Region:North America

Author(s):Rebecca

Product Code:KRAA5368

Pages:87

Published On:September 2025

By Type:The market is segmented into various types, including Shared Apartments, Private Rooms, Co-Working Spaces, Student Housing, Senior Living Communities, Luxury Co-Living Spaces, and Others. Among these, Shared Apartments and Student Housing are particularly prominent due to the increasing number of young professionals and students seeking affordable living arrangements in urban areas. The demand for Co-Working Spaces has also surged as remote work becomes more prevalent, allowing for flexible living and working environments.

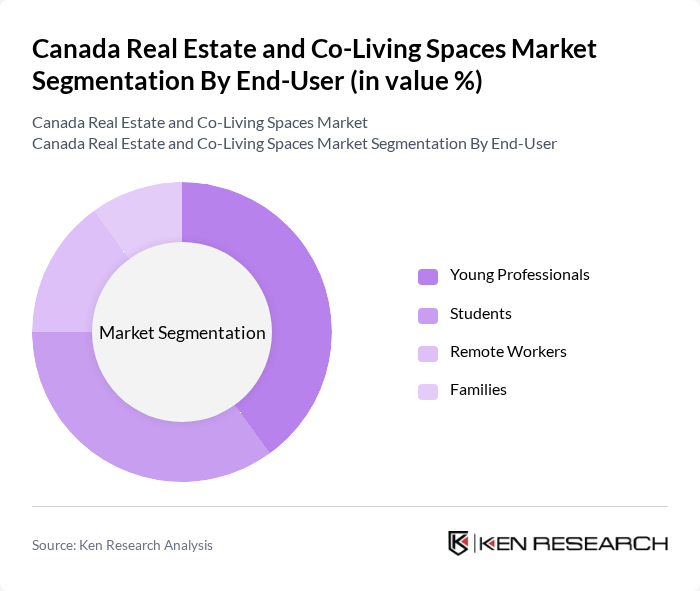

By End-User:The end-user segmentation includes Young Professionals, Students, Remote Workers, and Families. Young Professionals and Students are the dominant segments, driven by the need for affordable and flexible living arrangements in urban centers. The trend towards co-living is particularly appealing to these groups, as it fosters community living and provides access to shared amenities, which are essential for their lifestyle.

The Canada Real Estate and Co-Living Spaces Market is characterized by a dynamic mix of regional and international players. Leading participants such as Brookfield Asset Management, Tricon Residential, Dream Unlimited Corp., Minto Group Inc., The Daniels Corporation, QuadReal Property Group, Boardwalk Real Estate Investment Trust, CAPREIT, Homestead Land Holdings Limited, The Living Group, O2 Housing, Roomi, Common, WeLive, The Collective contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada real estate and co-living spaces market appears promising, driven by evolving consumer preferences and demographic shifts. As urbanization continues, the demand for innovative housing solutions will likely increase, particularly in major cities. Additionally, the integration of smart technologies and sustainable practices will enhance the appeal of co-living spaces, attracting environmentally conscious consumers. The collaboration between private developers and local governments may further facilitate the growth of this sector, addressing housing shortages effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Shared Apartments Private Rooms Co-Working Spaces Student Housing Senior Living Communities Luxury Co-Living Spaces Others |

| By End-User | Young Professionals Students Remote Workers Families |

| By Price Range | Budget Mid-Range Premium |

| By Location | Urban Centers Suburban Areas Rural Areas |

| By Amenities Offered | Furnished Units Utilities Included Community Events |

| By Duration of Stay | Short-Term Rentals Long-Term Rentals |

| By Service Model | Managed Co-Living Self-Managed Co-Living Hybrid Models |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Co-Living Space Tenants | 150 | Young Professionals, Students, Digital Nomads |

| Real Estate Developers | 100 | Property Developers, Investment Analysts |

| Urban Planners | 80 | City Planners, Housing Policy Makers |

| Property Management Firms | 70 | Property Managers, Operations Directors |

| Potential Investors in Co-Living | 60 | Venture Capitalists, Real Estate Investors |

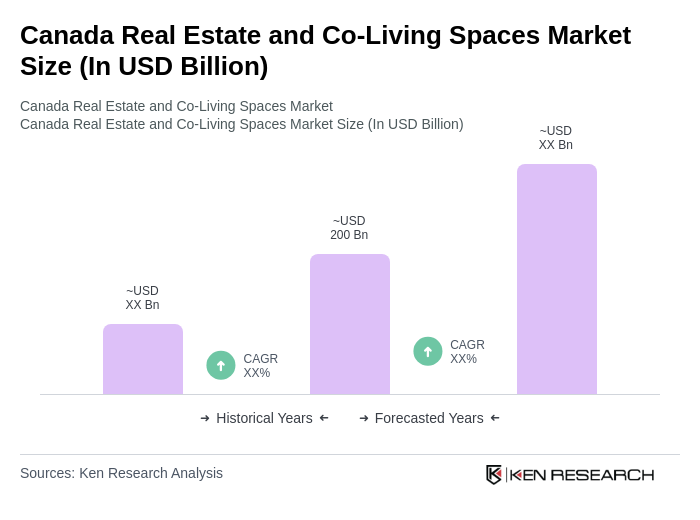

The Canada Real Estate and Co-Living Spaces Market is valued at approximately USD 200 billion, driven by urbanization, demand for affordable housing, and a growing preference for co-living arrangements among younger demographics.