Region:Europe

Author(s):Rebecca

Product Code:KRAB1750

Pages:94

Published On:October 2025

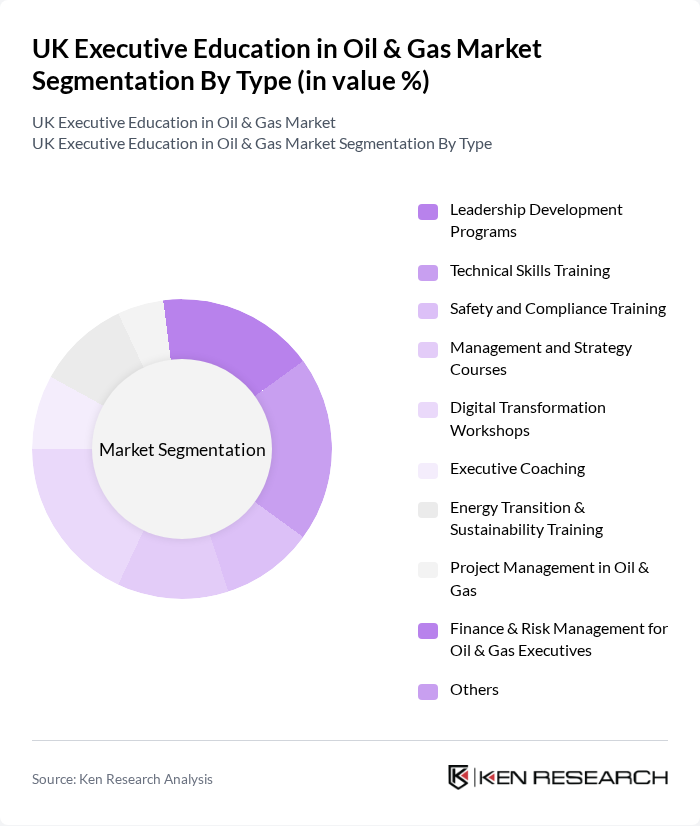

By Type:The market is segmented into a diverse range of educational programs, including Leadership Development Programs, Technical Skills Training, Safety and Compliance Training, Management and Strategy Courses, Digital Transformation Workshops, Executive Coaching, Energy Transition & Sustainability Training, Project Management in Oil & Gas, Finance & Risk Management for Oil & Gas Executives, and Others. These sub-segments address the sector’s evolving needs, focusing on upskilling professionals in areas such as advanced operations, regulatory compliance, digitalization, and sustainable practices. The increasing integration of digital transformation workshops and sustainability training reflects the industry’s adaptation to new technologies and environmental standards .

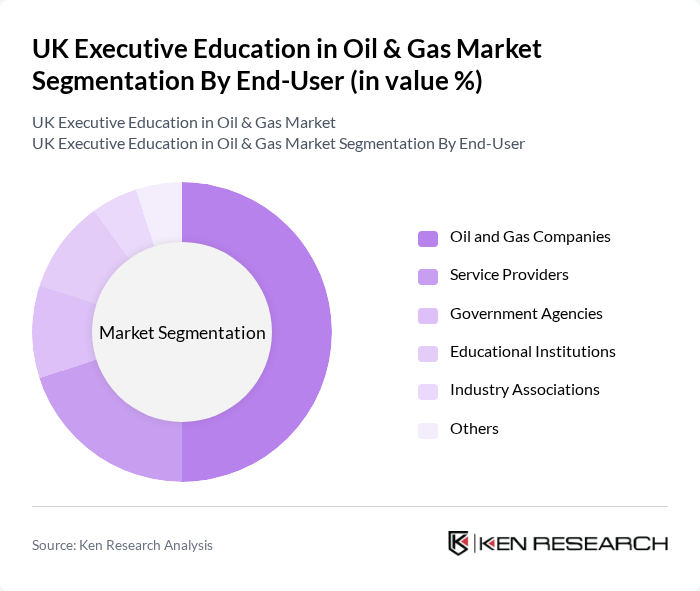

By End-User:The end-users of executive education in the oil and gas market include Oil and Gas Companies, Service Providers, Government Agencies, Educational Institutions, Industry Associations, and Others. Oil and gas companies represent the largest consumer segment, driven by the need to upskill their workforce in response to regulatory changes, digitalization, and sustainability goals. Service providers and industry associations also play a significant role, supporting the sector’s transition through specialized training and certification programs. Educational institutions and government agencies contribute to workforce development and policy compliance .

The UK Executive Education in Oil & Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as University of Aberdeen, Imperial College London, University of Edinburgh, University of Strathclyde, The Oil & Gas Academy, Energy Institute, Robert Gordon University, Oxford Management Centre, Hult Ashridge Executive Education, Cranfield University, University of Dundee, University of Glasgow, University of Nottingham, University of Southampton, University of Birmingham, PetroKnowledge, London Business School, Manchester Business School, Leeds University Business School, MSBM (Metropolitan School of Business and Management) contribute to innovation, geographic expansion, and service delivery in this space.

The future of executive education in the UK oil and gas market appears promising, driven by the increasing need for skilled professionals and the integration of advanced technologies. As companies adapt to regulatory changes and sustainability demands, training programs will evolve to include more digital and hybrid learning options. Additionally, partnerships with industry leaders will enhance the relevance of educational offerings, ensuring that professionals are equipped to meet the challenges of a dynamic energy landscape while fostering innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Leadership Development Programs Technical Skills Training Safety and Compliance Training Management and Strategy Courses Digital Transformation Workshops Executive Coaching Energy Transition & Sustainability Training Project Management in Oil & Gas Finance & Risk Management for Oil & Gas Executives Others |

| By End-User | Oil and Gas Companies Service Providers Government Agencies Educational Institutions Industry Associations Others |

| By Delivery Mode | In-Person Training Online Learning Hybrid Programs On-the-Job Training Executive Retreats & Immersive Simulations Others |

| By Duration | Short Courses (1-2 days) Medium Courses (1-4 weeks) Long Courses (1-6 months) Modular/Part-Time Programs Others |

| By Certification Type | Professional Certifications Academic Degrees Industry Recognized Credentials CPD (Continuing Professional Development) Accreditation Others |

| By Geographic Focus | Domestic UK Market European Market Global Market Others |

| By Price Range | Low-Cost Programs Mid-Range Programs Premium Programs Custom Corporate Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Executive Education Needs Assessment | 120 | HR Directors, Training Managers |

| Program Effectiveness Feedback | 90 | Participants of Recent Executive Programs |

| Industry Trends in Learning | 60 | Industry Analysts, Academic Experts |

| Digital Learning Preferences | 50 | Oil & Gas Professionals, Learning & Development Specialists |

| Future Skills Requirements | 70 | Senior Executives, Strategy Planners |

The UK Executive Education in Oil & Gas Market is valued at approximately USD 590 million, reflecting the industry's growing demand for skilled professionals amid digital transformation and sustainability initiatives.