Region:Central and South America

Author(s):Shubham

Product Code:KRAA0933

Pages:84

Published On:August 2025

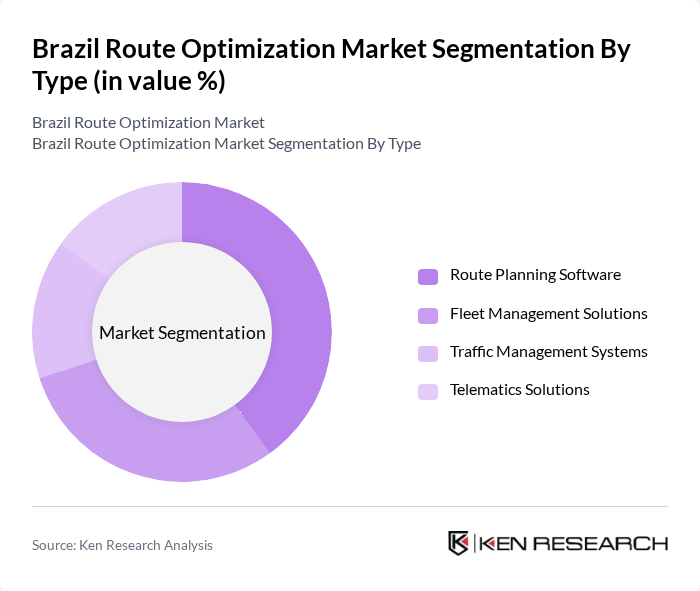

By Type:

The Route Planning Software segment is currently dominating the market due to its critical role in optimizing delivery routes, reducing operational costs, and supporting real-time decision-making. Companies are increasingly adopting these solutions to enhance efficiency and improve customer satisfaction. The growing trend of e-commerce and last-mile delivery has further accelerated the demand for advanced route planning tools, as businesses seek to meet consumer expectations for faster delivery times. Fleet Management Solutions also play a significant role, but the focus on route optimization software is more pronounced as businesses prioritize cost savings, sustainability, and operational efficiency .

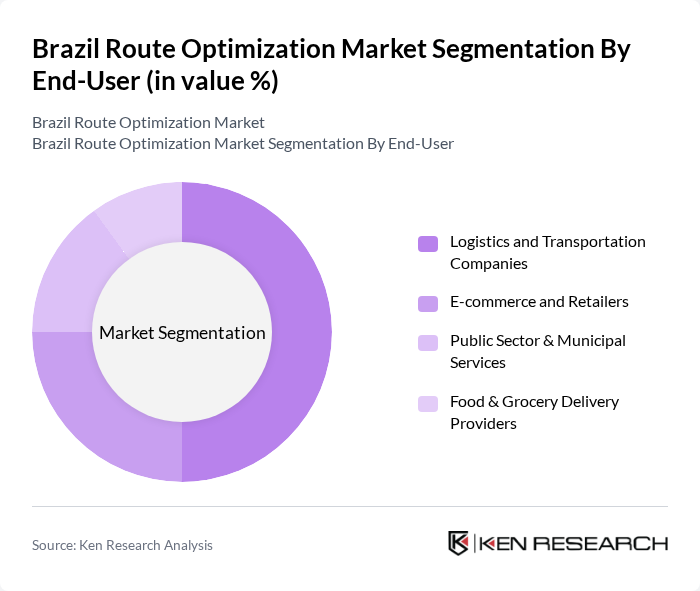

By End-User:

Logistics and Transportation Companies are the leading end-users in the market, driven by their need for efficient route optimization to manage large fleets and reduce costs. The rise of e-commerce has also significantly impacted this segment, as retailers seek to enhance their delivery capabilities and meet consumer demand for rapid fulfillment. Public sector initiatives and food delivery services are growing but currently represent a smaller share of the market compared to logistics companies, which have established systems and processes for route optimization .

The Brazil Route Optimization Market is characterized by a dynamic mix of regional and international players. Leading participants such as Maplink, Locus, RoutEasy, Ontruck, Trimble Inc., Oracle Corporation, SAP SE, HERE Technologies, A.P. Moller-Maersk (Maersk Logistics & Services), RTE Rodonaves, DHL Group, TOTVS, Linx, Geocontrol, Omnilink contribute to innovation, geographic expansion, and service delivery in this space.

The Brazil Route Optimization Market is poised for significant transformation as technological advancements and government initiatives converge. With the anticipated growth in e-commerce and urbanization, logistics providers will increasingly adopt real-time data analytics and mobile applications for route planning. Additionally, the integration of AI and machine learning will enhance operational efficiency, enabling companies to respond swiftly to changing market demands. This evolution will create a more competitive landscape, driving innovation and sustainability in logistics operations.

| Segment | Sub-Segments |

|---|---|

| By Type | Route Planning Software Fleet Management Solutions Traffic Management Systems Telematics Solutions |

| By End-User | Logistics and Transportation Companies E-commerce and Retailers Public Sector & Municipal Services Food & Grocery Delivery Providers |

| By Application | Last-Mile Delivery Optimization Freight and Cargo Routing Field Service Management Emergency & Utility Services |

| By Distribution Mode | Direct Sales Online Platforms Value-Added Resellers (VARs) Systems Integrators |

| By Region | Southeast Brazil South Brazil North Brazil Central-West Brazil |

| By Pricing Strategy | Subscription-Based One-Time License Freemium/Trial Model Usage-Based Pricing |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Government & Public Sector Third-Party Logistics Providers (3PLs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Delivery Optimization | 100 | Logistics Coordinators, Route Optimization Analysts |

| Long-Haul Transportation Efficiency | 80 | Fleet Managers, Operations Directors |

| Last-Mile Delivery Solutions | 70 | Delivery Managers, Customer Experience Leads |

| Technology Adoption in Logistics | 90 | IT Managers, Technology Implementation Specialists |

| Impact of Regulatory Changes | 60 | Compliance Officers, Policy Analysts |

The Brazil Route Optimization Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by the demand for efficient logistics solutions, advancements in technology, and the expansion of e-commerce.