Region:North America

Author(s):Rebecca

Product Code:KRAA1420

Pages:96

Published On:August 2025

By Type:The market can be segmented into various types of health insurance products, including Individual Health Insurance, Family Health Insurance, Group Health Insurance, Critical Illness Insurance, Dental Insurance, Vision Insurance, Prescription Drug Insurance, Disability Insurance, and Others. Each of these subsegments caters to different consumer needs and preferences, reflecting the diverse landscape of health insurance in Canada. Group Health Insurance remains the largest segment, driven by employer-sponsored plans and increasing demand for comprehensive coverage. There is also notable growth in supplemental products such as dental, vision, and critical illness insurance, reflecting consumer demand for broader protection .

By End-User:The end-users of health insurance in Canada can be categorized into Individuals, Families, Corporations, Government Entities, Seniors and Retirees, Students and Young Adults, and Self-Employed and Freelancers. Each group has distinct needs and preferences, influencing the types of insurance products they seek. Corporations and families represent the largest end-user segments, reflecting the dominance of employer-sponsored group plans and the growing need for family-oriented coverage. Seniors and retirees are an expanding segment due to demographic shifts, while students, young adults, and the self-employed are increasingly seeking flexible and digital-first insurance solutions .

The Canada Health And Medical Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Manulife Financial Corporation, Sun Life Financial Inc., The Canada Life Assurance Company (Great-West Lifeco Inc.), Intact Financial Corporation, Desjardins Group, Aviva Canada Inc., The Co-operators Group Limited, iA Financial Group (Industrial Alliance Insurance and Financial Services Inc.), RSA Canada, Allianz Global Assistance, Medavie Blue Cross, Pacific Blue Cross, Green Shield Canada, Ontario Blue Cross, SSQ Insurance, Beneva, Empire Life Insurance Company, CAA Insurance contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada health and medical insurance market appears promising, driven by technological advancements and evolving consumer preferences. The integration of digital solutions, such as telehealth and AI-driven claims processing, is expected to enhance service delivery and operational efficiency. Additionally, as consumers increasingly prioritize mental health and preventive care, insurers will likely adapt their offerings to meet these demands, fostering innovation and improving access to essential health services across the country.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Health Insurance Family Health Insurance Group Health Insurance Critical Illness Insurance Dental Insurance Vision Insurance Prescription Drug Insurance Disability Insurance Others |

| By End-User | Individuals Families Corporations Government Entities Seniors and Retirees Students and Young Adults Self-Employed and Freelancers |

| By Distribution Channel | Direct Sales Brokers and Agents Online Platforms Employer-Sponsored Plans Bancassurance (Insurance through Banks) Group Benefits Providers |

| By Coverage Type | Basic Coverage Comprehensive Coverage Supplemental Coverage Bronze Silver Gold |

| By Premium Range | Low Premium Medium Premium High Premium |

| By Policy Duration | Short-term Policies Long-term Policies |

| By Policy Type | Renewable Policies Non-renewable Policies Lifetime Policies |

| By Service Type | Inpatient Treatment Outpatient Treatment Preventive Care Mental Health Services Paramedical Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Health Insurance Insights | 100 | Policy Analysts, Government Officials |

| Private Health Insurance Trends | 80 | Insurance Executives, Product Managers |

| Patient Experience with Health Insurance | 90 | Policyholders, Healthcare Consumers |

| Healthcare Provider Perspectives | 60 | Doctors, Hospital Administrators |

| Regulatory Impact Assessment | 50 | Legal Advisors, Compliance Officers |

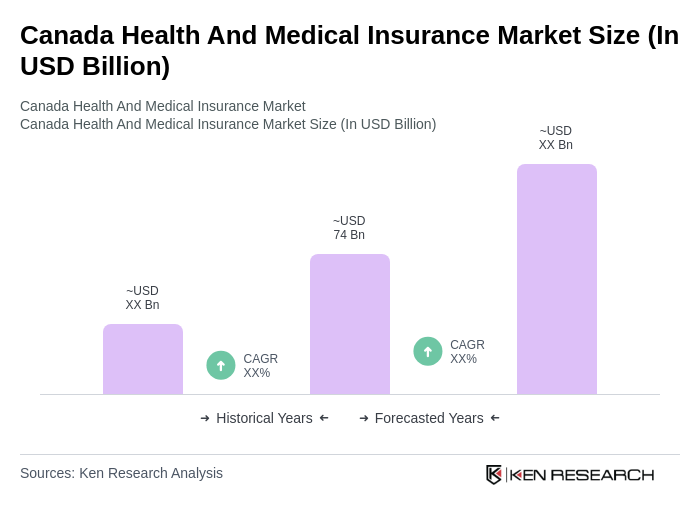

The Canada Health and Medical Insurance Market is valued at approximately USD 74 billion, reflecting significant growth driven by factors such as an aging population, rising healthcare costs, and increased consumer awareness regarding health insurance.