Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB0123

Pages:90

Published On:August 2025

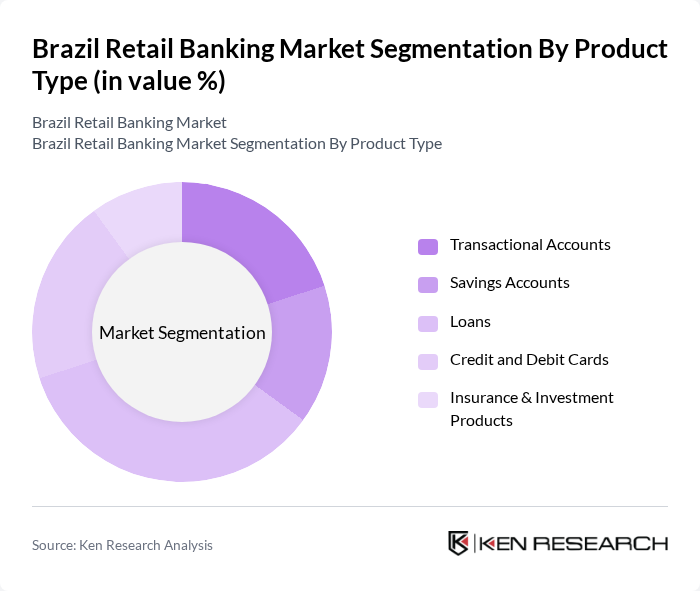

By Product Type:The product type segmentation includes various financial products offered by retail banks. The subsegments are transactional accounts, savings accounts, loans, credit and debit cards, and insurance & investment products. Among these, loans have emerged as the dominant subsegment, driven by increasing consumer demand for personal and mortgage loans. The trend towards consumer credit has been fueled by the expansion of digital lending platforms, the adoption of instant payment systems, and a growing economy, making loans a critical component of retail banking.

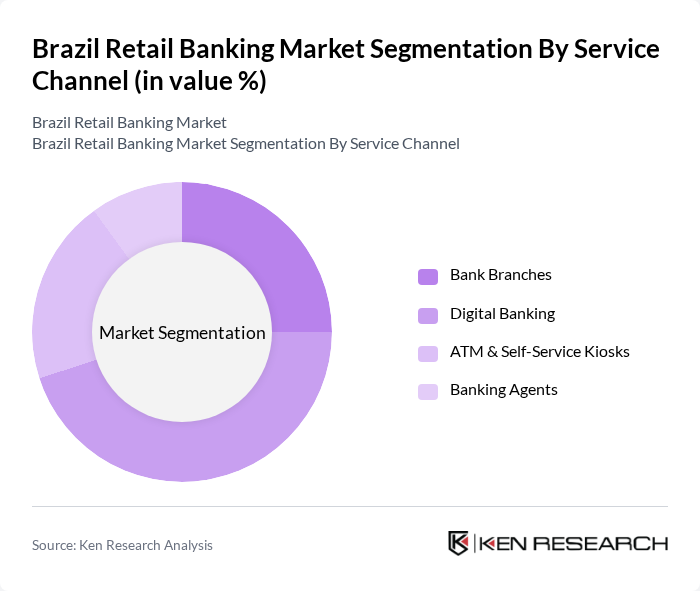

By Service Channel:The service channel segmentation encompasses the various platforms through which retail banking services are delivered. This includes bank branches, digital banking, ATMs & self-service kiosks, and banking agents. Digital banking has become the leading service channel, reflecting a significant shift in consumer behavior towards online banking solutions. The convenience and accessibility of digital platforms, combined with the rapid adoption of mobile banking and instant payment systems, have driven their adoption, especially among younger consumers.

The Brazil Retail Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Banco do Brasil S.A., Itaú Unibanco Holding S.A., Banco Bradesco S.A., Banco Santander (Brasil) S.A., Caixa Econômica Federal, Banco BTG Pactual S.A., Banco Safra S.A., Banco BV (Banco Votorantim S.A.), Banco Inter S.A., Nu Pagamentos S.A. (Nubank), C6 Bank S.A., Banco Original S.A., Banco Pan S.A., Banco BMG S.A., PagSeguro Digital Ltda. contribute to innovation, geographic expansion, and service delivery in this space.

The Brazilian retail banking market is poised for transformative growth driven by technological advancements and evolving consumer preferences. As digital banking continues to gain traction, banks are expected to invest heavily in innovative solutions to enhance customer experience. Additionally, the focus on financial inclusion will likely lead to the development of tailored products for underserved populations. With regulatory support and a growing middle class, the market is set to adapt and thrive in the coming years, despite existing challenges.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Transactional Accounts Savings Accounts Loans Credit and Debit Cards Insurance & Investment Products |

| By Service Channel | Bank Branches Digital Banking ATM & Self-Service Kiosks Banking Agents |

| By Customer Segment | Individual Customers Small and Medium Enterprises (SMEs) Corporates Government Entities |

| By Geographic Presence | Urban Areas Rural Areas |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Customers | 150 | Individual Account Holders, Small Business Owners |

| Loan Product Users | 100 | Personal Loan Borrowers, Mortgage Holders |

| Investment Service Clients | 80 | Wealth Management Clients, Retail Investors |

| Digital Banking Users | 120 | Mobile Banking Users, Online Account Managers |

| Banking Service Advisors | 60 | Financial Advisors, Customer Service Representatives |

The Brazil Retail Banking Market is valued at approximately USD 65 billion, reflecting significant growth driven by digital banking adoption, fintech expansion, and increased consumer spending, particularly among the growing middle class.