Region:Europe

Author(s):Dev

Product Code:KRAC0378

Pages:91

Published On:August 2025

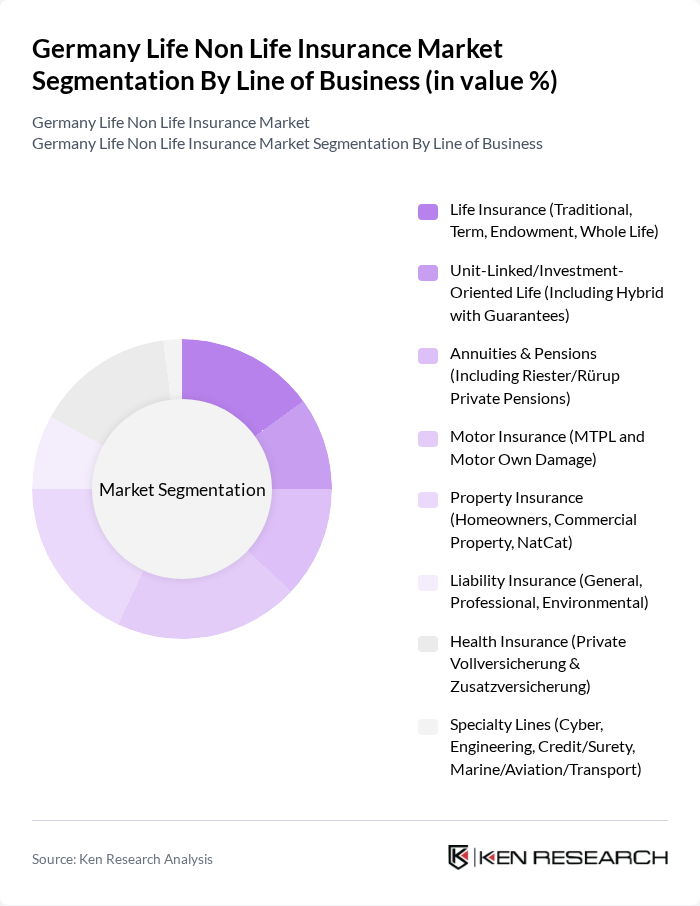

By Line of Business:

The line of business segmentation includes various subsegments such as Life Insurance (Traditional, Term, Endowment, Whole Life), Unit-Linked/Investment-Oriented Life (Including Hybrid with Guarantees), Annuities & Pensions (Including Riester/Rürup Private Pensions), Motor Insurance (MTPL and Motor Own Damage), Property Insurance (Homeowners, Commercial Property, NatCat), Liability Insurance (General, Professional, Environmental), Health Insurance (Private Vollversicherung & Zusatzversicherung), and Specialty Lines (Cyber, Engineering, Credit/Surety, Marine/Aviation/Transport). Among these, Health Insurance has emerged as a key growth driver, supported by rising healthcare costs and product innovation in both statutory add-ons and private coverage; however, in overall non-life premium mix, motor and property remain large contributors by share within P&C. Consumers are increasingly prioritizing health coverage, with statutory and private markets expanding offerings and digital services, which has led to sustained demand for comprehensive and supplementary health insurance products.

By Customer Type:

This segmentation includes Retail/Individuals, SMEs (Small and Medium-Sized Enterprises), Large Corporates/Institutional, and Public Sector/Non-Profits. The Retail/Individuals segment is the most significant, driven by the increasing awareness of personal financial security and the need for individual insurance products. Digital channels, telematics in motor, and modular add-on covers in health and property are reinforcing retail demand and personalization trends, while SMEs continue to expand uptake of liability, cyber, and property covers amid heightened risk awareness.

The Germany Life Non Life Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Allianz SE, Münchener Rückversicherungs-Gesellschaft AG (Munich Re), AXA Konzern AG, ERGO Group AG, Talanx AG, Generali Deutschland AG, Zurich Gruppe Deutschland, R+V Versicherung AG, Debeka Gruppe, Wüstenrot & Württembergische AG (W&W), HDI Global SE, SIGNAL IDUNA Gruppe, Provinzial Holding AG, LVM Versicherung, Bâloise Gruppe (Basler Versicherungen Deutschland) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the German life non-life insurance market appears promising, driven by technological innovations and evolving consumer preferences. As digital solutions become more prevalent, insurers are expected to enhance their service offerings, improving customer engagement and satisfaction. Additionally, the shift towards sustainable insurance practices will likely gain momentum, aligning with broader societal trends. Companies that adapt to these changes and invest in technology will be well-positioned to capture emerging market opportunities and drive growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Line of Business | Life Insurance (Traditional, Term, Endowment, Whole Life) Unit-Linked/Investment-Oriented Life (Including Hybrid with Guarantees) Annuities & Pensions (Including Riester/Rürup Private Pensions) Motor Insurance (MTPL and Motor Own Damage) Property Insurance (Homeowners, Commercial Property, NatCat) Liability Insurance (General, Professional, Environmental) Health Insurance (Private Vollversicherung & Zusatzversicherung) Specialty Lines (Cyber, Engineering, Credit/Surety, Marine/Aviation/Transport) |

| By Customer Type | Retail/Individuals SMEs (Small and Medium-Sized Enterprises) Large Corporates/Institutional Public Sector/Non-Profits |

| By Distribution Channel | Tied Agents (Exclusive Agents) Independent Agents & Brokers (Makler) Bancassurance Direct & Online (Insurer Websites, Digital Aggregators/Comparison Portals) Corporate/Direct Sales (Key Account) |

| By Policy Term | Short-Term (?1 year, typical in P&C) Long-Term (Multi-year Life, Pension, and Savings Contracts) |

| By Premium Structure | Regular/Level Premium Single Premium Flexible/Adjustable Premium |

| By Customer Risk Profile | Mass Market Affluent/High Net-Worth Individuals Commercial & Industrial Risk |

| By Coverage Scope | Basic/Statutory Coverage (e.g., MTPL) Comprehensive/All-Risks Coverage Riders/Add-ons (e.g., cyber extensions, natural hazard add-ons) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Life Insurance Policyholders | 150 | Individuals aged 30-55, Financial Advisors |

| Health Insurance Customers | 120 | Families, HR Managers from Corporates |

| Property Insurance Clients | 100 | Homeowners, Real Estate Agents |

| Casualty Insurance Users | 80 | Small Business Owners, Fleet Managers |

| Insurance Brokers and Agents | 90 | Insurance Brokers, Independent Agents |

The Germany Life Non Life Insurance Market is valued at approximately EUR 250 billion, reflecting a robust growth driven by increased consumer awareness, regulatory support, and a focus on risk protection amid economic challenges.