Region:Middle East

Author(s):Rebecca

Product Code:KRAC0263

Pages:97

Published On:August 2025

By Product Type:The product type segmentation includes a comprehensive range of financial offerings tailored to diverse customer needs. Subsegments include transactional accounts (current and checking), savings accounts, credit cards, personal loans, mortgages, auto loans, Islamic banking products (including Sharia-compliant financing and deposit products), wealth management and investment services, as well as emerging digital solutions such as buy-now-pay-later and digital wallets. These products address everyday transactions, long-term savings, investment planning, and digital payment convenience .

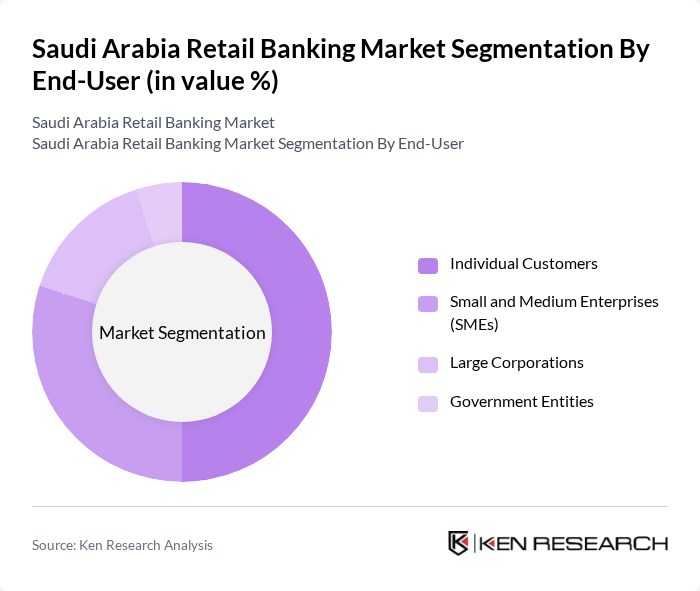

By End-User:The end-user segmentation covers the main customer categories utilizing retail banking services. This includes individual customers (consumers seeking personal financial products and digital banking), small and medium enterprises (SMEs) requiring business accounts and credit facilities, large corporations with complex financial needs, and government entities utilizing specialized banking solutions. Each segment has distinct banking requirements, from personal finance management to tailored business and institutional solutions .

The Saudi Arabia Retail Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi National Bank (SNB), Al Rajhi Bank, Riyad Bank, Saudi British Bank (SABB), Banque Saudi Fransi (BSF), Arab National Bank (ANB), Alinma Bank, Bank Albilad, Saudi Investment Bank (SAIB), Bank Aljazira, Gulf International Bank (GIB) Saudi Arabia, Emirates NBD Saudi Arabia, Abu Dhabi Commercial Bank (ADCB) Saudi Arabia, Qatar National Bank (QNB) Saudi Arabia, and STC Bank contribute to innovation, geographic expansion, and service delivery in this space .

The Saudi retail banking market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. In future, banks are expected to increasingly adopt artificial intelligence and machine learning to enhance operational efficiency and customer engagement. Additionally, the focus on sustainable banking practices will likely grow, aligning with global trends towards environmental responsibility. These developments will create a more competitive landscape, compelling banks to innovate continuously to meet customer expectations and regulatory demands.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Transactional Accounts (Current, Checking) Savings Accounts Credit Cards Personal Loans Mortgages Auto Loans Islamic Banking Products Wealth Management & Investment Services Buy-Now-Pay-Later & Digital Wallets |

| By End-User | Individual Customers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Distribution Channel | Branch Banking Online Banking Mobile Banking ATMs Call Centers Agent Banking & Kiosks |

| By Customer Segment | Mass Market/Retail Customers High Net-Worth Individuals (HNWIs) Corporate Clients Institutional Clients |

| By Service Type | Advisory & Financial Planning Services Transactional Services Custodial & Safe Deposit Services Risk Management & Insurance Services |

| By Geographic Presence | Central Region (Riyadh) Western Region (Jeddah, Mecca, Medina) Eastern Region (Dammam, Khobar) Southern Region Northern Region Urban Areas Rural Areas |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Customer Satisfaction | 100 | Retail Banking Customers, Account Holders |

| Loan Product Awareness | 60 | Potential Borrowers, Financial Advisors |

| Digital Banking Adoption | 80 | Tech-Savvy Customers, Young Professionals |

| Investment Services Feedback | 40 | Wealth Management Clients, Investors |

| Banking Service Preferences | 50 | Small Business Owners, Entrepreneurs |

The Saudi Arabia Retail Banking Market is valued at approximately USD 185 billion, driven by the increasing adoption of digital banking services, a growing population, and rising consumer demand for financial products.