Region:Africa

Author(s):Geetanshi

Product Code:KRAA2029

Pages:97

Published On:August 2025

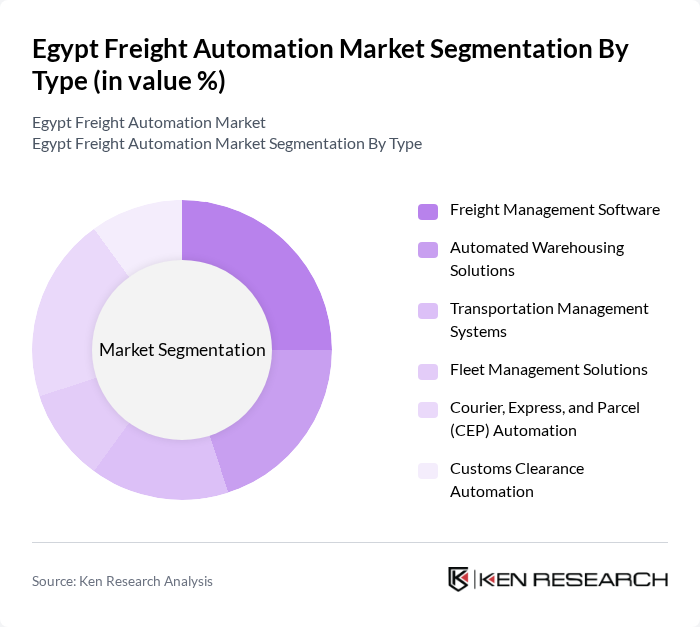

By Type:The market is segmented intoFreight Management Software,Automated Warehousing Solutions,Transportation Management Systems,Fleet Management Solutions,Courier, Express, and Parcel (CEP) Automation, andCustoms Clearance Automation. Each sub-segment plays a crucial role in enhancing operational efficiency and reducing costs in freight operations. Notably, the adoption of automated warehousing and digital freight management platforms has accelerated, driven by the need for real-time tracking, inventory optimization, and faster delivery cycles .

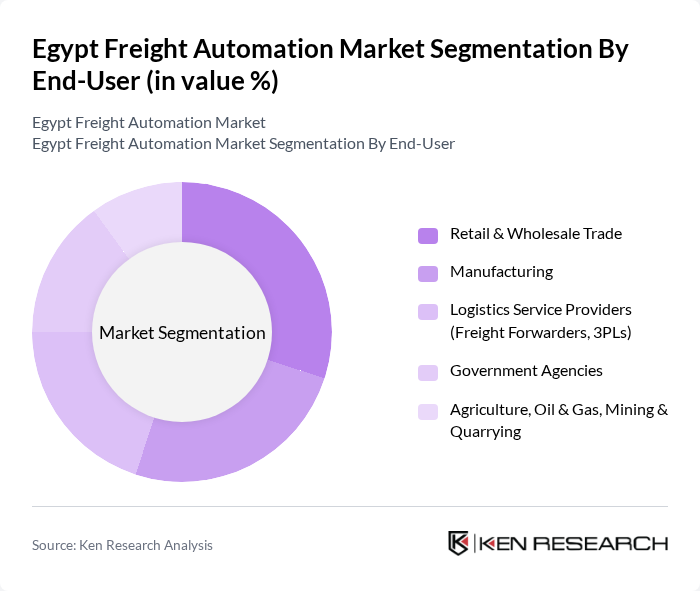

By End-User:The end-user segmentation includesRetail & Wholesale Trade,Manufacturing,Logistics Service Providers (Freight Forwarders, 3PLs),Government Agencies, andAgriculture, Oil & Gas, Mining & Quarrying. Retail and e-commerce sectors are major drivers of automation adoption, while manufacturing and logistics service providers increasingly rely on digital solutions for inventory and fleet management. Government initiatives and infrastructure investments have also spurred adoption in public sector logistics and strategic commodity storage .

The Egypt Freight Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain Egypt, Kuehne + Nagel Egypt, DB Schenker Egypt, Agility Logistics Egypt, CEVA Logistics Egypt, XPO Logistics, UPS Supply Chain Solutions Egypt, FedEx Express Egypt, Maersk Egypt, Yusen Logistics Egypt, Geodis Egypt, DSV Egypt, Bolloré Logistics Egypt, Egyptian National Railways (ENR), Raya Logistics, Trella, Bosta, Aramex Egypt, Suez Canal Container Terminal (SCCT), and Alexandria Container & Cargo Handling Co. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Egypt freight automation market appears promising, driven by technological advancements and increasing demand for efficient logistics solutions. As the government continues to invest in infrastructure, the integration of smart technologies will likely enhance operational efficiency. Additionally, the rise of e-commerce will necessitate further automation in logistics, leading to improved customer experiences. Companies that embrace these changes will be well-positioned to capitalize on emerging opportunities in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Management Software Automated Warehousing Solutions Transportation Management Systems Fleet Management Solutions Courier, Express, and Parcel (CEP) Automation Customs Clearance Automation |

| By End-User | Retail & Wholesale Trade Manufacturing Logistics Service Providers (Freight Forwarders, 3PLs) Government Agencies Agriculture, Oil & Gas, Mining & Quarrying |

| By Application | Freight Tracking & Visibility Inventory Management Order Fulfillment Supply Chain Optimization Route Planning & Scheduling |

| By Distribution Mode | Road Freight Rail Freight Air Freight Sea Freight |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time Purchase |

| By Service Type | Consulting Services Implementation Services Maintenance and Support Services |

| By Technology | Cloud-Based Solutions On-Premise Solutions Hybrid Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Freight Forwarding Services | 100 | Logistics Managers, Operations Directors |

| Automated Warehouse Solutions | 60 | Warehouse Managers, Technology Officers |

| Last-Mile Delivery Automation | 50 | Delivery Managers, Supply Chain Analysts |

| Cold Chain Logistics | 40 | Quality Control Managers, Operations Supervisors |

| Freight Management Software | 70 | IT Managers, Procurement Officers |

The Egypt Freight Automation Market is valued at approximately USD 1.1 billion, reflecting a significant growth trajectory driven by the demand for efficient logistics solutions and advancements in technology such as IoT and AI.