Region:Middle East

Author(s):Dev

Product Code:KRAA8399

Pages:99

Published On:November 2025

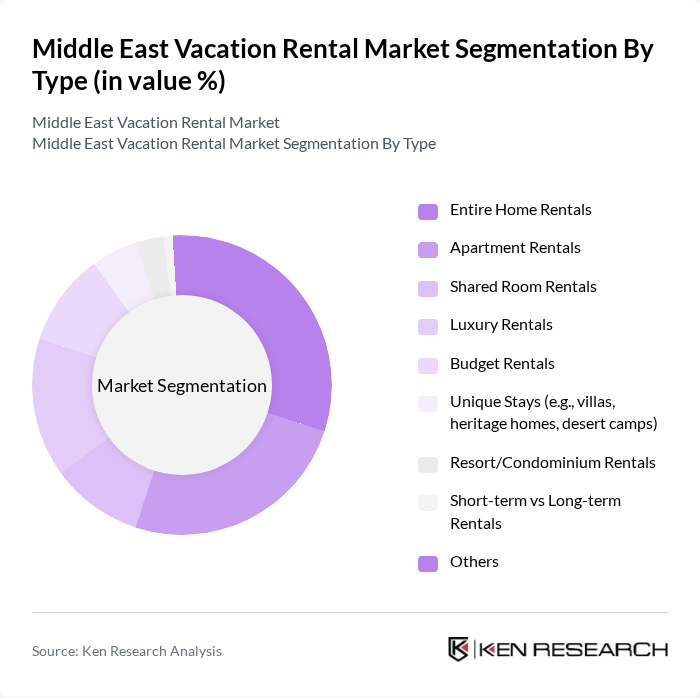

By Type:The vacation rental market can be segmented into various types, including entire home rentals, apartment rentals, shared room rentals, luxury rentals, budget rentals, unique stays (such as villas, heritage homes, and desert camps), resort/condominium rentals, short-term vs long-term rentals, and others. Each of these subsegments caters to different consumer preferences and budgets, contributing to the overall market dynamics. Notably, entire home and apartment rentals remain the most popular choices, while unique and luxury stays are gaining traction among travelers seeking distinctive experiences .

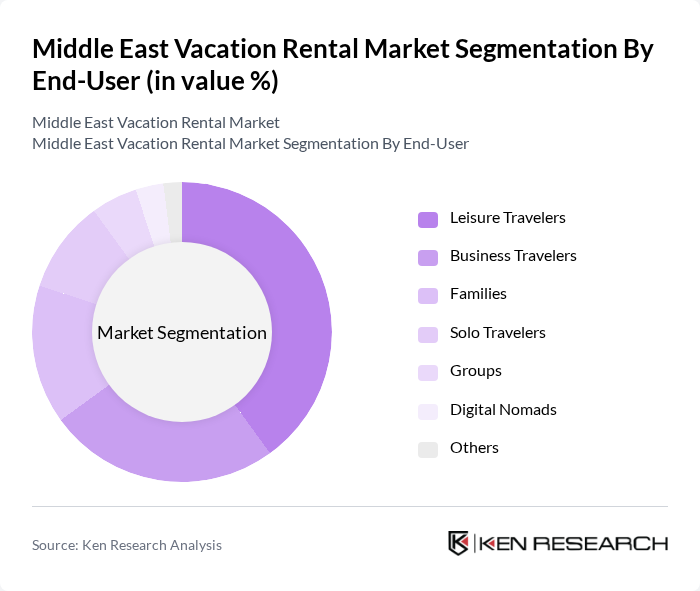

By End-User:The end-user segmentation includes leisure travelers, business travelers, families, solo travelers, groups, digital nomads, and others. Each group has distinct needs and preferences, influencing their choice of vacation rental types and amenities. Leisure travelers and families represent the largest segments, while digital nomads and business travelers are emerging as key growth drivers due to increased remote work and business travel flexibility .

The Middle East Vacation Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as Airbnb, Booking.com, Vrbo, Plum Guide, Nomad Homes, Bayut, Dubizzle, Staycae, Deluxe Holiday Homes, Maison Privee, Driven Holiday Homes, Key One Holiday Homes, bnbme, Silkhaus, and Blueground contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East vacation rental market appears promising, driven by ongoing tourism growth and evolving consumer preferences. As digital platforms continue to innovate, enhancing user experiences, the market is likely to see increased participation from both hosts and guests. Additionally, the integration of smart home technology and sustainable practices will cater to the growing demand for eco-friendly accommodations, positioning the sector for robust growth in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Entire Home Rentals Apartment Rentals Shared Room Rentals Luxury Rentals Budget Rentals Unique Stays (e.g., villas, heritage homes, desert camps) Resort/Condominium Rentals Short-term vs Long-term Rentals Others |

| By End-User | Leisure Travelers Business Travelers Families Solo Travelers Groups Digital Nomads Others |

| By Region | GCC Countries (UAE, Saudi Arabia, Qatar, Kuwait, Bahrain, Oman) Levant Region (Jordan, Lebanon, etc.) North Africa (Egypt, Morocco, etc.) Others |

| By Booking Channel | Online Travel Agencies (OTAs) Direct Booking through Websites Mobile Apps Social Media Platforms Offline Travel Agents Others |

| By Duration of Stay | Short-term (Less than 7 days) Medium-term (7-30 days) Long-term (More than 30 days) Others |

| By Amenities Offered | Pool and Spa Facilities Kitchen Facilities Wi-Fi and Connectivity Pet-Friendly Options Concierge/Housekeeping Services Others |

| By Customer Demographics | Age Groups (Millennials, Gen X, Boomers) Income Levels (Low, Middle, High) Nationalities (GCC, European, Asian, etc.) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Vacation Rentals in Dubai | 120 | Property Managers, Real Estate Agents |

| Coastal Rentals in the Red Sea Region | 90 | Property Owners, Tour Operators |

| Luxury Villas in Abu Dhabi | 60 | Luxury Travel Advisors, High-Net-Worth Individuals |

| Budget Accommodation in Jordan | 50 | Backpackers, Budget Travelers |

| Short-term Rentals in Qatar | 70 | Event Planners, Business Travelers |

The Middle East vacation rental market is valued at approximately USD 7.5 billion, reflecting significant growth driven by increasing demand for alternative accommodations and the rise of digital booking platforms.