Region:Europe

Author(s):Geetanshi

Product Code:KRAA8144

Pages:86

Published On:September 2025

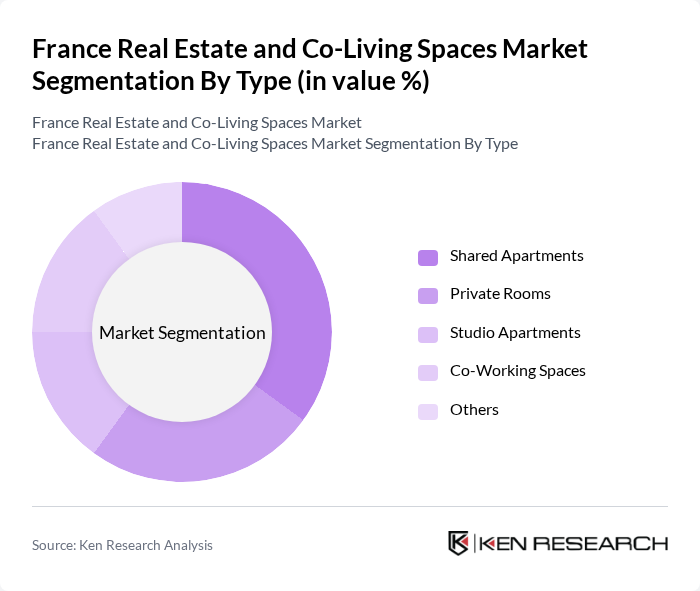

By Type:The market is segmented into various types, including Shared Apartments, Private Rooms, Studio Apartments, Co-Working Spaces, and Others. Among these, Shared Apartments are gaining popularity due to their affordability and community-oriented living, appealing particularly to young professionals and students. The demand for Co-Working Spaces is also on the rise, driven by the increase in remote work and the need for flexible working environments.

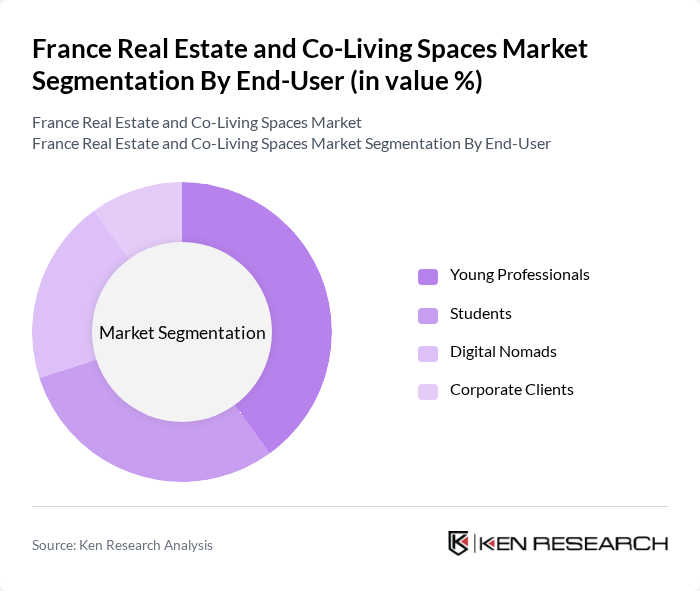

By End-User:The end-user segmentation includes Young Professionals, Students, Digital Nomads, and Corporate Clients. Young Professionals dominate the market, driven by their need for affordable and flexible living arrangements in urban areas. Students also represent a significant portion, particularly in cities with large universities, while Digital Nomads are increasingly seeking co-living spaces that offer both accommodation and work facilities.

The France Real Estate and Co-Living Spaces Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nexity, Bouygues Immobilier, Icade, Unibail-Rodamco-Westfield, Wojo, Colonies, The Student Hotel, Homelike, Roomlala, BAP, La Casa, Co-Liv, Oxygène, Urban Campus, The Collective contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France real estate and co-living spaces market appears promising, driven by evolving consumer preferences and urbanization trends. As cities continue to grow, the demand for innovative housing solutions will likely increase. Additionally, the integration of smart technologies and sustainability initiatives will play a crucial role in attracting tenants. The market is expected to adapt to these changes, fostering a collaborative living environment that meets the needs of diverse demographics, particularly young professionals and students.

| Segment | Sub-Segments |

|---|---|

| By Type | Shared Apartments Private Rooms Studio Apartments Co-Working Spaces Others |

| By End-User | Young Professionals Students Digital Nomads Corporate Clients |

| By Location | Urban Centers Suburban Areas Tourist Hotspots Others |

| By Price Range | Budget Mid-Range Premium |

| By Lease Duration | Short-Term Long-Term |

| By Amenities Offered | Furnished vs. Unfurnished Utilities Included Community Events |

| By Service Model | Managed Co-Living Self-Managed Hybrid Models |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Co-Living Space Operators | 100 | Property Managers, Business Development Managers |

| Real Estate Developers | 80 | Project Managers, Investment Analysts |

| Potential Tenants | 150 | Young Professionals, Students |

| Urban Planners | 60 | City Planners, Policy Makers |

| Financial Analysts in Real Estate | 70 | Investment Advisors, Market Analysts |

The France Real Estate and Co-Living Spaces Market is valued at approximately USD 50 billion, driven by urbanization, population growth, and the demand for affordable housing solutions, particularly in metropolitan areas like Paris, Lyon, and Marseille.