Region:North America

Author(s):Shubham

Product Code:KRAA1728

Pages:83

Published On:August 2025

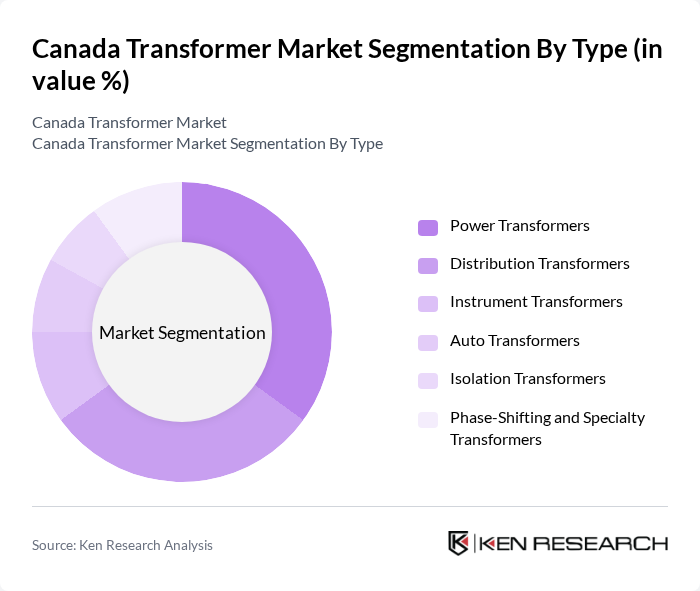

By Type:The transformer market can be segmented into various types, including Power Transformers, Distribution Transformers, Instrument Transformers, Auto Transformers, Isolation Transformers, and Phase-Shifting and Specialty Transformers. Each type serves distinct functions within the electrical grid, catering to different voltage levels and applications.

The Power Transformers segment is currently dominating the market due to their critical role in high-voltage transmission systems. These transformers are essential for stepping up voltage levels for long-distance transmission, which is increasingly necessary as Canada expands and refurbishes its grid to integrate renewable generation and accommodate load growth. Utilities’ investment programs and the need to replace aging assets further support spending on high?voltage transformers, reinforcing this segment’s lead.

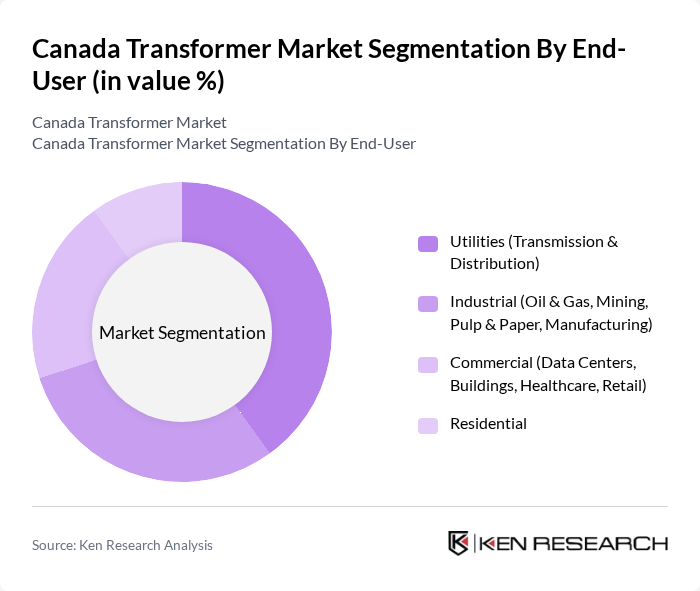

By End-User:The end-user segmentation includes Utilities (Transmission & Distribution), Industrial (Oil & Gas, Mining, Pulp & Paper, Manufacturing), Commercial (Data Centers, Buildings, Healthcare, Retail), and Residential sectors. Each of these sectors has unique requirements for transformers based on their operational needs and energy consumption patterns.

