Region:Central and South America

Author(s):Shubham

Product Code:KRAA0876

Pages:93

Published On:August 2025

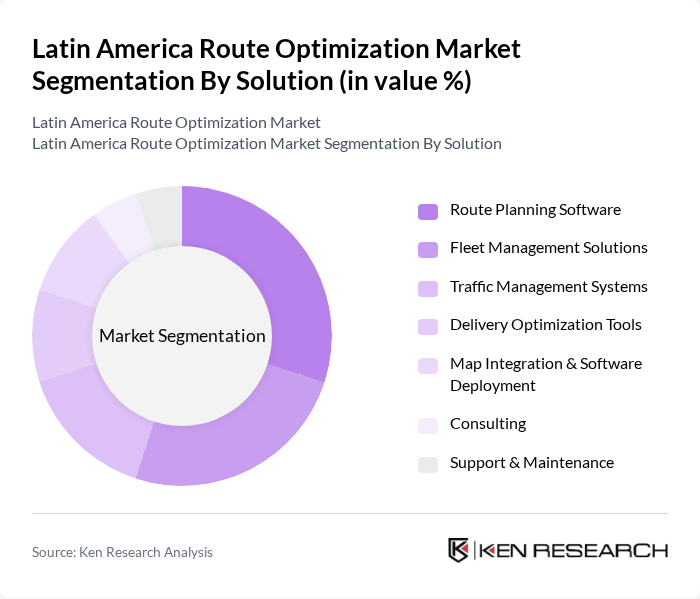

By Solution:The market is segmented into various solutions that address different aspects of route optimization. The primary subsegments include Route Planning Software, Fleet Management Solutions, Traffic Management Systems, Delivery Optimization Tools, Map Integration & Software Deployment, Consulting, and Support & Maintenance. Each of these solutions plays a crucial role in enhancing operational efficiency and reducing costs for businesses. Route Planning Software and Fleet Management Solutions remain the largest segments due to their direct impact on logistics performance and cost savings .

By Deployment Mode:The market is also segmented based on deployment modes, which include On-Premises, Cloud-Based, and Hybrid solutions. Cloud-based solutions are gaining popularity due to their scalability, ease of integration, and cost-effectiveness, particularly among small and medium-sized enterprises. On-premises solutions are preferred by organizations with stringent data security and compliance requirements, while hybrid models offer a balance between control and flexibility .

The Latin America Route Optimization Market is characterized by a dynamic mix of regional and international players. Leading participants such as Trimble Inc., Omnicomm, Descartes Systems Group, SAP SE, Oracle Corporation, Verizon Connect, Fleet Complete, Geotab Inc., Teletrac Navman, Locus.sh, Routific, Project44, WorkWave, Maplink, and Loggi contribute to innovation, geographic expansion, and service delivery in this space. These companies are investing in advanced analytics, artificial intelligence, and cloud-based platforms to enhance route optimization capabilities and address the evolving needs of logistics and transportation providers .

The future of the Latin America route optimization market appears promising, driven by technological advancements and increasing demand for efficient logistics solutions. As e-commerce continues to expand, companies will increasingly adopt AI and machine learning to enhance route planning and delivery efficiency. Furthermore, the focus on sustainability will push logistics providers to implement greener practices, aligning with global trends and regulatory requirements, ultimately transforming the logistics landscape in the region.

| Segment | Sub-Segments |

|---|---|

| By Solution | Route Planning Software Fleet Management Solutions Traffic Management Systems Delivery Optimization Tools Map Integration & Software Deployment Consulting Support & Maintenance |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Enterprise Size | Large Enterprises Small and Medium Enterprises (SMEs) |

| By Industry Vertical | Retail & FMCG Logistics & Transportation On-Demand Food & Grocery Delivery Ride Hailing & Taxi Services Homecare & Field Services Others |

| By Country | Brazil Mexico Argentina Chile Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Optimization in E-commerce | 100 | Logistics Coordinators, E-commerce Operations Managers |

| Route Planning for Retail Distribution | 80 | Supply Chain Managers, Distribution Center Supervisors |

| Transportation Management in Manufacturing | 60 | Operations Managers, Fleet Managers |

| Technology Adoption in Logistics | 50 | IT Managers, Technology Implementation Specialists |

| Impact of Regulatory Changes on Route Optimization | 40 | Compliance Officers, Policy Analysts |

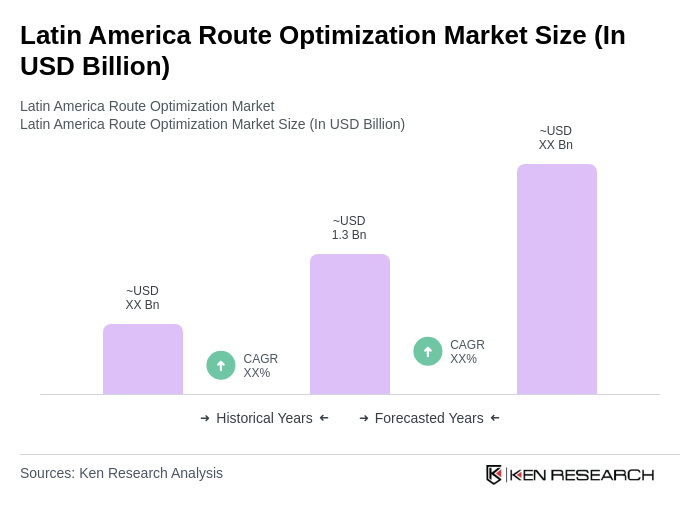

The Latin America Route Optimization Market is valued at approximately USD 1.3 billion, driven by the increasing demand for efficient logistics and transportation solutions, particularly in the context of rising e-commerce and urbanization across the region.