Low-End Products Mid-Range Products High-End Products |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By User Demographics | Age Groups Income Levels Education Levels |

| By Customer Loyalty | New Users Returning Users Loyal Customers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Real Estate Listings | 90 | Real Estate Agents, Property Managers |

| Automotive Sales | 70 | Car Dealership Owners, Sales Managers |

| Job Listings | 100 | HR Managers, Recruitment Specialists |

| Consumer Goods Sales | 80 | Small Business Owners, E-commerce Managers |

| Service Offerings | 60 | Service Providers, Freelancers |

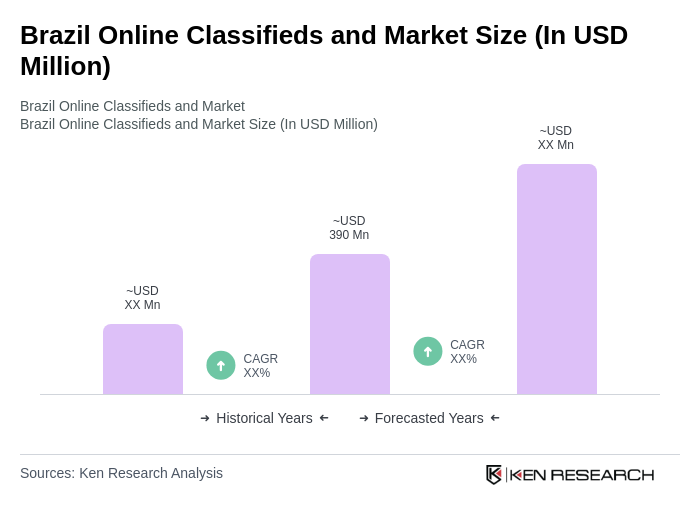

The Brazil Online Classifieds Market is valued at approximately USD 390 million. This growth is attributed to increased internet and mobile device penetration, along with a rising preference for online shopping and e-commerce activities.