Region:Middle East

Author(s):Shubham

Product Code:KRAA1068

Pages:97

Published On:August 2025

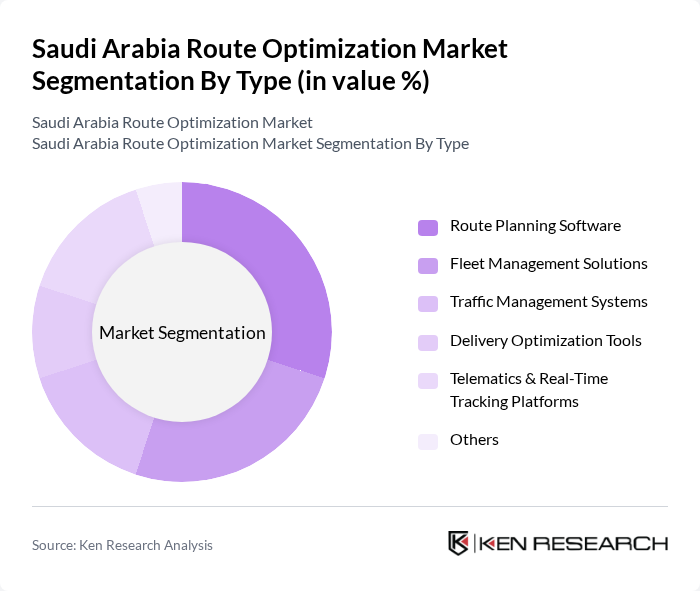

By Type:The market is segmented into Route Planning Software, Fleet Management Solutions, Traffic Management Systems, Delivery Optimization Tools, Telematics & Real-Time Tracking Platforms, and Others. Route Planning Software is gaining traction due to its ability to optimize delivery routes, minimize fuel consumption, and reduce operational costs through real-time data and advanced algorithms. Fleet Management Solutions are also significant, providing comprehensive oversight of vehicle performance, driver behavior, and logistics operations, which is particularly important for large-scale logistics and delivery providers .

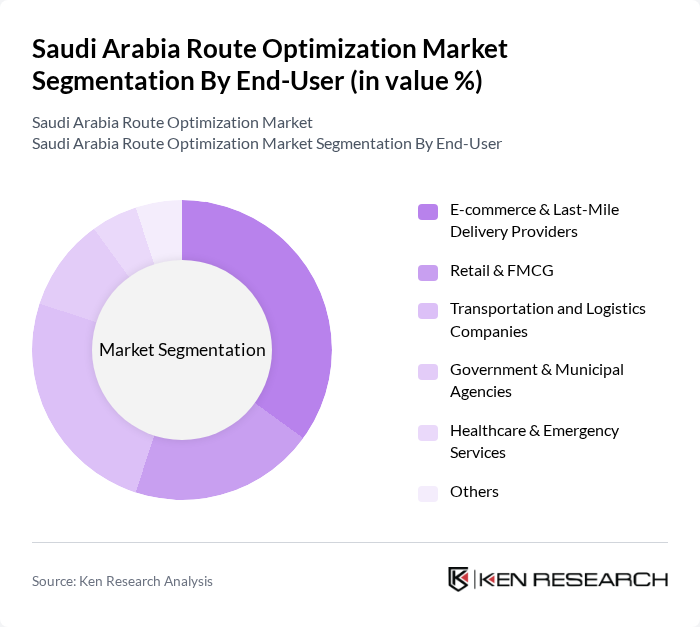

By End-User:The end-user segmentation includes E-commerce & Last-Mile Delivery Providers, Retail & FMCG, Transportation and Logistics Companies, Government & Municipal Agencies, Healthcare & Emergency Services, and Others. E-commerce & Last-Mile Delivery Providers are leading this segment, driven by the surge in online shopping and the need for efficient, timely deliveries. Transportation and Logistics Companies are also prominent users, as optimized routing is essential for reducing delivery costs, improving customer satisfaction, and supporting the growth of the logistics sector in Saudi Arabia .

The Saudi Arabia Route Optimization Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oracle Corporation, SAP SE, Trimble Inc., Wise Systems, Omnitracs LLC, Descartes Systems Group, Route4Me, Paragon Software Systems (Aptean), Sygic (A part of Eurowag), LogiNext Solutions, FarEye, HERE Technologies, Saudi Transport and Logistics Company (SAL), STC Solutions, Tahaqom (Takamul Smart Technology) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the route optimization market in Saudi Arabia appears promising, driven by ongoing technological advancements and government support. As logistics companies increasingly adopt AI and machine learning, operational efficiencies are expected to improve significantly. Additionally, the expansion of e-commerce will further necessitate optimized delivery routes, enhancing customer satisfaction. The focus on sustainability will also drive innovations in eco-friendly logistics solutions, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Route Planning Software Fleet Management Solutions Traffic Management Systems Delivery Optimization Tools Telematics & Real-Time Tracking Platforms Others |

| By End-User | E-commerce & Last-Mile Delivery Providers Retail & FMCG Transportation and Logistics Companies Government & Municipal Agencies Healthcare & Emergency Services Others |

| By Application | Last-Mile Delivery Long-Haul Transportation Urban Logistics & Smart City Mobility Emergency Response Routing Waste Collection & Utility Services Others |

| By Distribution Mode | Direct Sales Online Platforms Third-Party Logistics Providers System Integrators & VARs Others |

| By Pricing Strategy | Subscription-Based (SaaS) Pay-Per-Use One-Time License Purchase Freemium/Trial Models Others |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Government & Public Sector Others |

| By Technology Integration | GPS Tracking AI and Machine Learning IoT Solutions & Telematics Cloud-Based Platforms Mobile Application Integration Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Transportation Optimization | 100 | Logistics Managers, Fleet Supervisors |

| Rail Freight Route Management | 50 | Operations Directors, Rail Network Planners |

| Urban Delivery Solutions | 60 | Last-Mile Delivery Managers, City Logistics Coordinators |

| Technology Adoption in Logistics | 55 | IT Managers, Technology Implementation Leads |

| Impact of Government Policies on Logistics | 45 | Policy Analysts, Regulatory Affairs Managers |

The Saudi Arabia Route Optimization Market is valued at approximately USD 17 million, driven by the increasing demand for efficient logistics and transportation solutions, particularly due to the growth of e-commerce and urbanization.