Region:Africa

Author(s):Shubham

Product Code:KRAA0732

Pages:94

Published On:August 2025

By Type:The market is segmented into various types, including Route Optimization Software, Fleet Management Solutions, Telematics & GPS Tracking Devices, Consulting & Integration Services, and Others. Among these, Route Optimization Software is the leading sub-segment due to its ability to provide real-time data analytics, dynamic rerouting, and enhance decision-making processes for logistics companies. Fleet Management Solutions also hold a significant share as they integrate route optimization with vehicle tracking, predictive maintenance, and compliance management, catering to the growing need for operational efficiency and regulatory adherence .

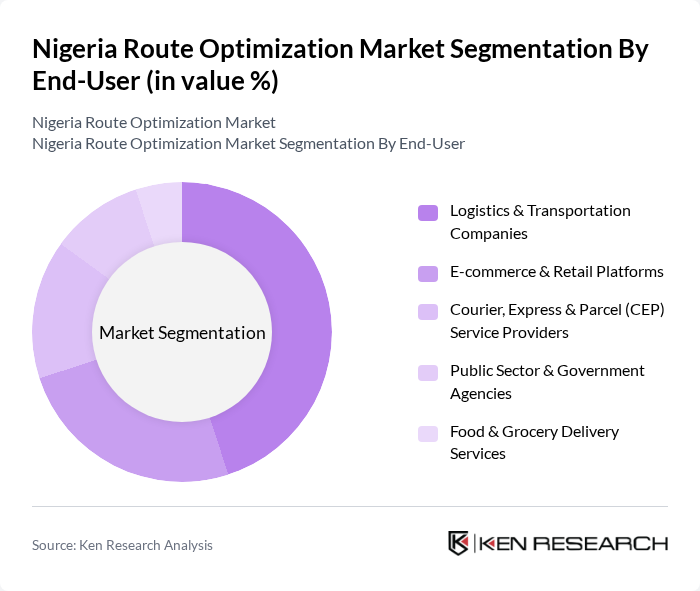

By End-User:The end-user segmentation includes Logistics & Transportation Companies, E-commerce & Retail Platforms, Courier, Express & Parcel (CEP) Service Providers, Public Sector & Government Agencies, Food & Grocery Delivery Services, and Others. Logistics & Transportation Companies dominate this segment as they require efficient route optimization to manage their fleets, reduce delivery times, and optimize last-mile delivery. E-commerce platforms are also increasingly adopting these solutions to enhance customer satisfaction through timely deliveries and real-time tracking capabilities .

The Nigeria Route Optimization Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gokada, Kobo360, Lori Systems, Red Star Express, A P Moller - Maersk Nigeria, Fortune Global Shipping and Logistics Limited, MDS Logistics, JOF Nigeria Limited, DreamWorks Global Logistics Limited, DHL Nigeria, UPS Nigeria, FedEx Red Star Express, Tranex, Zenith Carex International Limited, and AB Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Nigeria route optimization market appears promising, driven by technological advancements and increasing demand for efficient logistics solutions. As the government continues to invest in infrastructure, logistics companies are likely to adopt innovative technologies, including AI and machine learning, to enhance route planning. Additionally, the growing e-commerce sector will further necessitate the integration of real-time data analytics, enabling companies to optimize their operations and improve service delivery in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Route Optimization Software Fleet Management Solutions Telematics & GPS Tracking Devices Consulting & Integration Services Others |

| By End-User | Logistics & Transportation Companies E-commerce & Retail Platforms Courier, Express & Parcel (CEP) Service Providers Public Sector & Government Agencies Food & Grocery Delivery Services Others |

| By Application | Last-Mile Delivery Optimization Fleet Route Planning & Scheduling Real-Time Traffic & Incident Management Asset Tracking & Monitoring Others |

| By Distribution Mode | Direct Sales Online Platforms Value-Added Resellers (VARs) Others |

| By Pricing Model | Subscription-Based One-Time License Pay-Per-Use Freemium/Trial-Based Others |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| By Region | Northern Nigeria Southern Nigeria Eastern Nigeria Western Nigeria Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Service Providers | 100 | Operations Managers, Fleet Supervisors |

| E-commerce Delivery Systems | 60 | Logistics Coordinators, Supply Chain Analysts |

| Manufacturing Distribution Networks | 50 | Warehouse Managers, Distribution Directors |

| Public Transportation Optimization | 40 | City Planners, Transportation Analysts |

| Technology Providers for Route Optimization | 40 | Product Managers, Technical Sales Representatives |

The Nigeria Route Optimization Market is valued at approximately USD 320 million, driven by the increasing demand for efficient logistics solutions, rapid urbanization, and the growth of e-commerce, which necessitates optimized delivery routes for enhanced service efficiency.