Region:Africa

Author(s):Geetanshi

Product Code:KRAA8126

Pages:98

Published On:September 2025

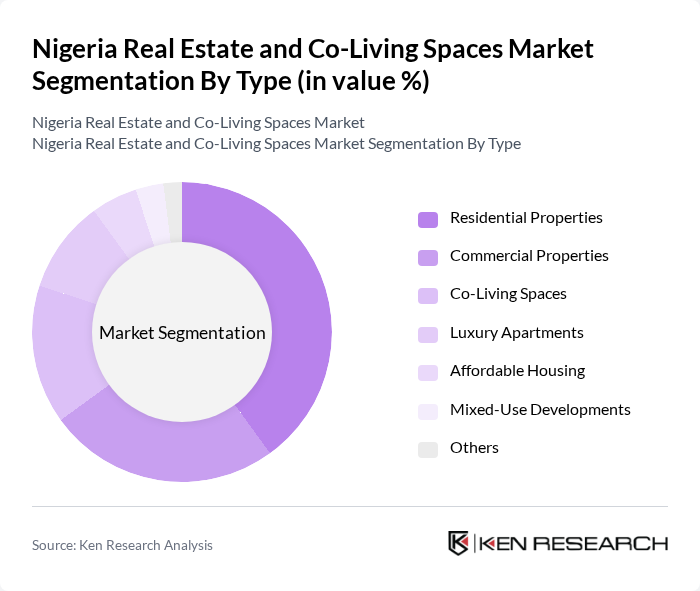

By Type:The market is segmented into various types, including Residential Properties, Commercial Properties, Co-Living Spaces, Luxury Apartments, Affordable Housing, Mixed-Use Developments, and Others. Among these, Residential Properties dominate the market due to the increasing population and urban migration, leading to a higher demand for housing solutions. Co-Living Spaces are gaining traction, especially among young professionals seeking affordable living arrangements in urban centers.

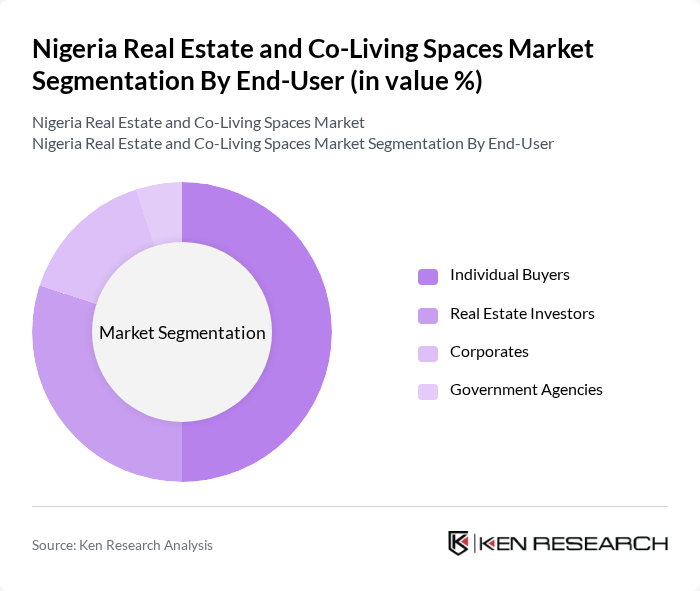

By End-User:The end-user segmentation includes Individual Buyers, Real Estate Investors, Corporates, and Government Agencies. Individual Buyers represent the largest segment, driven by the need for home ownership and investment in real estate. Real Estate Investors are increasingly focusing on co-living and affordable housing projects, while Corporates and Government Agencies are investing in commercial properties to support their operations.

The Nigeria Real Estate and Co-Living Spaces Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jumia House, PropertyPro.ng, LandWey Investment Limited, Adron Homes & Properties, RevolutionPlus Property, Eko Atlantic City, Mixta Africa, Nestle Nigeria Plc, Urban Shelter Limited, Alpha Mead Group, First World Communities, The Address Homes, Landmark Africa, Broll Property Group, Elysium Properties contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's real estate and co-living spaces market appears promising, driven by urbanization and a growing middle class. As the population continues to migrate to urban centers, the demand for innovative housing solutions will rise. Additionally, the integration of technology in property management and construction will enhance efficiency. With government support and private sector investment, the market is poised for transformation, addressing housing shortages and improving living standards across the country.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Properties Commercial Properties Co-Living Spaces Luxury Apartments Affordable Housing Mixed-Use Developments Others |

| By End-User | Individual Buyers Real Estate Investors Corporates Government Agencies |

| By Investment Source | Domestic Investors Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Discount Pricing |

| By Location | Urban Areas Suburban Areas Rural Areas Emerging Markets |

| By Property Size | Small Units Medium Units Large Units |

| By Development Stage | Pre-Construction Under Construction Completed Renovated |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Co-Living Space Tenants | 150 | Young Professionals, Students, Digital Nomads |

| Real Estate Developers | 100 | Property Developers, Investment Analysts |

| Urban Planners | 80 | City Planners, Housing Policy Makers |

| Property Management Firms | 70 | Property Managers, Operations Directors |

| Real Estate Investors | 60 | Real Estate Investors, Venture Capitalists |

The Nigeria Real Estate and Co-Living Spaces Market is valued at approximately USD 15 billion, driven by urbanization, population growth, and increasing demand for affordable housing solutions. This growth reflects a five-year historical analysis of the market's expansion.