Region:Middle East

Author(s):Rebecca

Product Code:KRAC0296

Pages:84

Published On:August 2025

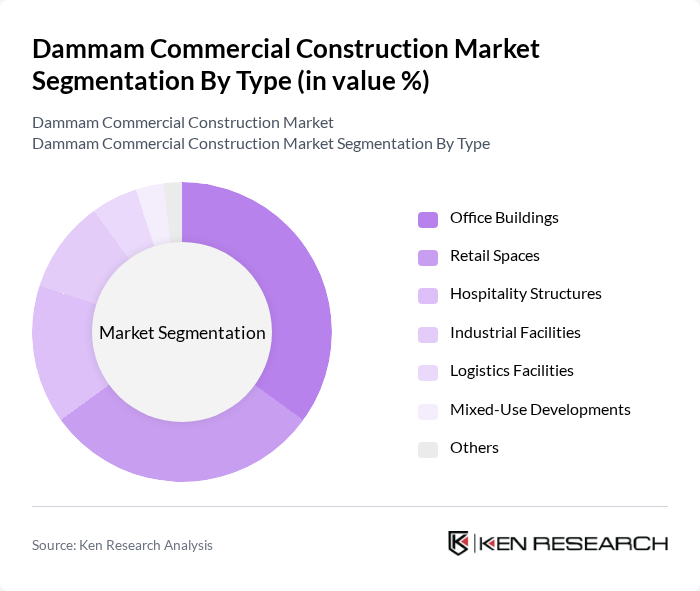

By Type:The commercial construction market in Dammam is segmented into office buildings, retail spaces, hospitality structures, industrial facilities, logistics facilities, mixed-use developments, and others. Among these, office buildings and retail spaces are the most prominent, driven by the increasing demand for modern workspaces and shopping centers. The hospitality sector is also witnessing growth due to the rise in tourism and business travel. Industrial and logistics facilities are experiencing notable expansion, supported by government-driven industrial diversification and logistics investments .

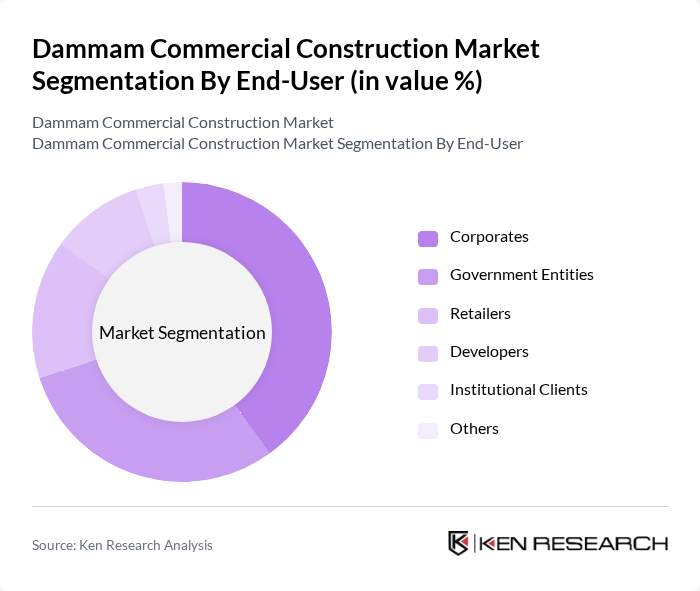

By End-User:The end-user segmentation of the commercial construction market in Dammam includes corporates, government entities, retailers, developers, institutional clients, and others. Corporates and government entities are the leading end-users, as they are driving the demand for office spaces and public infrastructure projects. Retailers are also significant contributors, with the expansion of shopping centers and commercial complexes. Developers are increasingly active, leveraging public-private partnerships and government incentives to deliver large-scale projects .

The Dammam Commercial Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Binladin Group, El Seif Engineering Contracting Company, Nesma & Partners Contracting Company Ltd., Al Kifah Contracting Company, Al Rashid Trading & Contracting Co., Al Fouzan Trading & General Construction Co., Almabani General Contractors, Al Yamama Company, Ahmad N. Albinali & Sons Co., Contracting & Construction Enterprises Ltd. (CCE), Al-Arrab Contracting Company (ACC), Kabbani Construction Group, Umm Al Qura for Development & Construction Co., Construction & Planning Co. Ltd. (C&P), Al Shoula Group contribute to innovation, geographic expansion, and service delivery in this space.

The Dammam commercial construction market is poised for significant growth, driven by urbanization and government investments. As the population increases, the demand for commercial spaces will rise, particularly in retail and hospitality sectors. Additionally, the adoption of sustainable construction practices and smart building technologies will shape future projects. Companies that adapt to these trends and invest in skilled labor will likely thrive, positioning themselves favorably in a competitive market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Office Buildings Retail Spaces Hospitality Structures Industrial Facilities Logistics Facilities Mixed-Use Developments Others |

| By End-User | Corporates Government Entities Retailers Developers Institutional Clients Others |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Grants Others |

| By Application | New Construction Renovation and Remodeling Infrastructure Development Facility Management Others |

| By Project Size | Small Scale Projects Medium Scale Projects Large Scale Projects Mega Projects Others |

| By Construction Method | Traditional Construction Prefabricated Construction Design-Build Construction Management at Risk Others |

| By Policy Support | Subsidies for Green Building Tax Incentives for Developers Regulatory Support for Infrastructure Projects Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Project Managers, Site Supervisors |

| Commercial Building Developments | 75 | Architects, Construction Executives |

| Infrastructure Projects (Roads, Bridges) | 65 | Civil Engineers, Government Officials |

| Real Estate Development Trends | 50 | Real Estate Analysts, Investment Managers |

| Construction Material Suppliers | 80 | Supply Chain Managers, Procurement Officers |

The Dammam Commercial Construction Market is valued at approximately USD 250 million, reflecting significant growth driven by urbanization, government investments in infrastructure, and increased commercial activities in the region.