Region:Middle East

Author(s):Rebecca

Product Code:KRAD0319

Pages:100

Published On:August 2025

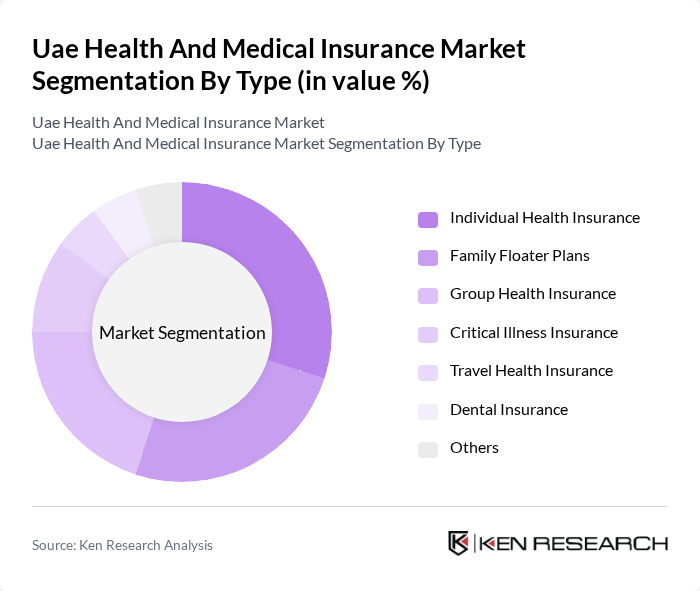

By Type:The market is segmented into various types of health insurance products, including Individual Health Insurance, Family Floater Plans, Group Health Insurance, Critical Illness Insurance, Travel Health Insurance, Dental Insurance, and Others. Each of these sub-segments caters to different consumer needs and preferences, reflecting the diverse landscape of health insurance in the UAE. The market is witnessing increased demand for customized products, such as wellness programs, preventive care, and mental health coverage, especially among expatriates and health-conscious consumers.

The Individual Health Insurance segment is currently leading the market, driven by the increasing awareness among individuals regarding the importance of personal health coverage. Consumers are increasingly opting for tailored plans that meet their specific health needs, leading to a rise in demand for individual policies. Family Floater Plans are also gaining traction as families seek comprehensive coverage under a single policy, which is often more economical than purchasing individual plans for each member.

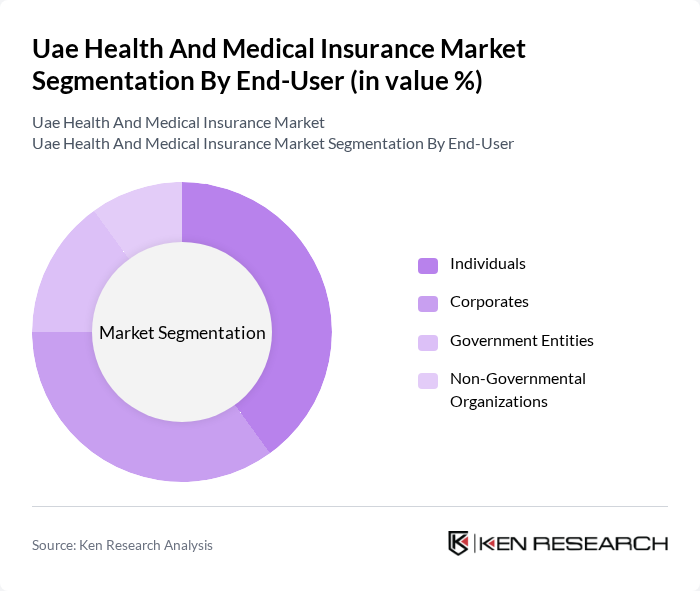

By End-User:The market is segmented by end-users, including Individuals, Corporates, Government Entities, and Non-Governmental Organizations. Each segment has unique requirements and purchasing behaviors, influencing the overall dynamics of the health insurance market. Corporates and government entities are significant contributors, as many employers provide health insurance as part of employee benefits, while NGOs offer coverage to staff and beneficiaries.

Among the end-user segments, Individuals represent the largest share, as a significant portion of the population seeks personal health insurance to mitigate medical expenses. Corporates also play a vital role, as many companies provide health insurance as part of employee benefits, which enhances employee satisfaction and retention. Government entities contribute to the market by offering health coverage to their employees, while NGOs often provide health insurance to their staff and beneficiaries.

The UAE health and medical insurance market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi National Insurance Company (ADNIC), Dubai Insurance Company, Oman Insurance Company (Sukoon Insurance), AXA Gulf (now GIG Gulf), Allianz Partners, National Health Insurance Company – Daman, MetLife UAE, Orient Insurance, Emirates Insurance Company, National General Insurance Company (NGI), Al Buhaira National Insurance Company, Union Insurance Company, Al Ain Ahlia Insurance Company, Ras Al Khaimah National Insurance Company (RAKNIC), Islamic Arab Insurance Company (Salama) contribute to innovation, geographic expansion, and service delivery in this space.

The UAE health and medical insurance market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The integration of digital health solutions and telemedicine services is expected to enhance accessibility and efficiency in healthcare delivery. Additionally, the focus on preventive healthcare will likely reshape insurance offerings, encouraging insurers to develop tailored plans that address specific health needs. As the expatriate population continues to grow, demand for customized insurance solutions will further drive market evolution.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Health Insurance Family Floater Plans Group Health Insurance Critical Illness Insurance Travel Health Insurance Dental Insurance Others |

| By End-User | Individuals Corporates Government Entities Non-Governmental Organizations |

| By Coverage Type | Comprehensive Coverage Basic Coverage Catastrophic Coverage |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents Banks Hospitals & Clinics |

| By Premium Range | Low Premium Plans Medium Premium Plans High Premium Plans |

| By Policy Duration | Short-Term Policies Long-Term Policies |

| By Health Condition | Pre-existing Conditions Non-pre-existing Conditions Chronic Conditions |

| By Level of Coverage | Platinum Gold Silver Bronze |

| By Demographics | Adults Senior Citizens Minors |

| By Service Provider | Private Health Insurance Providers Public Health Insurance Providers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Individual Health Insurance Policyholders | 120 | Policyholders aged 25-60, diverse income levels |

| Corporate Health Insurance Buyers | 80 | HR Managers, Finance Directors from SMEs and large corporations |

| Healthcare Providers (Hospitals and Clinics) | 60 | Administrators, Billing Managers, and Insurance Coordinators |

| Insurance Brokers and Agents | 50 | Insurance Brokers, Independent Agents with health insurance focus |

| Regulatory Bodies and Health Authorities | 40 | Policy Makers, Regulatory Officers in health insurance |

The UAE health and medical insurance market is valued at approximately USD 8.7 billion, driven by factors such as population growth, rising healthcare costs, and government initiatives aimed at achieving universal health coverage.