Region:Middle East

Author(s):Geetanshi

Product Code:KRAC2341

Pages:80

Published On:October 2025

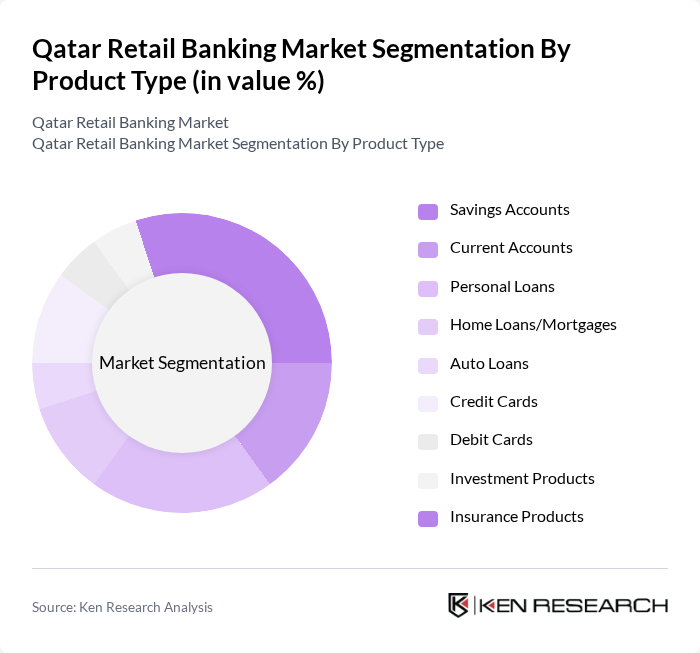

By Product Type:The product type segmentation includes various financial products offered by retail banks. The subsegments are Savings Accounts, Current Accounts, Personal Loans, Home Loans/Mortgages, Auto Loans, Credit Cards, Debit Cards, Investment Products, and Insurance Products. Among these, Savings Accounts and Personal Loans are particularly popular due to their accessibility and the growing trend of financial literacy among consumers. The rise in mobile wallet penetration and payroll card programs for the migrant workforce has also increased demand for digital account products and payment cards .

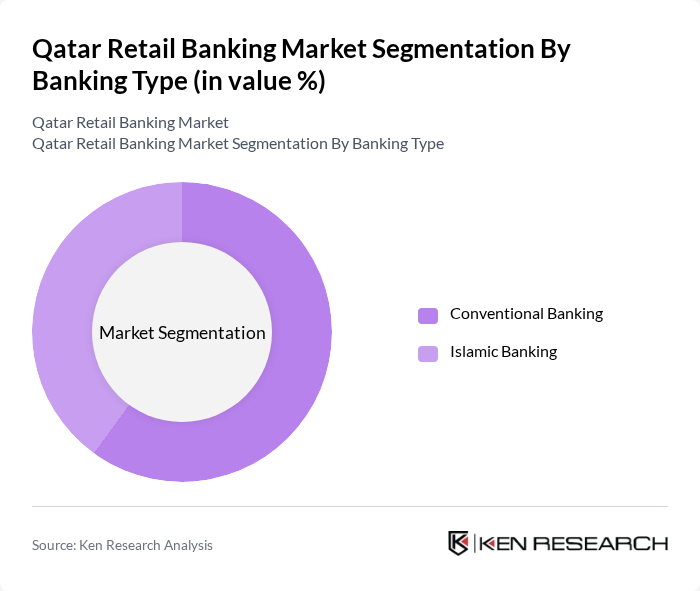

By Banking Type:The banking type segmentation includes Conventional Banking and Islamic Banking. Conventional Banking is more prevalent due to its established presence and wider acceptance among the general population. However, Islamic Banking is gaining traction, particularly among the Muslim population, due to its compliance with Sharia law and ethical banking practices. Islamic banks in Qatar have maintained a stable market share, supported by asset growth and increasing consumer preference for Sharia-compliant products .

The Qatar Retail Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar National Bank (QNB), Qatar Islamic Bank (QIB), Commercial Bank of Qatar (CBQ), Doha Bank, Masraf Al Rayan, Ahli Bank, Qatar Development Bank (QDB), International Bank of Qatar (IBQ), Al Khalij Commercial Bank, Qatar International Islamic Bank (QIIB), Emirates NBD, Abu Dhabi Commercial Bank (ADCB), Standard Chartered Bank, HSBC Bank Middle East, and Arab Bank contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Qatar retail banking market appears promising, driven by technological advancements and evolving consumer preferences. As digital banking continues to gain traction, banks are expected to invest heavily in innovative solutions to enhance customer experience. Additionally, the focus on sustainable banking practices will likely shape the industry, with banks adopting eco-friendly initiatives to attract environmentally conscious consumers. Overall, the market is poised for transformation, aligning with global trends while catering to local needs.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Savings Accounts Current Accounts Personal Loans Home Loans/Mortgages Auto Loans Credit Cards Debit Cards Investment Products Insurance Products |

| By Banking Type | Conventional Banking Islamic Banking |

| By Service Channel | Branch Banking Online Banking Mobile Banking ATM Services Call Centers |

| By Customer Segment | Mass Retail Customers Affluent Customers High Net-Worth Individuals (HNWIs) Expatriates Youth and Students |

| By Income Level | Low-Income Segment Middle-Income Segment High-Income Segment |

| By Geographic Coverage | Doha Al Rayyan Al Wakrah Other Municipalities |

| By Technology Adoption | Digital-First Customers Hybrid Channel Users Traditional Branch Users |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Customer Satisfaction | 100 | Retail Banking Customers, Account Holders |

| Loan Product Awareness | 60 | Potential Borrowers, Financial Advisors |

| Investment Services Utilization | 50 | Wealth Management Clients, Investment Advisors |

| Digital Banking Adoption | 80 | Tech-Savvy Customers, Young Professionals |

| Customer Service Experience | 50 | Customer Service Representatives, Branch Managers |

The Qatar Retail Banking Market is valued at approximately USD 3.7 billion, reflecting significant growth driven by increasing demand for banking services, a growing population, and rising disposable incomes, alongside advancements in digital banking and innovative financial products.