Region:Africa

Author(s):Geetanshi

Product Code:KRAA5558

Pages:83

Published On:September 2025

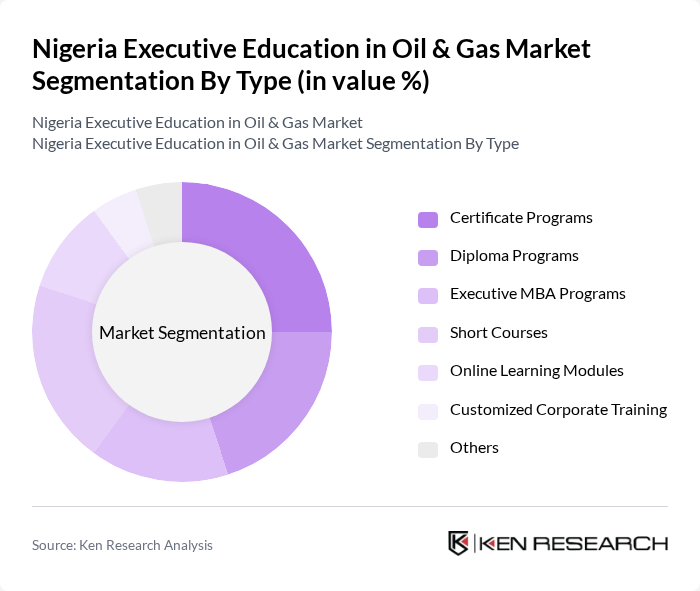

By Type:The market is segmented into various types of educational programs that cater to the diverse needs of professionals in the oil and gas sector. The subsegments include Certificate Programs, Diploma Programs, Executive MBA Programs, Short Courses, Online Learning Modules, Customized Corporate Training, and Others. Each of these subsegments plays a crucial role in providing specialized knowledge and skills to individuals seeking to advance their careers in this industry.

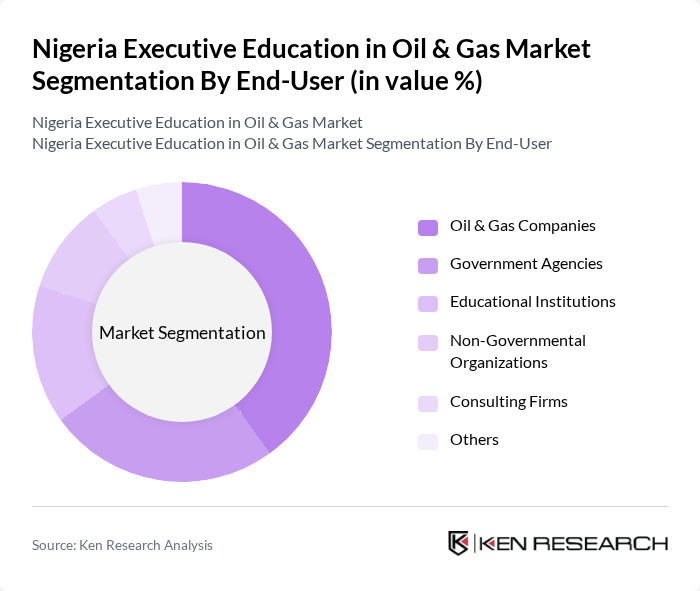

By End-User:The end-users of executive education in the oil and gas market include various stakeholders such as Oil & Gas Companies, Government Agencies, Educational Institutions, Non-Governmental Organizations, Consulting Firms, and Others. Each of these end-users has specific training needs that drive the demand for tailored educational programs.

The Nigeria Executive Education in Oil & Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nigerian Institute of Oil and Gas, Petroleum Training Institute, Lagos Business School, University of Port Harcourt, University of Lagos, Nigerian National Petroleum Corporation (NNPC), Shell Nigeria, Total Nigeria, Chevron Nigeria, ExxonMobil Nigeria, Halliburton Nigeria, Schlumberger Nigeria, Baker Hughes Nigeria, Seplat Petroleum Development Company, Oando PLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of executive education in Nigeria's oil and gas sector appears promising, driven by technological advancements and a growing emphasis on sustainability. As the industry evolves, educational institutions are likely to adopt more digital learning solutions, enhancing accessibility and flexibility for professionals. Additionally, the increasing focus on compliance and regulatory training will shape curricula, ensuring that graduates are well-equipped to navigate the complexities of the sector while promoting sustainable practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Certificate Programs Diploma Programs Executive MBA Programs Short Courses Online Learning Modules Customized Corporate Training Others |

| By End-User | Oil & Gas Companies Government Agencies Educational Institutions Non-Governmental Organizations Consulting Firms Others |

| By Delivery Mode | In-Person Training Online Training Hybrid Training On-the-Job Training Others |

| By Duration | Short-Term Courses (Less than 3 months) Medium-Term Courses (3 to 6 months) Long-Term Courses (More than 6 months) Others |

| By Certification Type | Accredited Programs Non-Accredited Programs Industry-Specific Certifications Others |

| By Geographic Reach | National Programs Regional Programs International Programs Others |

| By Price Range | Low-Cost Programs Mid-Range Programs Premium Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Executive Education Programs | 150 | Training Managers, Learning & Development Directors |

| Corporate Training Needs Assessment | 100 | HR Managers, Talent Development Specialists |

| Industry Skill Gap Analysis | 80 | Operations Managers, Technical Training Coordinators |

| Market Demand for Certifications | 70 | Professional Development Officers, Industry Analysts |

| Feedback on Educational Program Effectiveness | 90 | Alumni, Current Participants in Executive Programs |

The Nigeria Executive Education in Oil & Gas Market is valued at approximately USD 1.2 billion, reflecting a significant demand for skilled professionals and the necessity for continuous professional development in the sector.