Region:Asia

Author(s):Dev

Product Code:KRAB0662

Pages:94

Published On:August 2025

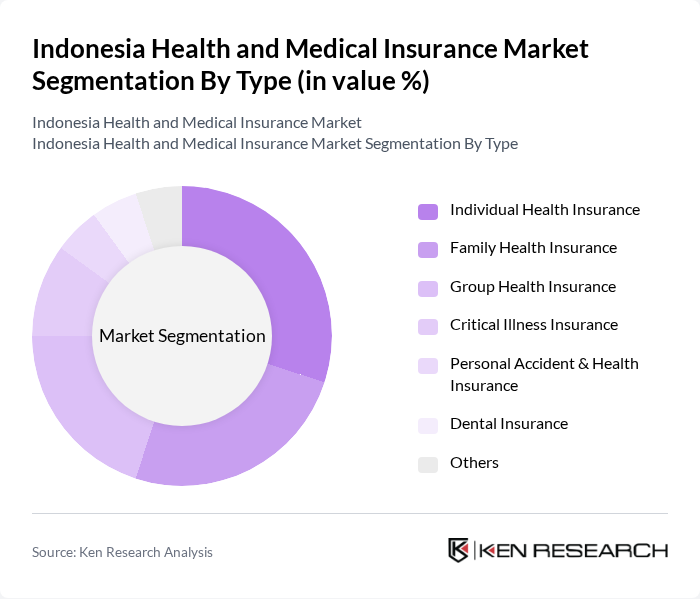

By Type:This segmentation includes various types of health insurance products available in the market.

Among the various types of health insurance,Individual Health Insuranceis currently the leading sub-segment. This dominance is attributed to increasing awareness of personal health management, the growing trend of individuals seeking tailored insurance solutions, and the rise in lifestyle-related diseases. The expansion of digital distribution channels and embedded insurance offerings has further propelled demand for individual plans, as consumers are more inclined to invest in comprehensive coverage that provides financial security against unforeseen medical expenses.

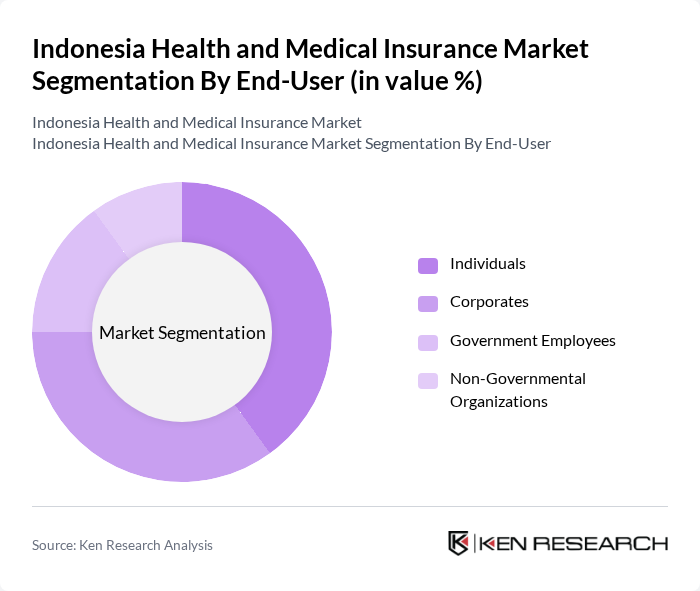

By End-User:This segmentation categorizes the market based on the primary users of health insurance products.

In the end-user segmentation,Individualsrepresent the largest segment, driven by a growing awareness of health issues and the need for personal health coverage. The increasing number of self-employed individuals and freelancers has also contributed to this trend, as they seek to secure their health needs independently. Corporates follow closely, as many companies are now offering health insurance as part of their employee benefits, reflecting a shift towards prioritizing employee well-being. SME corporate-wellness adoption is also supporting growth in the corporate segment.

The Indonesia Health and Medical Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Asuransi Jiwa Manulife Indonesia, PT Prudential Life Assurance, PT Asuransi Allianz Life Indonesia, PT AXA Mandiri Financial Services, PT BNI Life Insurance, PT Asuransi Jiwa Sinarmas MSIG, PT AIA Financial, PT Asuransi Jiwa Sequis Life, PT Asuransi Cigna, PT Tokio Marine Life Insurance Indonesia, PT FWD Insurance Indonesia, PT Great Eastern Life Indonesia, PT Avrist Assurance, PT Sinar Mas Multiartha Tbk, PT Asuransi Jiwa Inhealth Indonesia (Mandiri Inhealth) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the health and medical insurance market in Indonesia appears promising, driven by increasing digitalization and a growing focus on preventive healthcare. As telemedicine becomes more prevalent, insurers are likely to adapt their offerings to include virtual consultations and digital health services. Additionally, the emphasis on mental health coverage is expected to rise, reflecting changing societal attitudes. These trends will likely shape the market landscape, fostering innovation and enhancing consumer engagement in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Health Insurance Family Health Insurance Group Health Insurance Critical Illness Insurance Personal Accident & Health Insurance Dental Insurance Others |

| By End-User | Individuals Corporates Government Employees Non-Governmental Organizations |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents |

| By Coverage Type | Inpatient Coverage Outpatient Coverage Maternity Coverage Emergency Coverage Lifetime Coverage |

| By Premium Range | Low Premium Medium Premium High Premium |

| By Age Group | Children Adults Seniors |

| By Policy Duration | Short-Term Policies Long-Term Policies Lifetime Policies |

| By Region | Java Sumatra Kalimantan Sulawesi Maluku Papua |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Individual Health Insurance Policyholders | 120 | Policyholders aged 25-60, diverse income levels |

| Corporate Health Insurance Clients | 80 | HR Managers, Benefits Coordinators from SMEs and Corporates |

| Healthcare Providers (Hospitals and Clinics) | 60 | Administrators, Financial Officers, and Medical Directors |

| Insurance Brokers and Agents | 50 | Insurance Agents, Brokers specializing in health insurance |

| Regulatory Bodies and Health Policy Experts | 40 | Government Officials, Health Policy Analysts |

The Indonesia Health and Medical Insurance Market is valued at approximately USD 1.5 billion, driven by increasing healthcare costs, rising middle-class demand, and the expansion of health insurance products tailored to diverse consumer needs.