Region:North America

Author(s):Rebecca

Product Code:KRAB1739

Pages:98

Published On:October 2025

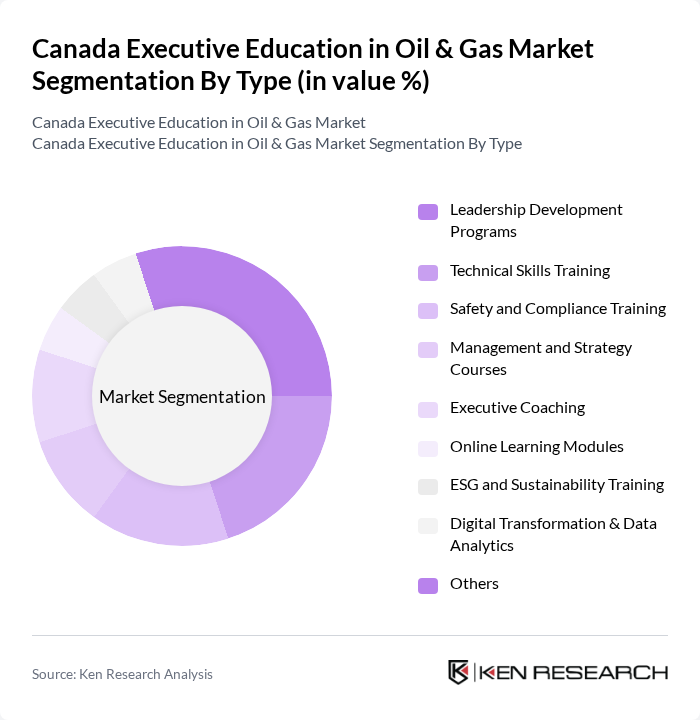

By Type:The market is segmented into various types of educational programs that cater to the specific needs of professionals in the oil and gas sector. The subsegments include Leadership Development Programs, Technical Skills Training, Safety and Compliance Training, Management and Strategy Courses, Executive Coaching, Online Learning Modules, ESG and Sustainability Training, Digital Transformation & Data Analytics, and Others. Among these, Leadership Development Programs are particularly prominent, as organizations prioritize developing effective leaders to navigate the complexities of the industry, especially given Canada's position as the world's fourth largest oil producer and fifth largest gas producer.

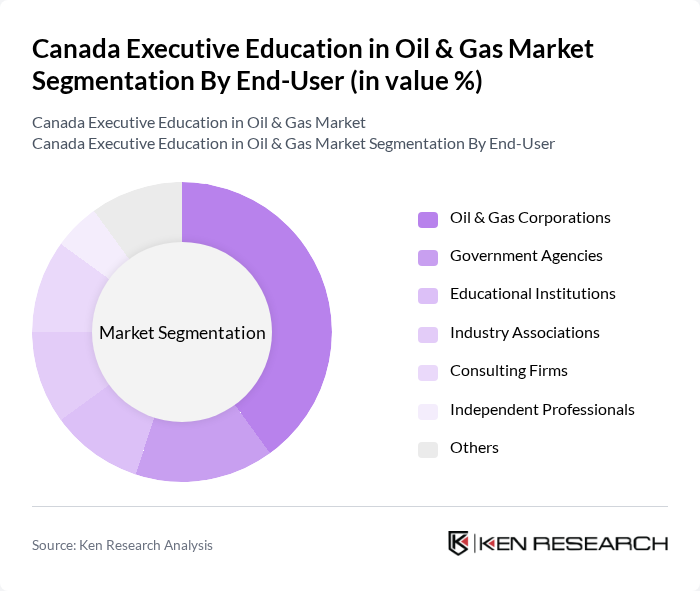

By End-User:The end-user segmentation includes various stakeholders in the oil and gas industry, such as Oil & Gas Corporations, Government Agencies, Educational Institutions, Industry Associations, Consulting Firms, Independent Professionals, and Others. Oil & Gas Corporations are the leading end-users, as they invest significantly in executive education to ensure their workforce is equipped with the latest skills and knowledge to remain competitive in a rapidly evolving market. This is particularly relevant as 88% of oil and gas producers expect production growth, with gas producers anticipating 6.3% growth and oil producers expecting 4.6% growth, driving increased demand for skilled professionals.

The Canada Executive Education in Oil & Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as University of Alberta – Faculty of Extension, Executive Education, University of Calgary – Haskayne School of Business, Executive Education, Ivey Business School – Executive Education, Haskayne School of Business, University of Calgary, UBC Sauder School of Business – Executive Education, Schulich Executive Education Centre (SEEC), York University, Queen's University – Smith School of Business, Executive Education, McGill Executive Institute, McGill University, Canadian Association of Petroleum Producers (CAPP), Canadian Energy Regulator (CER), Oil and Gas Training Institute (OGTI), Canadian School of Petroleum, Enform (now part of Energy Safety Canada), PetroSkills Canada, Energy Safety Canada contribute to innovation, geographic expansion, and service delivery in this space.

The future of executive education in Canada’s oil and gas sector appears promising, driven by ongoing technological advancements and a strong emphasis on sustainability. As the industry adapts to new regulations and market demands, educational institutions are likely to innovate their curricula, incorporating digital learning and interdisciplinary approaches. This evolution will not only enhance the skill sets of professionals but also align educational outcomes with the strategic goals of the industry, fostering a more resilient workforce prepared for future challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Leadership Development Programs Technical Skills Training Safety and Compliance Training Management and Strategy Courses Executive Coaching Online Learning Modules ESG and Sustainability Training Digital Transformation & Data Analytics Others |

| By End-User | Oil & Gas Corporations Government Agencies Educational Institutions Industry Associations Consulting Firms Independent Professionals Others |

| By Delivery Mode | In-Person Training Online Courses Hybrid Learning Workshops and Seminars Corporate In-House Programs Others |

| By Duration | Short-Term Courses (Less than 3 months) Medium-Term Courses (3 to 6 months) Long-Term Programs (More than 6 months) Modular/Stackable Programs Others |

| By Certification Type | Professional Certifications Diplomas Degrees Micro-credentials Others |

| By Geographic Focus | National Programs Regional Programs International Programs Others |

| By Price Range | Low-Cost Programs Mid-Range Programs Premium Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Upstream Oil Production | 100 | Production Managers, Field Engineers |

| Midstream Transportation and Storage | 60 | Logistics Coordinators, Operations Managers |

| Downstream Refining Operations | 75 | Refinery Managers, Quality Control Supervisors |

| Regulatory Compliance and Environmental Impact | 50 | Compliance Officers, Environmental Managers |

| Market Trends and Consumer Insights | 55 | Market Analysts, Business Development Managers |

The Canada Executive Education in Oil & Gas Market is valued at approximately USD 1.3 billion, reflecting the industry's significant demand for skilled professionals and the necessity for continuous training to adapt to technological advancements and regulatory changes.