Region:Asia

Author(s):Shubham

Product Code:KRAA1923

Pages:90

Published On:August 2025

By Type:The commercial construction market can be segmented into various types, including office buildings, retail spaces, hospitality venues, institutional buildings, industrial and logistics facilities, mixed-use developments, and data centers. Each of these segments caters to specific consumer needs and market demands, reflecting the diverse nature of commercial construction .

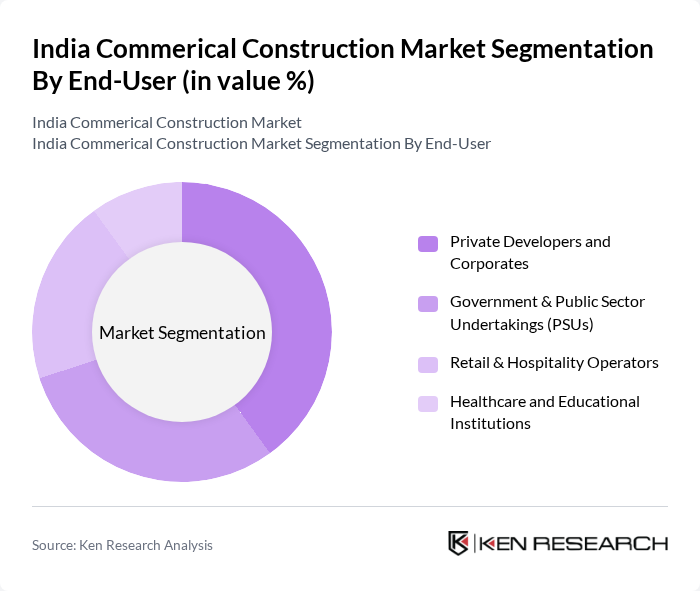

By End-User:The end-user segmentation includes private developers and corporates, government and public sector undertakings (PSUs), retail and hospitality operators, and healthcare and educational institutions. Each end-user group has distinct requirements and influences the types of commercial construction projects undertaken .

The India Commercial Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as Larsen & Toubro Limited (L&T), Tata Projects Limited, Shapoorji Pallonji & Company Private Limited, Hindustan Construction Company Ltd. (HCC), Kalpataru Projects International Ltd. (formerly Kalpataru Power Transmission Ltd.), NCC Limited (formerly Nagarjuna Construction Company), NBCC (India) Limited, JMC Projects (India) Ltd. (now merged into Kalpataru Projects International Ltd.), DLF Limited, Sobha Limited, Prestige Group (Prestige Estates Projects Limited), Oberoi Realty Limited, Godrej Properties Limited, Bharti Realty Limited, B. L. Kashyap and Sons Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the commercial construction market in India appears promising, driven by ongoing urbanization and government initiatives. With the anticipated increase in infrastructure spending and the push for sustainable development, the sector is likely to witness significant growth. Additionally, the integration of technology in construction processes is expected to enhance efficiency and reduce costs. As cities expand, the demand for innovative commercial spaces will continue to rise, presenting opportunities for growth and investment in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Office Buildings Retail (Malls, High-Street, Showrooms) Hospitality (Hotels, Resorts, Convention Centers) Institutional (Healthcare, Education, Government) Industrial & Logistics (Warehouses, Industrial Parks) Mixed-Use Developments Data Centers |

| By End-User | Private Developers and Corporates Government & Public Sector Undertakings (PSUs) Retail & Hospitality Operators Healthcare and Educational Institutions |

| By Region | North India South India East India West India |

| By Application | New Construction Renovation and Remodeling Tenant Improvements & Fit-outs |

| By Investment Source | Domestic Investments Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Real Estate Investment Trusts (REITs) |

| By Policy Support | Incentives for Green Buildings & IGBC/GRIHA Ratings Tax Exemptions & Stamp Duty Concessions Single-Window Clearances & RERA Compliance |

| By Construction Methodology | Traditional Construction Modular/Prefabricated Construction Sustainable/Green Construction Smart/Technology-Enabled Construction (BIM, IoT) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Office Construction | 120 | Project Managers, Architects |

| Retail Space Development | 100 | Real Estate Developers, Urban Planners |

| Hospitality Sector Projects | 80 | Construction Managers, Investment Analysts |

| Infrastructure and Public Works | 70 | Government Officials, Policy Makers |

| Green Building Initiatives | 60 | Sustainability Consultants, Engineers |

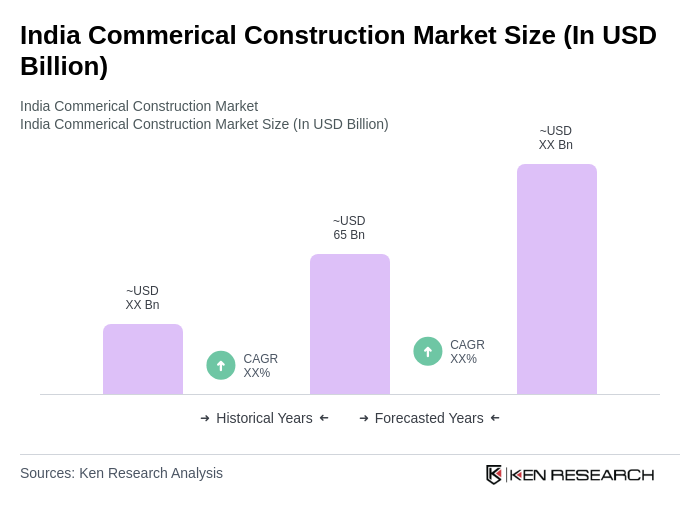

The India Commercial Construction Market is valued at approximately USD 65 billion, driven by rapid urbanization, foreign direct investment in real estate, and government spending on infrastructure projects such as metro rail and highways.