Region:Europe

Author(s):Dev

Product Code:KRAB0642

Pages:94

Published On:August 2025

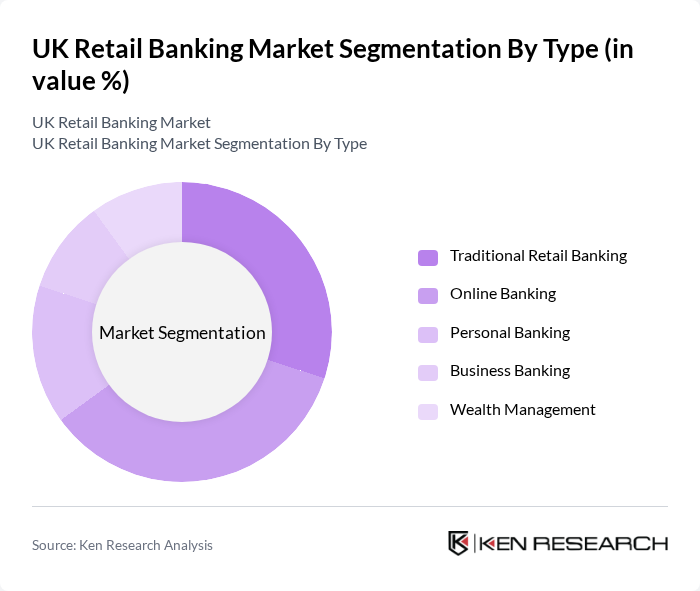

By Type:The UK Retail Banking Market is segmented into Traditional Retail Banking, Online Banking, Personal Banking, Business Banking, and Wealth Management. Online Banking has experienced rapid growth, driven by consumer demand for digital convenience and the proliferation of mobile banking apps. Traditional Retail Banking continues to serve a significant segment, particularly among customers who value in-person service. The rise of fintech firms has intensified competition, leading to ongoing innovation in product offerings and customer engagement strategies .

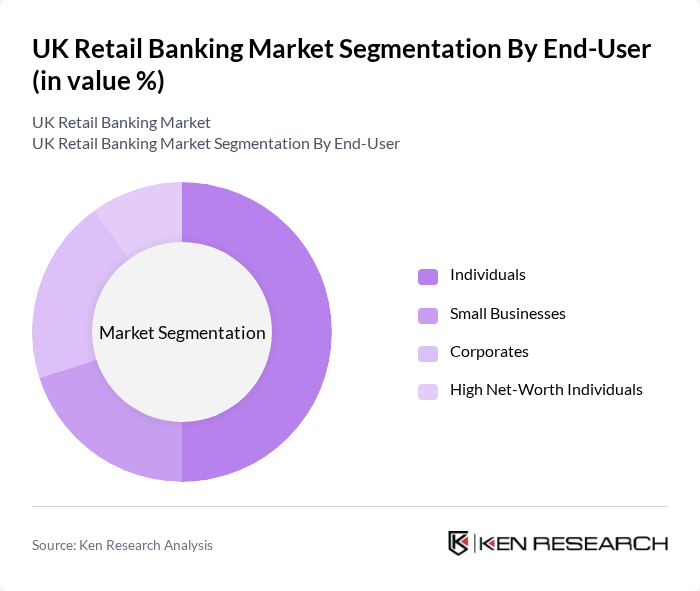

By End-User:The market is also segmented by end-users, including Individuals, Small Businesses, Corporates, and High Net-Worth Individuals. Individuals account for the largest share, reflecting high demand for personal banking products such as savings, loans, and digital payment services. Small businesses increasingly seek tailored banking solutions to support operations and growth, while Corporates and High Net-Worth Individuals require specialized offerings such as investment management and bespoke advisory services .

The UK Retail Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Barclays PLC, HSBC Holdings PLC, Lloyds Banking Group PLC, NatWest Group PLC, Santander UK PLC, Nationwide Building Society, Virgin Money UK PLC, Metro Bank PLC, TSB Bank PLC, Clydesdale Bank PLC, Atom Bank PLC, Monzo Bank Ltd., Revolut Ltd., Starling Bank Ltd., and Allica Bank Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The UK retail banking market is poised for transformative growth driven by technological advancements and changing consumer preferences. As digital banking continues to expand, banks will increasingly focus on enhancing customer experiences through personalized services and innovative fintech partnerships. The emphasis on sustainability and ESG factors will also shape banking strategies, aligning with consumer values. The integration of AI and machine learning in banking operations is expected to redefine service delivery, making banking more efficient and customer-centric.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Retail Banking Online Banking Personal Banking Business Banking Wealth Management |

| By End-User | Individuals Small Businesses Corporates High Net-Worth Individuals |

| By Distribution Channel | Branches Online Platforms Mobile Apps |

| By Product Offering | Deposit Accounts (Current, Savings) Loans (Personal, Mortgage, SME) Credit and Debit Cards Investment Products Insurance Products |

| By Customer Segment | Mass Market Customers Affluent Customers High Net-Worth Individuals SMEs Corporates |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing |

| By Service Type | Advisory Services Transactional Services Support Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Customer Satisfaction | 100 | Retail Banking Customers, Account Holders |

| Mortgage Product Insights | 60 | Homebuyers, Mortgage Advisors |

| Personal Loan Utilization | 50 | Personal Loan Borrowers, Financial Advisors |

| Digital Banking Adoption | 80 | Tech-Savvy Customers, Digital Banking Users |

| Investment Product Preferences | 40 | Investors, Wealth Management Clients |

The UK Retail Banking Market is valued at approximately USD 71 billion, driven by increasing consumer demand for digital financial services and the rapid adoption of mobile and online banking platforms.