Region:Asia

Author(s):Rebecca

Product Code:KRAB1726

Pages:99

Published On:October 2025

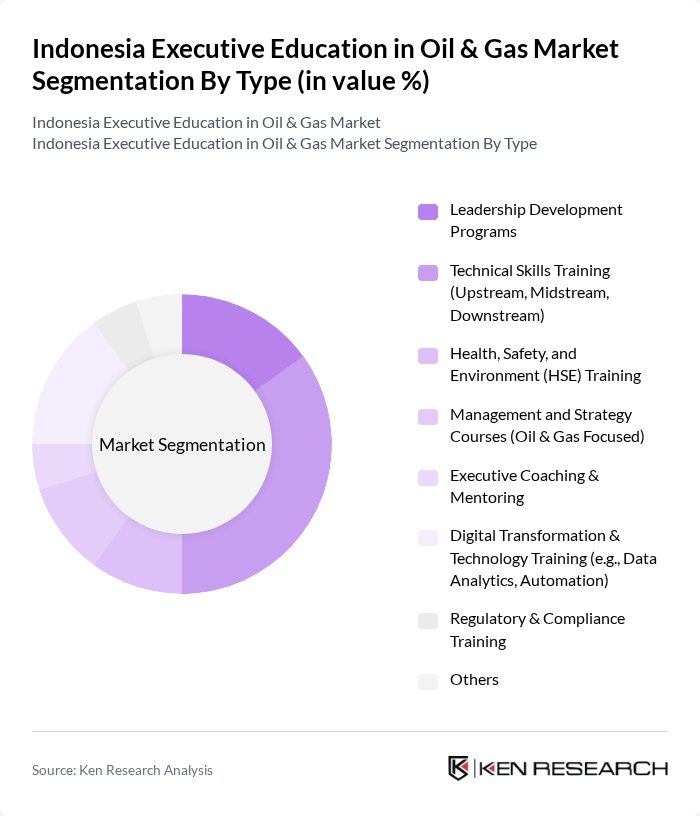

By Type:The market is segmented into Leadership Development Programs, Technical Skills Training (Upstream, Midstream, Downstream), Health, Safety, and Environment (HSE) Training, Management and Strategy Courses (Oil & Gas Focused), Executive Coaching & Mentoring, Digital Transformation & Technology Training (e.g., Data Analytics, Automation), Regulatory & Compliance Training, and Others. Technical Skills Training is the leading segment, reflecting the industry's need for specialized operational knowledge and compliance with evolving technological standards.

By End-User:The end-user segmentation includes National Oil Companies (NOCs), International Oil Companies (IOCs), Oilfield Services Providers, Government Agencies & Regulators, Educational Institutions, Consulting & Engineering Firms, and Others. National Oil Companies are the primary end-users, driven by their mandate to enhance workforce capabilities and comply with national competency certification requirements.

The Indonesia Executive Education in Oil & Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as Universitas Gadjah Mada (UGM) – Center for Oil & Gas Training, Institut Teknologi Bandung (ITB) – School of Business and Management, Oil & Gas Executive Programs, Pertamina University (Universitas Pertamina), Universitas Indonesia (UI) – Executive Education in Energy Management, PPM School of Management – Energy & Oil/Gas Executive Programs, Lembaga Pendidikan dan Pelatihan Migas (LPP Migas), Oil & Gas Training Center (OGTC) Indonesia, Indonesian Petroleum Association (IPA) – Training & Certification Division, Energy Institute Indonesia, Jakarta School of Energy & Sustainability, Universitas Trisakti – Faculty of Earth Technology and Energy, Universitas Pembangunan Nasional "Veteran" Jakarta (UPNVJ), Universitas Kristen Satya Wacana – Oil & Gas Management Programs, Universitas Diponegoro – Center for Energy Studies, Universitas Brawijaya – Oil & Gas Executive Training contribute to innovation, geographic expansion, and service delivery in this space.

The future of executive education in Indonesia's oil and gas sector appears promising, driven by increasing investments in infrastructure and a growing emphasis on technological advancements. As the industry evolves, educational institutions are likely to adapt their curricula to meet the changing demands of the workforce. Additionally, the rising focus on sustainability practices will encourage the development of specialized programs, ensuring that professionals are equipped to address environmental challenges while maintaining operational efficiency in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Leadership Development Programs Technical Skills Training (Upstream, Midstream, Downstream) Health, Safety, and Environment (HSE) Training Management and Strategy Courses (Oil & Gas Focused) Executive Coaching & Mentoring Digital Transformation & Technology Training (e.g., Data Analytics, Automation) Regulatory & Compliance Training Others |

| By End-User | National Oil Companies (NOCs) International Oil Companies (IOCs) Oilfield Services Providers Government Agencies & Regulators Educational Institutions Consulting & Engineering Firms Others |

| By Program Duration | Short-term Courses (1-3 months) Medium-term Courses (3-6 months) Long-term Courses (6 months - 1 year) Others |

| By Delivery Mode | In-person Training Online Training Hybrid Training On-the-job/Field-based Training Others |

| By Certification Type | Professional Certifications (e.g., IWCF, NEBOSH, API) Academic Degrees Industry Recognized Certifications Company-specific Certifications Others |

| By Geographic Focus | Java-Bali Sumatra Kalimantan Sulawesi Eastern Indonesia (Papua, Maluku, etc.) Others |

| By Price Range | Low-cost Programs Mid-range Programs Premium Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Executive Education Programs | 60 | Program Directors, Curriculum Developers |

| Industry Professionals in Oil & Gas | 50 | Mid-level Managers, Technical Experts |

| Government Officials in Energy Sector | 40 | Policy Makers, Regulatory Authorities |

| Academic Institutions Offering Oil & Gas Courses | 45 | Deans, Faculty Members |

| Participants of Past Executive Programs | 55 | Alumni, Current Students |

The Indonesia Executive Education in Oil & Gas Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the demand for skilled professionals and government initiatives aimed at enhancing local expertise in the sector.