Region:Europe

Author(s):Shubham

Product Code:KRAA1756

Pages:95

Published On:August 2025

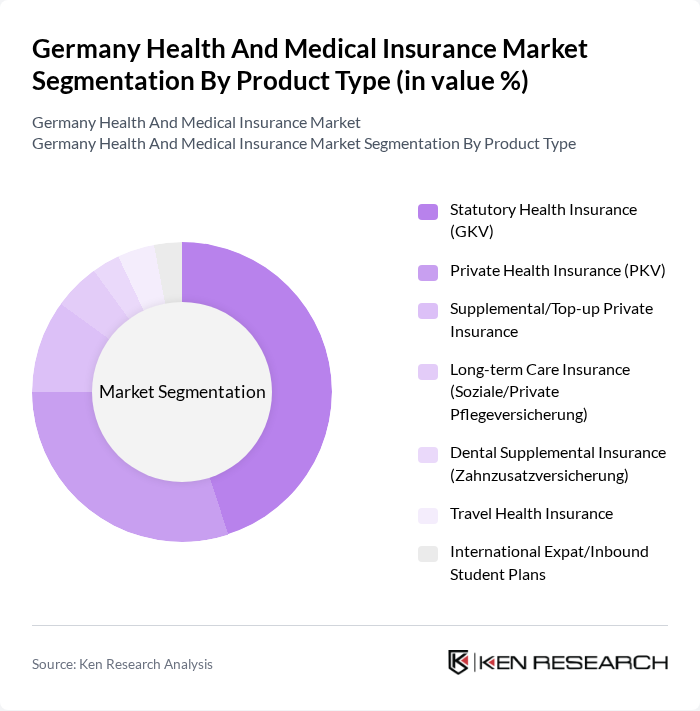

By Product Type:The product type segmentation includes various insurance offerings that cater to different healthcare needs. The subsegments are Statutory Health Insurance (GKV), Private Health Insurance (PKV), Supplemental/Top-up Private Insurance, Long-term Care Insurance (Soziale/Private Pflegeversicherung), Dental Supplemental Insurance (Zahnzusatzversicherung), Travel Health Insurance, and International Expat/Inbound Student Plans. Among these, Statutory Health Insurance (GKV) is the most dominant segment, primarily due to its mandatory nature for employees and its extensive coverage options, which appeal to a broad demographic.

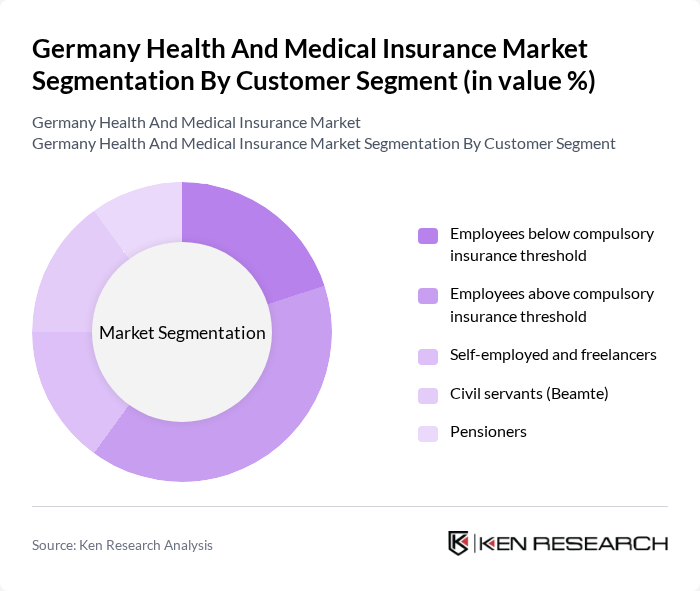

By Customer Segment:The customer segment includes various groups that utilize health insurance based on their employment status and income levels. The subsegments are Employees below compulsory insurance threshold, Employees above compulsory insurance threshold, Self-employed and freelancers, Civil servants (Beamte), and Pensioners. The segment of Employees above the compulsory insurance threshold is particularly significant, as it includes higher-income individuals who often opt for private health insurance, leading to increased market penetration in this demographic.

The Germany Health And Medical Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Allianz Private Krankenversicherung (Allianz PKV), Techniker Krankenkasse (TK), AOK – Die Gesundheitskasse (e.g., AOK Baden?Württemberg), DKV Deutsche Krankenversicherung AG (ERGO Group), BARMER, Debeka Krankenversicherungsverein a. G., HanseMerkur Krankenversicherung AG, AXA Krankenversicherung AG, SIGNAL IDUNA Krankenversicherung a. G., Gothaer Krankenversicherung AG, HUK?COBURG?Krankenversicherung AG, LVM Krankenversicherungs?AG, R+V Krankenversicherung AG, Die Continentale Krankenversicherung a. G., KKH Kaufmännische Krankenkasse contribute to innovation, geographic expansion, and service delivery in this space.

The future of the German health and medical insurance market appears promising, driven by technological advancements and evolving consumer preferences. As telemedicine and digital health solutions gain traction, insurers are likely to adapt their offerings to include these services. Additionally, the increasing focus on mental health coverage will shape product development, catering to a growing demand for comprehensive health solutions. Overall, the market is poised for transformation, with innovative approaches enhancing accessibility and affordability for consumers.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Statutory Health Insurance (GKV) Private Health Insurance (PKV) Supplemental/Top-up Private Insurance Long-term Care Insurance (Soziale/Private Pflegeversicherung) Dental Supplemental Insurance (Zahnzusatzversicherung) Travel Health Insurance International Expat/Inbound Student Plans |

| By Customer Segment | Employees below compulsory insurance threshold Employees above compulsory insurance threshold Self-employed and freelancers Civil servants (Beamte) Pensioners |

| By Distribution Channel | Direct from Insurer Brokers and Multiple Agents (Makler) Credit Institutions/Bancassurance Online Platforms and Aggregators Tied Agents |

| By Term of Coverage | Short-term Long-term |

| By Income/Eligibility | Employed annual income below threshold (JAEG) Employed annual income above threshold (JAEG) Self-employed Civil servants (allowance-eligible) |

| By Age Group | Children and adolescents Adults (18–64) Seniors (65+) |

| By Coverage Type | Inpatient (hospital) coverage Outpatient coverage Preventive and wellness coverage Dental and vision add-ons |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Health Insurance Policyholders | 140 | Individuals enrolled in statutory health insurance plans |

| Private Health Insurance Clients | 100 | Members of private health insurance schemes |

| Healthcare Professionals | 80 | Doctors, nurses, and healthcare administrators |

| Insurance Company Executives | 60 | CEOs, CFOs, and product managers from health insurance firms |

| Policy Analysts and Regulators | 50 | Government officials and policy advisors in health insurance |

The Germany Health and Medical Insurance Market is valued at approximately USD 78 billion, driven by factors such as an aging population, rising healthcare costs, and increased demand for comprehensive health coverage.