Region:Asia

Author(s):Geetanshi

Product Code:KRAB0106

Pages:99

Published On:August 2025

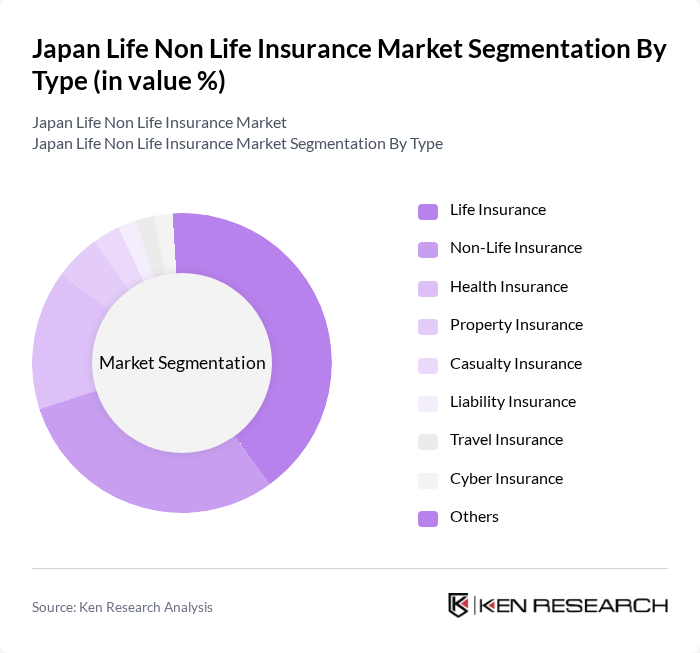

By Type:

The segmentation by type includes various subsegments such as Life Insurance, Non-Life Insurance, Health Insurance, Property Insurance, Casualty Insurance, Liability Insurance, Travel Insurance, Cyber Insurance, and Others. Among these,Life Insuranceis the leading subsegment, driven by the increasing need for financial security and retirement planning among the aging population.Health Insuranceis also gaining traction due to rising healthcare costs, chronic disease prevalence, and a growing emphasis on preventive care. The demand for Non-Life Insurance products, particularlyProperty and Casualty Insurance, is bolstered by urbanization, increased asset ownership, and heightened awareness of risks such as natural disasters and liability.

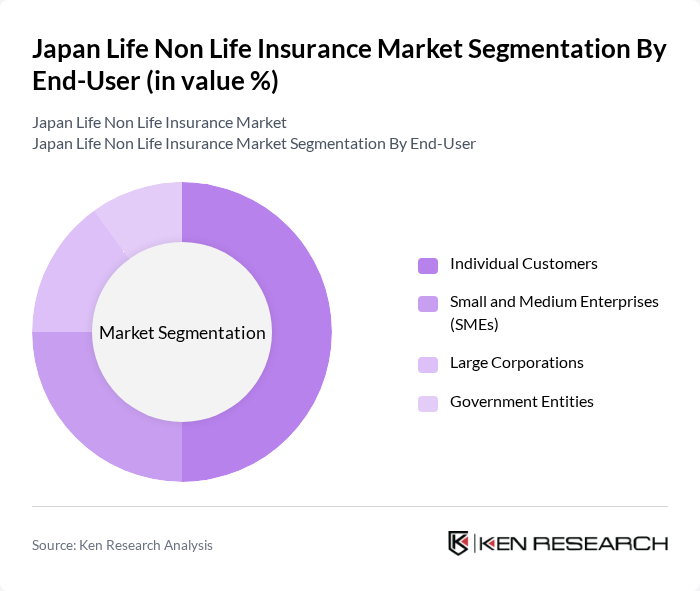

By End-User:

This segmentation includes Individual Customers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities.Individual Customersdominate the market, driven by the increasing awareness of personal financial planning and the need for life and health insurance.SMEsare also significant contributors, as they seek insurance solutions to mitigate risks associated with business operations, including new composite packages for product liability and supply-chain continuity.Large CorporationsandGovernment Entitiesfollow, focusing on comprehensive insurance packages to protect their assets and employees.

The Japan Life Non Life Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nippon Life Insurance Company, Dai-ichi Life Holdings, Inc., Tokio Marine Holdings, Inc., Sompo Holdings, Inc., Mitsui Sumitomo Insurance Company, Limited, Aioi Nissay Dowa Insurance Co., Ltd., Meiji Yasuda Life Insurance Company, Japan Post Insurance Co., Ltd., MS&AD Insurance Group Holdings, Inc., T&D Holdings, Inc., Asahi Mutual Life Insurance Company, Sony Life Insurance Co., Ltd., Fukoku Mutual Life Insurance Company, Prudential Life Insurance Co., Ltd. (Japan), MetLife Insurance K.K. (Japan) contribute to innovation, geographic expansion, and service delivery in this space.

The Japan Life Non Life Insurance Market is poised for transformation driven by technological advancements and evolving consumer expectations. Insurers are increasingly adopting digital platforms to enhance customer engagement and streamline operations. Additionally, the focus on sustainability and personalized insurance solutions is expected to reshape product offerings. As the market adapts to these trends, companies that leverage data analytics and innovative technologies will likely gain a competitive edge, ensuring long-term growth and resilience in a dynamic environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Life Insurance Non-Life Insurance Health Insurance Property Insurance Casualty Insurance Liability Insurance Travel Insurance Cyber Insurance Others |

| By End-User | Individual Customers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Distribution Channel | Direct Sales Insurance Agents Brokers Online Platforms Bancassurance |

| By Policy Duration | Short-Term Policies Long-Term Policies |

| By Premium Range | Low Premium Medium Premium High Premium |

| By Customer Demographics | Age Group Income Level Geographic Location |

| By Policy Type | Whole Life Term Life Universal Life Endowment Plans |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Life Insurance Policyholders | 150 | Individuals aged 30-60, Middle to High Income |

| Non-Life Insurance Customers | 100 | Homeowners, Small Business Owners |

| Insurance Brokers and Agents | 80 | Licensed Insurance Brokers, Independent Agents |

| Insurance Company Executives | 50 | C-Suite Executives, Department Heads |

| Regulatory Bodies and Analysts | 40 | Regulatory Officials, Market Analysts |

The Japan Life Non Life Insurance Market is valued at approximately USD 325 billion, driven by factors such as an aging population, rising healthcare costs, and increased consumer awareness regarding insurance products.