Region:North America

Author(s):Geetanshi

Product Code:KRAA2005

Pages:89

Published On:August 2025

By Type:The market is segmented into various types of automation solutions, including Freight Management Systems, Automated Guided Vehicles (AGVs), Robotics and Robotic Process Automation (RPA), Freight Tracking & Visibility Solutions, Automated Storage and Retrieval Systems (AS/RS), Warehouse Control Systems, and Others. Among these, Freight Management Systems are leading the market due to their ability to streamline operations, optimize routes, and enhance visibility across the supply chain. The increasing complexity of logistics operations and the need for real-time data analytics are driving the adoption of these systems .

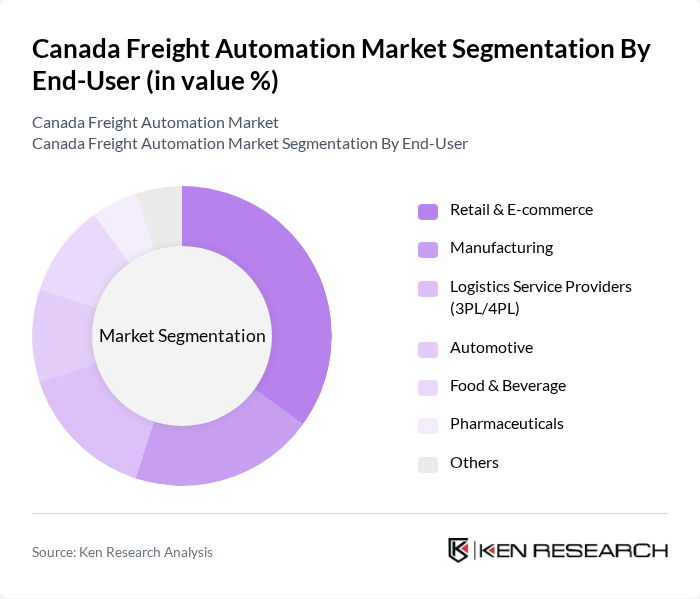

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Logistics Service Providers (3PL/4PL), Automotive, Food & Beverage, Pharmaceuticals, and Others. The Retail & E-commerce sector is the dominant end-user, driven by the rapid growth of online shopping and the need for efficient last-mile delivery solutions. Increasing consumer expectations for fast and reliable delivery services are pushing retailers to adopt advanced freight automation technologies. Manufacturing and logistics service providers are also accelerating adoption to optimize supply chain operations and improve productivity .

The Canada Freight Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as TFI International Inc., Mullen Group Ltd., CN (Canadian National Railway Company), Canadian Pacific Kansas City Limited (CPKC), Purolator Inc., FedEx Corporation, UPS Supply Chain Solutions, DHL Group (DHL Supply Chain & Global Forwarding), XPO Inc., Attabotics Inc., Honeywell International Inc., Siemens AG, ABB Ltd., Trimble Inc., Geodis, DSV A/S, C.H. Robinson Worldwide, Inc., J.B. Hunt Transport Services, Inc., Ryder System, Inc., Sanctuary Cognitive Systems Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada freight automation market appears promising, driven by ongoing technological advancements and increasing demand for efficiency. As companies continue to adopt AI and IoT solutions, operational capabilities will enhance significantly. Furthermore, the expansion of e-commerce and government initiatives supporting smart logistics will likely create a conducive environment for automation growth. In future, the integration of autonomous vehicles and sustainable practices is expected to reshape the logistics landscape, fostering innovation and competitiveness in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Management Systems Automated Guided Vehicles (AGVs) Robotics and Robotic Process Automation (RPA) Freight Tracking & Visibility Solutions Automated Storage and Retrieval Systems (AS/RS) Warehouse Control Systems Others |

| By End-User | Retail & E-commerce Manufacturing Logistics Service Providers (3PL/4PL) Automotive Food & Beverage Pharmaceuticals Others |

| By Component | Hardware (Sensors, Conveyors, RFID, Robotics) Software (TMS, WMS, Analytics, AI/ML) Services (Integration, Maintenance, Consulting) |

| By Application | Freight Transportation (Road, Rail, Air, Pipeline) Warehouse & Inventory Management Last-Mile Delivery Automation Yard Management Others |

| By Distribution Mode | Direct Sales Online Sales Distributors/Channel Partners |

| By Industry Vertical | Automotive Pharmaceuticals Food & Beverage Oil & Gas Agriculture Construction Others |

| By Policy Support | Subsidies for Automation Tax Incentives Grants for Technology Adoption |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Automation | 100 | Fleet Managers, Logistics Coordinators |

| Rail Freight Innovations | 60 | Operations Managers, Rail Network Planners |

| Air Cargo Automation | 40 | Air Freight Managers, Cargo Operations Supervisors |

| Warehouse Automation Solutions | 80 | Warehouse Managers, Automation Technology Specialists |

| Last-Mile Delivery Automation | 50 | Last-Mile Delivery Managers, E-commerce Logistics Heads |

The Canada Freight Automation Market is valued at approximately USD 3.8 billion, reflecting a significant growth driven by the demand for efficient logistics solutions and advancements in automation technologies such as AI, machine learning, and robotics.