Region:Europe

Author(s):Shubham

Product Code:KRAA0824

Pages:100

Published On:August 2025

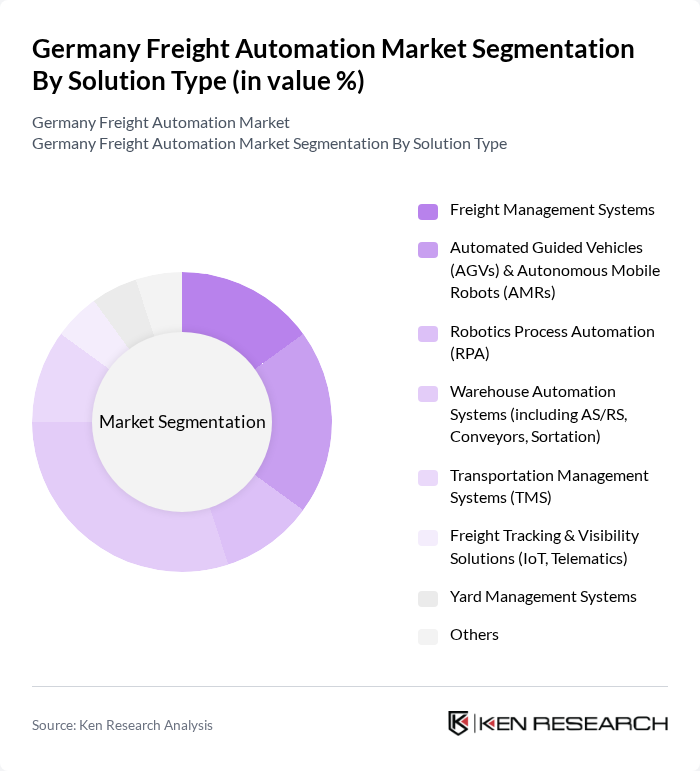

By Solution Type:The freight automation market is segmented into various solution types, including Freight Management Systems, Automated Guided Vehicles (AGVs) & Autonomous Mobile Robots (AMRs), Robotics Process Automation (RPA), Warehouse Automation Systems, Transportation Management Systems (TMS), Freight Tracking & Visibility Solutions, Yard Management Systems, and Others. Among these, Warehouse Automation Systems are leading the market due to the increasing need for efficient inventory management, order fulfillment, and the integration of advanced robotics and automated storage/retrieval systems .

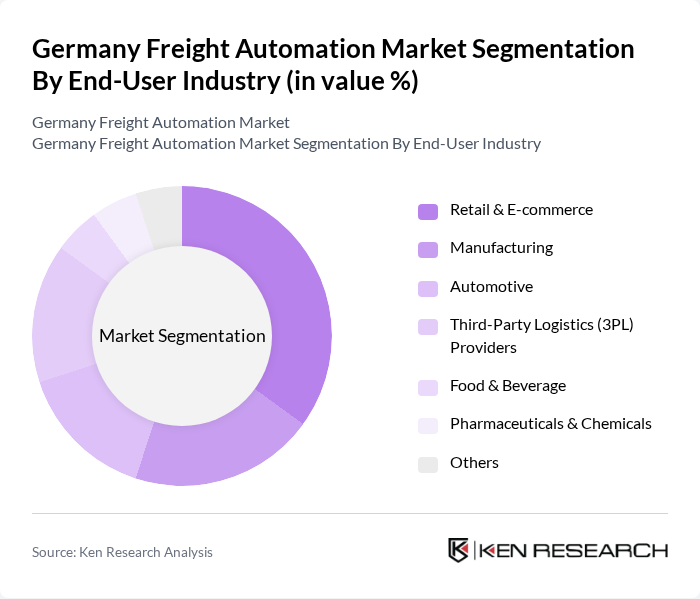

By End-User Industry:The end-user industries for freight automation include Retail & E-commerce, Manufacturing, Automotive, Third-Party Logistics (3PL) Providers, Food & Beverage, Pharmaceuticals & Chemicals, and Others. The Retail & E-commerce sector is the dominant segment, driven by the surge in online shopping, the need for efficient order fulfillment, and the adoption of automation in warehousing and last-mile delivery. Manufacturing and automotive sectors are also significant adopters due to Germany's strong industrial base and focus on process optimization .

The Germany Freight Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Deutsche Post DHL Group, Kuehne + Nagel International AG, DB Schenker, Jungheinrich AG, Kion Group AG, Bosch Rexroth AG, SSI Schäfer Group, Vanderlande Industries B.V., Knapp AG, Hellmann Worldwide Logistics, Geodis, DSV A/S, XPO Logistics, and CEVA Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Germany freight automation market appears promising, driven by technological advancements and evolving consumer expectations. As companies increasingly prioritize sustainability, the shift towards eco-friendly logistics solutions is expected to gain momentum. Additionally, the integration of autonomous vehicles and smart warehousing technologies will likely reshape the logistics landscape, enhancing efficiency and reducing operational costs. Collaborative logistics platforms are also anticipated to emerge, fostering partnerships that drive innovation and streamline supply chain processes.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Freight Management Systems Automated Guided Vehicles (AGVs) & Autonomous Mobile Robots (AMRs) Robotics Process Automation (RPA) Warehouse Automation Systems (including AS/RS, Conveyors, Sortation) Transportation Management Systems (TMS) Freight Tracking & Visibility Solutions (IoT, Telematics) Yard Management Systems Others |

| By End-User Industry | Retail & E-commerce Manufacturing Automotive Third-Party Logistics (3PL) Providers Food & Beverage Pharmaceuticals & Chemicals Others |

| By Application | Freight Transportation (Road, Rail, Air, Sea) Inventory & Warehouse Management Order Fulfillment & Picking Supply Chain Optimization Last-Mile Delivery Automation Hazardous & Sensitive Goods Handling Others |

| By Mode of Transport | Road Freight Rail Freight Air Freight Sea Freight Intermodal Freight Others |

| By Sales Channel | Direct Sales Online Sales Distributors/Integrators Retailers Others |

| By Pricing Model | Subscription-Based Perpetual License Pay-Per-Use Others |

| By Policy & Regulatory Support | Government Grants Tax Incentives Subsidies for Automation Compliance with EU/Local Regulations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Automation | 100 | Fleet Managers, Operations Directors |

| Rail Freight Innovations | 60 | Logistics Coordinators, Technology Officers |

| Air Cargo Automation | 50 | Airline Cargo Managers, Supply Chain Analysts |

| Maritime Freight Solutions | 40 | Port Operations Managers, Shipping Line Executives |

| Last-Mile Delivery Automation | 70 | Last-Mile Delivery Managers, E-commerce Logistics Heads |

The Germany Freight Automation Market is valued at approximately USD 4.5 billion, reflecting significant growth driven by the demand for efficient logistics solutions and advancements in automation technologies.