Region:North America

Author(s):Shubham

Product Code:KRAB0765

Pages:99

Published On:August 2025

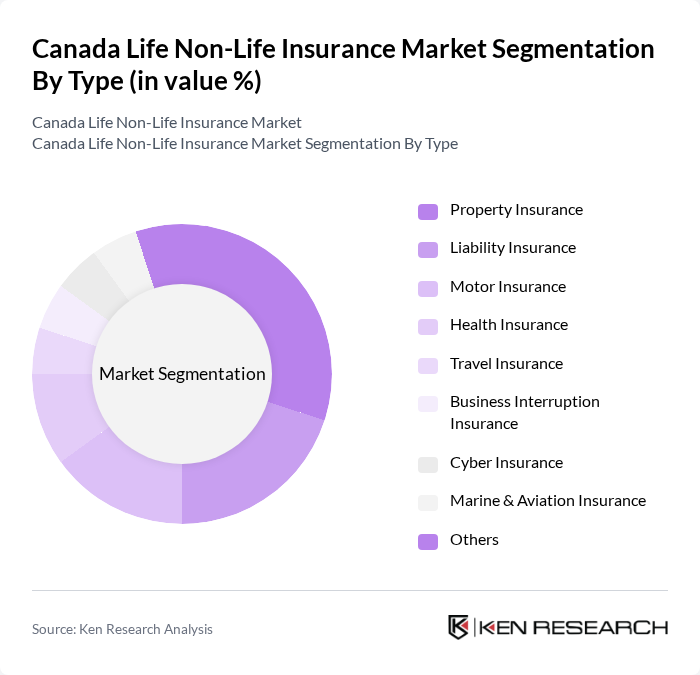

By Type:

The non-life insurance market is segmented into various types, including Property Insurance, Liability Insurance, Motor Insurance, Health Insurance, Travel Insurance, Business Interruption Insurance, Cyber Insurance, Marine & Aviation Insurance, and Others. Among these,Property Insuranceremains the leading sub-segment, driven by the increasing value of real estate, heightened awareness of property risks due to climate-related events, and a growing demand for comprehensive and customizable coverage options. The expanding digital economy and increased cyber threats have also led to a notable rise in demand for cyber insurance, while business interruption and liability products are gaining traction among commercial clients seeking to mitigate operational risks .

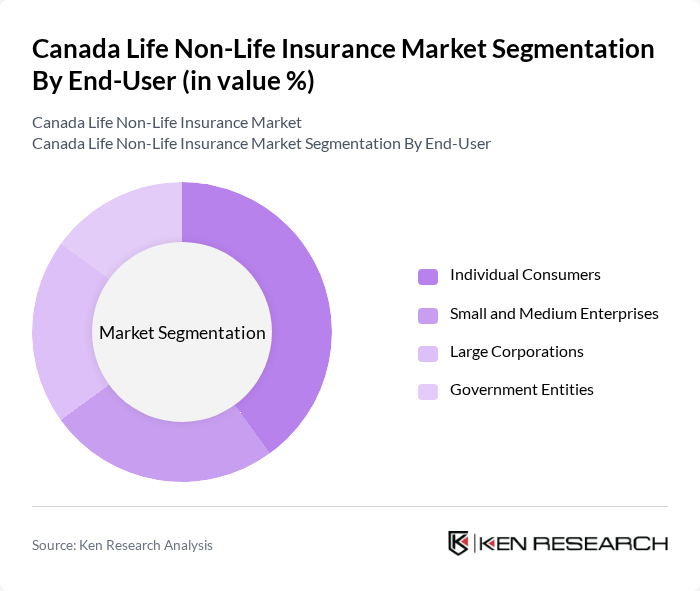

By End-User:

This market is segmented by end-users, including Individual Consumers, Small and Medium Enterprises, Large Corporations, and Government Entities. TheIndividual Consumerssegment is the most significant, reflecting the broad spectrum of personal insurance needs, from property and motor to health and travel coverage. Growth in this segment is supported by the increasing number of households, rising awareness of personal risk management, and the introduction of digital and direct-to-consumer insurance platforms. Small and medium enterprises are also a key growth area, particularly for liability, cyber, and business interruption products .

The Canada Life Non-Life Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Intact Financial Corporation, Aviva Canada Inc., The Co-operators Group Limited, Economical Mutual Insurance Company, RSA Canada, Wawanesa Mutual Insurance Company, Desjardins General Insurance Group, Allstate Insurance Company of Canada, Travelers Canada, Zurich Insurance Company Ltd., AIG Insurance Company of Canada, Chubb Insurance Company of Canada, Liberty Mutual Insurance Company, SGI CANADA, Northbridge Insurance, Great-West Lifeco Inc., Manulife Financial Corporation, Sun Life Financial Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada Life Non-Life Insurance market appears promising, driven by technological innovations and evolving consumer preferences. As digital platforms become increasingly prevalent, insurers are expected to enhance their online offerings, improving accessibility and customer engagement. Additionally, the focus on sustainability will likely lead to the development of eco-friendly insurance products, aligning with the growing demand for responsible business practices. These trends indicate a dynamic market landscape poised for transformation and growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Property Insurance Liability Insurance Motor Insurance Health Insurance Travel Insurance Business Interruption Insurance Cyber Insurance Marine & Aviation Insurance Others |

| By End-User | Individual Consumers Small and Medium Enterprises Large Corporations Government Entities |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents Bancassurance |

| By Coverage Type | Comprehensive Coverage Third-Party Coverage Named Peril Coverage |

| By Policy Duration | Short-Term Policies Long-Term Policies |

| By Premium Range | Low Premium Medium Premium High Premium |

| By Customer Segment | High Net-Worth Individuals Middle-Class Families Low-Income Households New Immigrants Seniors |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Property Insurance Sector | 100 | Underwriters, Risk Managers |

| Liability Insurance Sector | 80 | Claims Adjusters, Legal Advisors |

| Motor Insurance Sector | 90 | Insurance Agents, Customer Service Representatives |

| Health Insurance Sector | 40 | Policy Analysts, Healthcare Consultants |

| Commercial Insurance Sector | 60 | Business Development Managers, Financial Analysts |

The Canada Life Non-Life Insurance Market is valued at approximately USD 82 billion, driven by factors such as increasing consumer awareness, natural disasters, and the demand for customizable insurance products like cyber insurance and climate risk coverage.