Region:Asia

Author(s):Shubham

Product Code:KRAB0561

Pages:82

Published On:August 2025

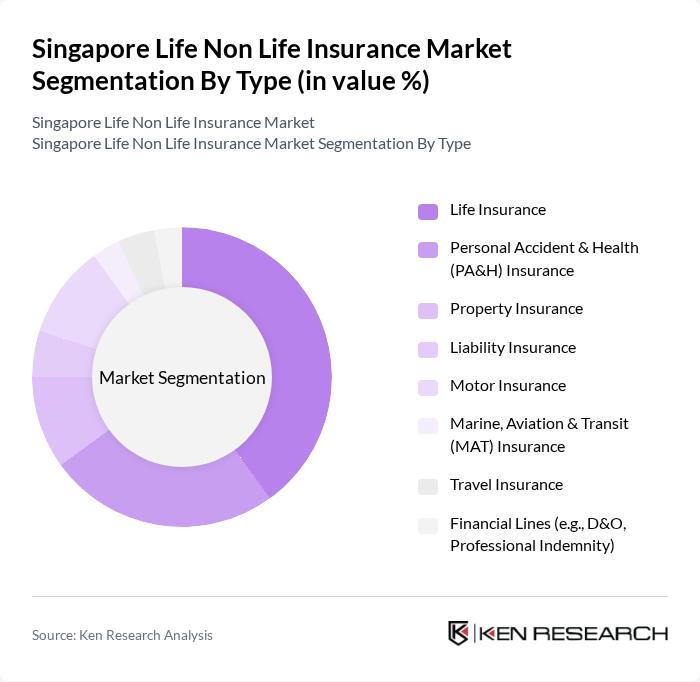

By Type:The market is segmented into various types of insurance products, including Life Insurance, Personal Accident & Health (PA&H) Insurance, Property Insurance, Liability Insurance, Motor Insurance, Marine, Aviation & Transit (MAT) Insurance, Travel Insurance, and Financial Lines (e.g., D&O, Professional Indemnity). Among these, Life Insurance is the most dominant segment, driven by the increasing awareness of long-term financial planning, rising uptake of investment-linked policies, and the growing aging population. Demand for health-related insurance products has surged, with private health and PA&H contributing materially to general insurance growth alongside motor, supported by regulatory and demographic factors .

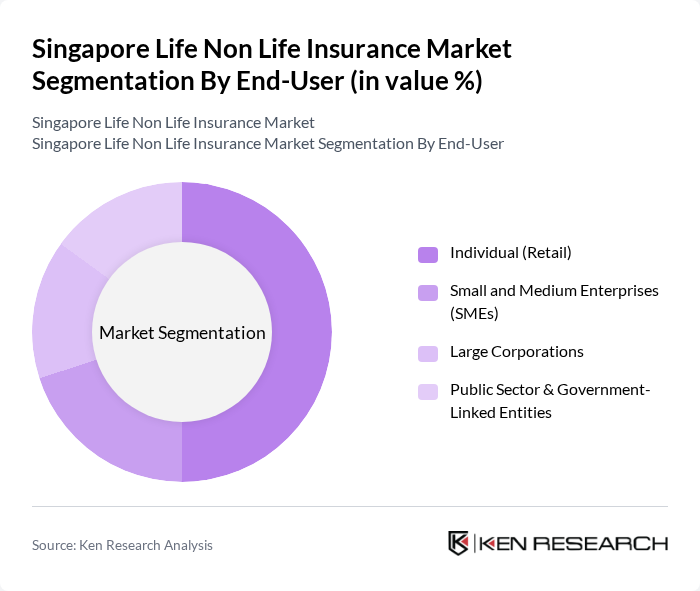

By End-User:The market is segmented by end-users into Individual (Retail), Small and Medium Enterprises (SMEs), Large Corporations, and Public Sector & Government-Linked Entities. The Individual segment is the largest, driven by continued growth in retail life policies (including investment-linked and protection products) and demand for private health coverage. SMEs and larger corporates are increasing uptake of property, liability, motor, and financial lines to manage operational and cyber risks in a tightening regulatory and cybersecurity environment .

The Singapore Life Non Life Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as AIA Singapore Private Limited, Prudential Assurance Company Singapore (Pte) Limited, Great Eastern Life Assurance Company Limited, Income Insurance Limited (formerly NTUC Income), Manulife (Singapore) Pte. Ltd., Allianz Insurance Singapore Pte. Ltd., Tokio Marine Life Insurance Singapore Ltd. and Tokio Marine Insurance Singapore Ltd., Aviva Ltd. (operating in Singapore as Singlife with Aviva; now The Great Eastern-Singlife entities as applicable), Zurich Insurance Company Ltd. (Singapore Branch), Chubb Insurance Singapore Limited, Sompo Insurance Singapore Pte. Ltd., MSIG Insurance (Singapore) Pte. Ltd., Liberty Insurance Pte Ltd (Singapore), QBE Insurance (Singapore) Pte Ltd, FWD Singapore Pte. Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Singapore life non-life insurance market appears promising, driven by technological advancements and evolving consumer preferences. As digital platforms become more prevalent, insurers are expected to enhance their online offerings, catering to a tech-savvy population. Additionally, the focus on sustainability will likely lead to the development of eco-friendly insurance products, aligning with global trends. Overall, the market is poised for growth, with opportunities for innovation and strategic partnerships on the horizon.

| Segment | Sub-Segments |

|---|---|

| By Type | Life Insurance Personal Accident & Health (PA&H) Insurance Property Insurance Liability Insurance Motor Insurance Marine, Aviation & Transit (MAT) Insurance Travel Insurance Financial Lines (e.g., D&O, Professional Indemnity) |

| By End-User | Individual (Retail) Small and Medium Enterprises (SMEs) Large Corporations Public Sector & Government-Linked Entities |

| By Distribution Channel | Direct (Insurer-owned channels) Brokers Bancassurance Agents Digital/Online Platforms |

| By Policy Duration | Short-Term (?1 year, typical for non-life) Long-Term (multi-year, common in life/health) |

| By Premium Range | Low Premium Medium Premium High Premium |

| By Customer Demographics | Age Group Income Level Occupation Expatriates vs. Citizens/PRs |

| By Claims Process | Manual Claims Automated/Straight-Through Processing (STP) Claims Hybrid Claims |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Property Insurance Market | 120 | Underwriters, Risk Managers |

| Health Insurance Sector | 100 | Claims Adjusters, Product Managers |

| Motor Insurance Segment | 110 | Insurance Agents, Customer Service Representatives |

| Travel Insurance Insights | 80 | Travel Agents, Policyholders |

| Liability Insurance Analysis | 90 | Legal Advisors, Corporate Risk Officers |

The Singapore Life Non-Life Insurance Market is valued at approximately USD 17 billion, reflecting the combined scale of life insurance weighted premiums and general insurance gross written premiums, supported by robust growth in both sectors.