The Utilities segment is the largest end-user of transformers, driven by grid reinforcement and replacement of aging infrastructure, as well as renewable and distributed energy integration needs. Ongoing investments by Canadian utilities in substation upgrades and T&D expansion keep utility demand ahead of industrial and commercial users.

The Canada Transformer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Energy Canada Limited, Hitachi Energy Canada Inc., Schneider Electric Canada Inc., Eaton Industries (Canada) Company, General Electric (GE Vernova) Canada, ABB Canada, Northern Transformer Corporation, PTI Transformers Inc. (Regina, Saskatoon, Winnipeg), Electric Power Inc. (EPI) Canada, Hammond Power Solutions Inc. (HPS), Mitsubishi Electric Sales Canada Inc., Toshiba International Corporation Canada, S&C Electric Company (Canada), Nidec Industrial Solutions Canada, CG Power Systems Canada (Avantha Group) contribute to innovation, geographic expansion, and service delivery in this space.

The Canada transformer market is poised for significant transformation driven by technological advancements and regulatory changes. As the shift towards renewable energy sources accelerates, the demand for innovative transformer solutions will increase. Additionally, the integration of smart grid technologies and IoT applications will enhance operational efficiency. In future, the focus on sustainability and energy efficiency will likely lead to a more competitive landscape, encouraging manufacturers to innovate and adapt to evolving market needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Power Transformers Distribution Transformers Instrument Transformers Auto Transformers Isolation Transformers Phase-Shifting and Specialty Transformers |

| By End-User | Utilities (Transmission & Distribution) Industrial (Oil & Gas, Mining, Pulp & Paper, Manufacturing) Commercial (Data Centers, Buildings, Healthcare, Retail) Residential |

| By Application | Power Generation (Thermal, Hydro, Nuclear) Transmission Distribution Renewable Integration (Wind, Solar, BESS Interconnection) |

| By Component | Core Windings Insulation Tap Changer |

| By Sales Channel | Direct Sales (Utility/Industrial Tenders) OEM/EPC Partnerships Distributors |

| By Cooling Type | Oil-Immersed Dry-Type |

| By Power Rating | Small Power (?60 MVA) Medium Power (61–600 MVA) Large Power (>600 MVA) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility Company Transformers | 120 | Energy Managers, Procurement Officers |

| Industrial Transformer Applications | 90 | Operations Managers, Facility Engineers |

| Renewable Energy Integration | 80 | Project Managers, Sustainability Officers |

| Transformer Maintenance Services | 60 | Maintenance Supervisors, Technical Directors |

| Smart Transformer Technologies | 100 | R&D Managers, Product Development Engineers |

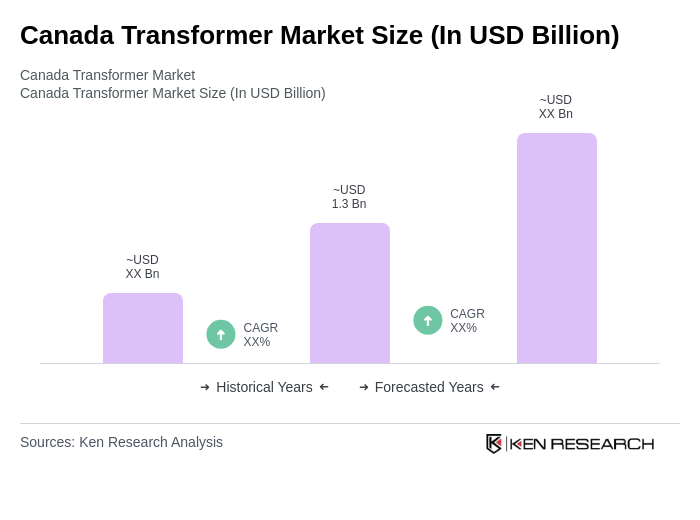

The Canada Transformer Market is valued at approximately USD 1.3 billion, driven by increasing electricity demand, infrastructure modernization, and the transition to renewable energy sources requiring new grid integration equipment.